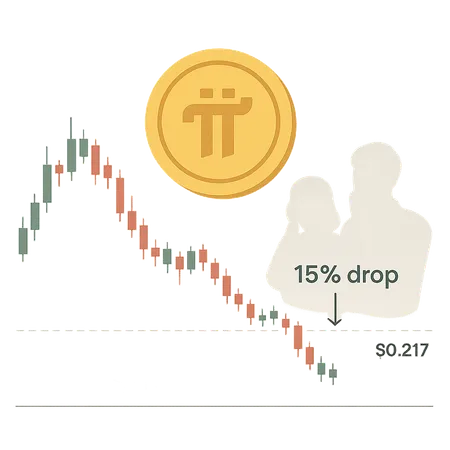

Pi Coin Tries to Recover After 15% Drop as Inflows Remain Muted

Summary

Pi Coin price snapshot and recent context

Pi Coin is attempting to recover after weeks of sluggish momentum. The token is holding above the $0.217 support level after a pullback that erased roughly 15% from recent highs. That drop has left traders cautious: price has rebounded modestly, but the rebound lacks the breadth typically seen when buyers aggressively re-enter the market.

Market participants are parsing both on-chain signals and exchange flows to decide whether this is a short-lived bounce or the start of a steadier recovery. Pi’s situation reflects a broader theme in the crypto market where many altcoins show price resilience but limited fresh capital inflows.

Price action, support and technical cues

Short-term charts show Pi forming a higher-low above $0.217, which gives bulls a near-term defensive line. Volume during the bounce has been below the multi-week average, however, which suggests buyers are tentative. If Pi closes above the recent local resistance with expanding volume, momentum could attract more speculative trading.

At present, risk management is critical: a failure to hold the $0.217 level would expose Pi to renewed selling and lower support bands. Traders often look for confirmation from liquidity metrics and stable inflows before committing larger positions.

Flows, on-chain signals and investor appetite

On-chain data and exchange flow reports indicate that investor inflows remain muted. Few large wallet movements and limited deposit activity imply that new money is not yet fueling the rebound. This contrasts with other high-profile speculative pockets — including parts of the blockchain ecosystem and some memecoins — where heightened retail interest can drive quick, volatile run-ups.

DeFi and NFT narratives have lifted segments of the market recently, but Pi’s recovery appears more dependent on targeted buying rather than broad speculative waves. Without a pickup in inflows, rallies may struggle to sustain themselves beyond short squeezes.

What traders should watch and practical takeaways

Watch three items closely: volume on green candles, net exchange flows, and major wallet activity. A consistent pickup across these metrics would increase the probability of a durable recovery. Conversely, rising outflows or renewed macro risk-off conditions could push Pi back toward prior lows.

For users of platforms like Bitlet.app, which provide access to installment and P2P exchange features, this is a reminder to match risk limits to market liquidity — smaller, phased entries can reduce downside if the token fails to attract fresh capital.

Outlook

Pi’s current rebound is constructive but tentative. The asset needs stronger inflows and sustained volume to convert the recovery into a broader uptrend. Until those signals appear, expect choppy trading and tight ranges around the $0.217 support. Traders should remain opportunistic but disciplined, using clear stop levels and monitoring on-chain flows for confirmation.