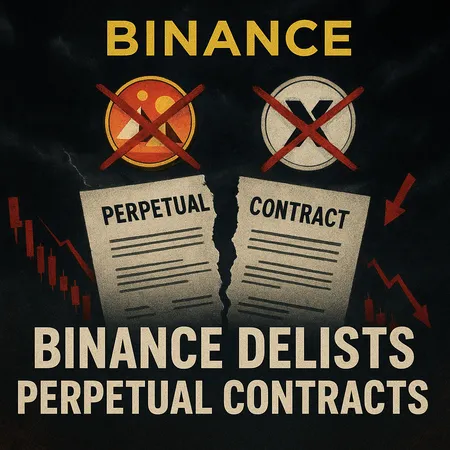

Binance to Delist Perpetual Contracts for MANA and EGLD — What Traders Need to Know

Quick summary

Binance has announced it will delist perpetual contract trading for two tokens: Decentraland (MANA) and MultiversX (EGLD). The decision affects only perpetual derivatives — spot markets and other products may remain available — but leveraged traders should expect immediate effects on liquidity and pricing.

Why exchanges delist perpetuals (likely reasons)

Exchanges typically remove perpetual contracts for tokens when risk and market conditions change. Common drivers include:

- Low derivatives liquidity: thin orderbooks can make mark-price calculations and liquidations more volatile.

- Elevated systemic risk: tokens with higher volatility or unusual on-chain activity can increase counterparty exposure for an exchange.

- Regulatory considerations: changes in jurisdictional rules or internal compliance reviews can force product pruning.

In this case, Binance’s move likely reflects a combination of lower perpetual liquidity and risk-management decisions rather than issues with the underlying blockchains themselves.

Immediate market effects to watch

Volatility and spreads

Perpetual delistings often cause short-term volatility as open positions are closed or migrated. Expect wider bid-ask spreads in remaining venues and potential price swings for MANA and EGLD.

Forced deleveraging and liquidations

Traders with leveraged long or short positions on Binance will need to close or roll positions before the deadline to avoid forced liquidations. This can create clustered order flow that exacerbates moves.

Impact on funding rates and open interest

Open interest on other exchanges may spike as traders relocate positions, which can temporarily push funding rates up or down depending on directional pressure.

What this means for holders and traders

- Spot holders of MANA and EGLD are not directly affected by a perpetual delisting, but secondary-market prices may still react.

- Derivatives traders should close, hedge, or migrate positions before Binance’s deadlines to control execution risk.

- Market makers and liquidity providers may widen spreads or pull inventory, reducing execution quality.

Practical steps for traders (short checklist)

- Confirm the exact delisting schedule and liquidation/settlement details on Binance.

- Close or migrate leveraged positions to other reputable venues if you intend to maintain exposure.

- Use limit orders and staggered execution to avoid slippage during volatile windows.

- Review margin and liquidation thresholds — do not wait until the last moment.

- Consider spot or over-the-counter (OTC) routes for large adjustments.

Broader implications for the crypto market

Perpetual product pruning signals healthy risk discipline by major venues but can concentrate liquidity elsewhere. For tokens tied to virtual worlds and digital assets — like MANA, which intersects with the NFTs ecosystem — derivatives availability matters for traders and institutional desks that hedge large exposures. Overall, such removals can weigh on derivatives sentiment across the wider crypto market in the near term.

Where Bitlet.app fits in

If you use services like Bitlet.app to monitor positions, installment plans, or P2P trades, now is a good time to recheck your exposure to MANA and EGLD and ensure your risk rules align with the new derivatives landscape.

Final takeaways

- Binance is delisting perpetual contracts for MANA and EGLD — a targeted move that primarily affects leveraged traders.

- Expect short-term volatility, widened spreads, and migration of open interest to other venues.

- Act proactively: verify deadlines, close or hedge positions, and use measured execution to reduce slippage.

Stay alert for Binance’s official timeline and any follow-up statements; delistings can evolve quickly and have ripple effects across exchanges and DeFi liquidity pools.