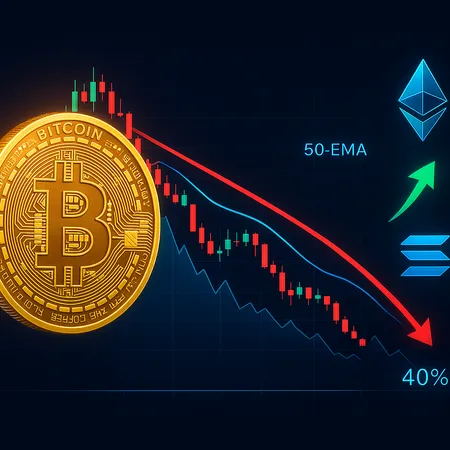

Bitcoin Dominance Has Broken Below 50 EMA — Could a Drop Under 40% Spark Altseason?

Summary

Bitcoin dominance — the share of total crypto market cap held by BTC — has stayed elevated for much of the past year, often hovering above 50% and at times approaching 60%, effectively capping many altcoin rallies. Recently, however, dominance has slipped under its 50-period exponential moving average (50 EMA), a technical signal that suggests the market's risk appetite could be shifting away from a Bitcoin-led regime.

Technical snapshot: why the 50 EMA matters

When dominance trades below the 50 EMA, it often signals a change in trend momentum. For years a high dominance has suppressed altcoins by funneling capital into Bitcoin as a perceived safe haven and liquidity magnet. A break under the 50 EMA doesn't guarantee a long-term reversal, but it increases the odds that capital could rotate back into altcoins if supportive on-chain and macro conditions appear.

Technically, a sustained move lower would put 40% dominance into focus as the next meaningful support zone. If dominance slides toward or below that level, market structure typically favors broader altcoin participation, higher correlation among risk assets, and more pronounced sector-specific rallies.

Potential market scenarios and what they mean

Bullish alt-season: A decline from the 50 EMA toward 40% or below would likely coincide with rising altcoin market caps, stronger ETH/BTC performance, and inflows into sectors like NFTs, DeFi, and memecoins. This rotation usually brings higher volatility but outsized returns for selected projects.

Bitcoin reconquest: If Bitcoin reclaims its 50 EMA quickly and dominance bounces higher, BTC would remain the market’s directional engine and altcoin gains could be muted or short-lived.

Sideways consolidation: Dominance can also drift between ranges, leading to sporadic sector rotations rather than a clear alt-season. In this case, selective opportunities appear while overall market leadership remains undecided.

What traders and investors should watch

Focus on a handful of high-signal metrics: the ETH/BTC ratio (a rising ETH/BTC often precedes altcoin leadership), stablecoin on-exchange supply, large exchange inflows/outflows, and perpetual futures funding rates. On-chain whale movements and liquidity concentration by sector provide early clues about where capital is rotating.

Risk management matters — a rapid fall in dominance can fuel sharp, short-term rallies in small-cap tokens, but also leads to steep drawdowns when sentiment reverses. Traders can use dollar-cost averaging, position sizing, and stop discipline. Platforms like Bitlet.app offer tools for monitoring markets and executing diversified strategies, which can help manage exposure during a potential altcoin rotation.

Conclusion: prepare for opportunity, manage risk

Breaking below the 50 EMA is an important technical development that raises the probability of an altcoin-friendly regime, especially if dominance trends toward 40%. That scenario would likely unlock capital flows into NFTs, DeFi and memecoins, creating both opportunities and heightened volatility. Keep a close watch on ETH/BTC strength, stablecoin flows, and funding rates — and plan position sizing accordingly rather than chasing momentum blindly.