Viral Poll Triggers Identity Crisis: Is the Lightning Network 'Real' Bitcoin?

Summary

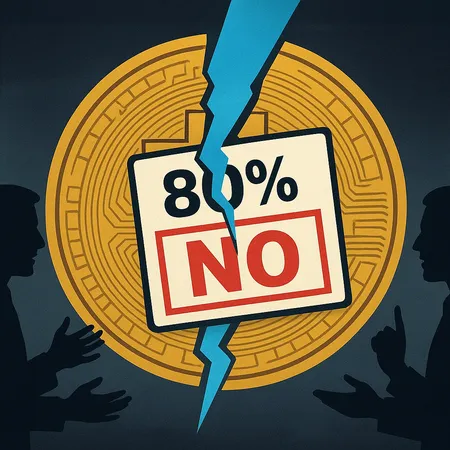

Community split after a viral poll

A short, viral poll recently captured headlines when more than 80% of participants voted that the Lightning Network is not “real Bitcoin.” The result cascaded through forums, X threads and Telegram groups, triggering heated exchanges between two broad camps: on‑chain purists who prioritize immutable, full‑node settlement, and layer‑2 advocates who emphasize scalability, speed and low fees.

The reaction was less about polling methodology than identity. For many crypto users the question isn't purely technical — it's philosophical: what defines Bitcoin? That framing pushed the conversation from routing algorithms into debates about custody, decentralization and the future of payments on the blockchain.

Why critics say Lightning isn't 'real Bitcoin'

Critics typically cite three core objections. First, custody and trust: Lightning relies on payment channels and often involves custodial or semi‑custodial wallets for convenience, which conflicts with the self‑custody ethos many associate with Bitcoin. Second, centralization risks: concerns about routing hubs and liquidity providers concentrating power are common talking points. Third, on‑chain finality: because many Lightning transactions settle off‑chain, purists argue they lack the finality and censorship resistance of on‑chain transfers.

These objections mirror historical anxieties in the crypto market where new layers and innovations — from DeFi to memecoins and NFTs — are regularly measured against perceived founding principles. For critics, Lightning crosses a line where convenience may erode foundational guarantees.

Technical reality vs ideological purity

The technical case for Lightning is straightforward: it enables near‑instant, low‑fee micro‑payments, reduces on‑chain congestion and opens avenues for new UX patterns (micropayments for content, streaming money, IoT billing). The network uses hashed timelock contracts and multi‑path routing to minimize counterparty risk and automate settlement when channels close.

Still, technical nuance gets lost in social media soundbites. Many Lightning implementations and wallet providers now support non‑custodial solutions where users control channel keys. Adoption also depends on liquidity management and better UX; these are engineering problems, not purely ideological ones. The underlying blockchain remains the settlement layer — Lightning is a complementary technology, not a replacement for on‑chain Bitcoin.

What this means for users, wallets and merchants

The poll's fallout matters beyond rhetoric. Retailers and payments stacks weigh trust and usability: some merchants prefer the economic benefits of Lightning (faster checkout, lower fees), while conservative players insist on on‑chain settlement for legal or accounting clarity. Wallet developers must decide how much to prioritize custodial convenience versus non‑custodial control.

Services like Bitlet.app and other intermediaries that offer hybrid experiences will be important bridges: they can onboard users to layer‑2 payments while keeping the option for on‑chain settlement and custody. For the broader crypto ecosystem — including NFTs and memecoins that experiment with new payment rails — the Lightning debate signals that adoption is as much social and political as it is technical.

Bottom line: identity is contested, but adoption is pragmatic

The viral poll underscored a real cultural divide but it doesn't change the technical role of Lightning: a layer‑2 scaling solution designed to complement Bitcoin's settlement layer. Identity debates are unlikely to resolve quickly — Bitcoin's community has a long history of ideological disputes — yet market incentives (merchant adoption, low fees, better UX) will continue to push layer‑2 usage.

For users and builders, the practical takeaway is clear: understand trade‑offs. If you prioritize absolute on‑chain finality and maximum permissionlessness, on‑chain Bitcoin remains the answer. If you need micropayments, speed and cost efficiency, the Lightning Network offers compelling benefits. Either way, expect the conversation to shape wallet features, merchant integrations and how newcomers first experience Bitcoin.