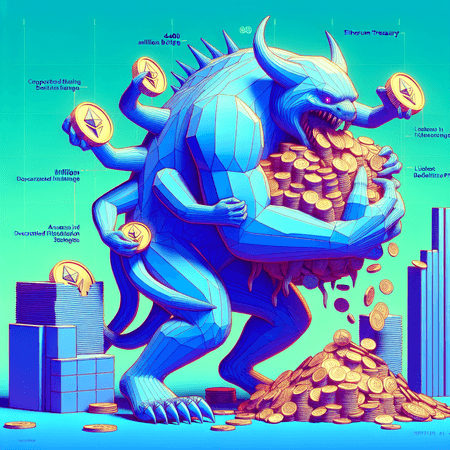

ETHZilla Corporation Sells $40M Ethereum Holdings to Fund Stock Buybacks

ETHZilla Corporation (Nasdaq: ETHZ) recently announced it sold $40 million worth of its Ethereum (ETH) treasury holdings to fund a stock buyback program. This strategic move aims to reduce the company's net asset value (NAV) discount and enhance shareholder value. The buyback program has already led to the repurchase of approximately 600,000 shares for $12 million, with plans to use remaining proceeds for further share repurchases.

In addition to these buybacks, ETHZilla invested $15 million into Satschel, Inc., targeting advancements in decentralized finance (DeFi) integration and real-world asset tokenization — moves that align with expanding blockchain applications beyond trading and speculation.

Despite the recent sale, the company still holds around $400 million in Ethereum, demonstrating its long-term commitment to the crypto asset. The stock price experienced a 7.3% surge following the announcement, although the price-to-book ratio remained high at 53.7x.

Investors await the upcoming third-quarter 2025 earnings release scheduled for November 14, 2025, for more insights on ETHZilla's financial health and strategic direction.

For crypto enthusiasts or investors looking to access cryptocurrencies with flexible payment options, platforms like Bitlet.app offer innovative solutions such as Crypto Installment services. Bitlet.app allows users to buy cryptos now and pay monthly, making crypto investments more accessible without the need for a large upfront payment.