Toncoin Drops to Key $2.07 Support Level as Selling Pressure Builds

Summary

Quick recap of today's move

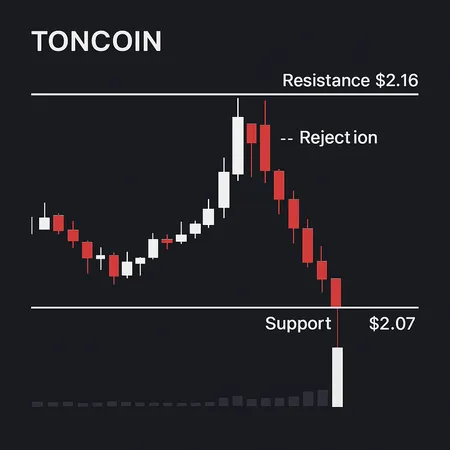

Toncoin briefly pushed up toward $2.16 before reversing lower, a swing that CoinDesk Research's technical analysis model flagged as significant. The peak of that attempt recorded 3.61 million tokens exchanged — the highest volume for the period — which points to concentrated selling and a clear resistance zone. After the reversal, TON settled back at the short-term support near $2.07, and market participants are increasingly cautious as net selling pressure mounts.

Market snapshot and liquidity context

The heavy volume at the $2.16 level suggests that many traders used that price to exit or reduce positions, creating a supply wall that heavier bids will need to absorb to retake the highs. On-chain flows and exchange liquidity look patchy during the move, which can amplify intraday volatility for smaller-cap altcoins. This behaviour isn't unique to TON — similar patterns have shown up across the broader blockchain sector when momentum encounters clustered sell orders. Watch for widening spreads and thinning order books; they increase the risk of sharper moves when the next catalyst arrives.

Technical implications and possible scenarios

The high-volume rejection at $2.16 converts that level into a technical resistance until buyers can break through with conviction. If $2.07 fails as support on follow-through selling, TON could test lower multi-week support zones as traders look for safe re-entry points. Conversely, a sustained reclaim of $2.16 on higher-than-average volume would flip sentiment faster and could trigger short-covering rallies. In short: a break below $2.07 is the bearish trigger, while a volume-backed breakout above $2.16 would be the bullish signal to watch.

What traders and hodlers should monitor

Risk-conscious traders should prioritize: volume confirmation, order-book depth, and correlation with the wider DeFi and crypto market movement. Use tight, pre-defined stops and consider scaling into positions rather than committing full size at a single level. Platforms like Bitlet.app can simplify risk management with order alerts and limit orders so you don't chase volatile fills. Remember that high-volume rejections often lead to short-term chop before a clear trend resumes — patience and position sizing matter.

Bottom line

Toncoin's rejected rally and the 3.61 million-token volume node at $2.16 raise the probability of further consolidation or a downward probe if $2.07 cannot hold. Traders should wait for clear volume-supported confirmation before betting on a sustained trend change, and maintain disciplined risk controls while monitoring on-chain liquidity and exchange order books.