SoFi Becomes First U.S. Consumer Bank to Offer Crypto Trading — 'Bank-Level Confidence'

Summary

Quick overview

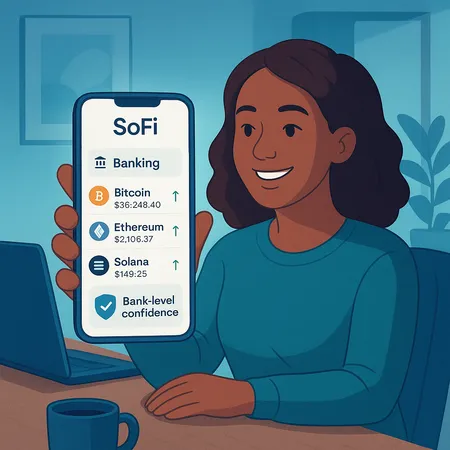

SoFi announced that its consumer banking app now supports in-app cryptocurrency trading, making it the first nationwide consumer bank in the U.S. to provide this capability. The integration allows customers to trade bitcoin, ethereum and solana alongside SoFi's existing banking, lending and investment products. SoFi frames the launch as delivering bank-level confidence, a phrase that underscores security, regulatory alignment and seamless access for users who already bank with SoFi.

What SoFi announced and how it works

SoFi’s rollout embeds crypto trading directly into its core mobile experience, rather than routing customers to a separate exchange. That means deposits, account funding and trade settlement can interact more smoothly with the bank’s savings, loans and investing features. The company says the offering emphasizes custody, compliance and transaction monitoring — features many retail customers expect from a bank.

Which assets are available at launch

At debut, SoFi supports bitcoin (BTC), ethereum (ETH) and solana (SOL). These three assets cover the largest market-cap cryptocurrencies and a fast-growing smart-contract chain, giving customers exposure to both established and more developer-driven ecosystems. While the selection is focused, SoFi may expand assets later depending on demand and regulatory considerations.

Why "bank-level confidence" matters for retail adoption

Describing the product as providing bank-level confidence is a strategic positioning move. Many retail users still view crypto through a security and regulatory lens: they want clear custody arrangements, compliance controls and the reassurance that comes from a familiar banking brand. By integrating trading into a bank app, SoFi reduces friction for users who might otherwise avoid standalone exchanges.

This shift also affects the broader blockchain ecosystem and the retail crypto market. Banks offering crypto can increase mainstream flows, but they also bring tighter KYC/AML processes and potentially different fee models compared with decentralized platforms and pure crypto exchanges.

Implications for users, competitors and platforms

For everyday customers the immediate benefits are convenience and familiarity: one app, consolidated balances and a single customer-support channel. For institutional observers, SoFi’s move signals a new phase of mainstreaming where traditional financial rails and crypto rails begin to interoperate more tightly.

Competitors — both banks and crypto-native exchanges — will likely respond by emphasizing custody guarantees, insurance, lower fees or broader asset catalogs. Platforms such as Bitlet.app should expect increased competitive pressure to highlight features where crypto-native services still lead: advanced trading tools, staking, access to memecoins and NFTs, and deep liquidity for margin traders.

Regulatory and product risks to watch

While integration is attractive, it raises questions: how will SoFi handle custody vs. third-party custodians, what are the fee structures, and how will the platform manage market volatility and liquidity during stress events? Regulatory scrutiny of bank‑crypto linkages remains active, so SoFi’s framework for compliance will be watched closely by both regulators and industry peers.

Final takeaways

SoFi’s launch of crypto trading inside its consumer bank app is a meaningful milestone for mainstream adoption. By offering bitcoin, ethereum and solana with a promise of bank-level confidence, SoFi lowers barriers for retail customers while nudging competitors to strengthen custody and compliance features. Investors and users should monitor asset availability, fees and the company’s custody disclosures to understand how this will reshape retail flows into crypto.

As mainstream banks adopt crypto features, platforms across the industry — from legacy exchanges to newer services like Bitlet.app — will need to sharpen their value propositions around custody, user experience and product breadth.