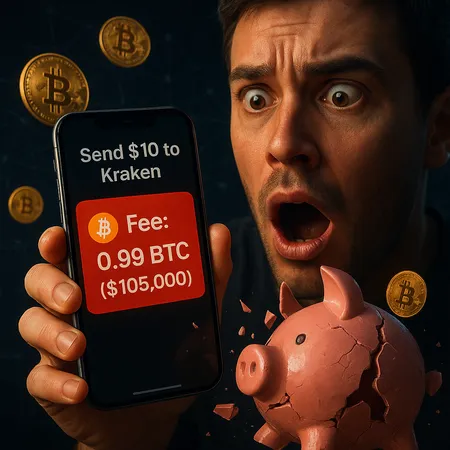

Bitcoin User Pays $105K Fee on $10 Transfer — What Went Wrong?

Summary

In an attention-grabbing mistake this week, a Bitcoin user attempted to send $10 to Kraken but accidentally set the miner fee to 0.99 BTC, roughly $105,000 at current prices. The transaction confirmed with the exorbitant fee, leaving the sender with little recourse once miners collected the reward.

How could a fee balloon to nine figures?

Several factors can cause a fee error of this size. The most common culprits are wallet UI confusion — for example, toggling a slider to “max” or mistaking satoshi-per-byte fields — and broken fee estimators that recommend extreme values during brief mempool anomalies. Manual configuration mistakes (entering fee in satoshis vs BTC) or a copy-paste error when editing advanced settings can also produce catastrophes.

Wallet bugs, user error, and network conditions

While network congestion sometimes pushes fees higher, current on-chain activity rarely justifies a 0.99 BTC fee. That points to either a wallet-level bug or human error. Hardware wallet confirmations usually show detailed amounts, but a hurried user can approve transactions without scrutinizing the fee. Developers and custodial platforms must design clearer confirmations and defaults to prevent such losses.

Is the money recoverable?

Unfortunately, miner fees are paid directly to the miner who mines the block containing the transaction. Once a transaction is confirmed, those fees are effectively irretrievable unless a miner chooses to return them — an exceedingly rare and reputationally driven act. The practical steps for someone in this situation are to: check transaction details, contact wallet support and the receiving exchange, and publicly document the case to appeal to the miner or pool. Still, realistic recovery chances remain low.

Broader lessons for users and platforms

This incident underscores the importance of safer UX and clearer fee estimation across the crypto market. Users should enable transaction previews, avoid manual fee inputs unless experienced, and test small transfers when using unfamiliar wallets. Custodial platforms and apps — including Bitlet.app — can help by offering educational prompts, conservative fee defaults, and one-click confirmations that highlight fee amounts in fiat.

Accidents like this are painful reminders that while blockchain transactions offer finality and censorship resistance, they also carry permanence. Double-check fee fields, use well-audited wallets, and consider small test transactions to avoid becoming the next headline.