Institutional Wave: How Franklin Templeton’s XRP ETF Could Rewire Demand, Liquidity, and Custody

Summary

Executive snapshot

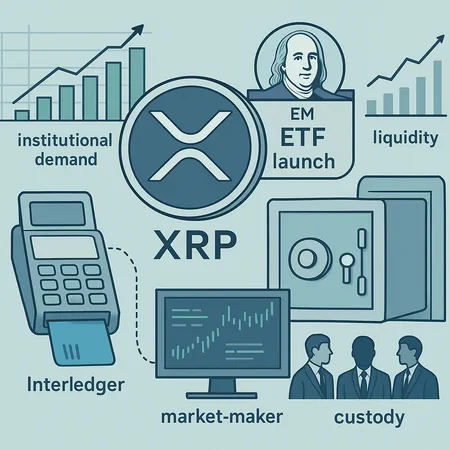

Franklin Templeton’s move to launch an XRP ETF — following Canary Capital’s first entry — signals a new institutional chapter for XRP. ETFs change the mechanics of demand: they aggregate investor flows, rely on authorized participants for creation/redemption, and concentrate custody with regulated custodians. That combination can materially alter liquidity, pricing dynamics, and the infrastructure surrounding XRP.

This piece unpacks how ETF-driven demand differs from growth in on‑ledger utility (chiefly Ripple’s Interledger and potential Visa compatibility), explores short-term price and custody implications, and outlines practical takeaways for retail holders, market makers, and prospective ETF issuers.

Why an institutional XRP ETF matters

An ETF does more than give investors an easier ticker to trade. It creates a predictable, regulatory‑framed conduit for capital. Authorized participants (APs) bridge the ETF and spot markets: when inflows occur, APs buy spot XRP (or deposit into the ETF’s trust) and create ETF shares; when outflows occur, the reverse happens. That mechanism imposes arbitrage linkages between ETF price and underlying spot — and it brings institutional custodianship, reporting, and compliance into the XRP ecosystem.

Franklin Templeton’s announcement is notable because of the asset manager’s scale and distribution reach; TokenPost covered the planned launch, emphasizing growing institutional interest in XRP as a tradable, regulated vehicle (see the TokenPost announcement). Expert sentiment surveyed around the launch is broadly bullish because major managers can mobilize sizeable, sustained demand rather than episodic retail spikes (see reactions covered by CoinGape). Canary Capital’s debut already primed markets: one boutique ETF can prove the retail and intermediary appetite, but a heavyweight like Franklin Templeton introduces a very different demand profile.

How ETF demand dynamics differ from payment-led utility

ETF-driven demand

- Bucketed flows and predictability: ETFs tend to accumulate and redeem in chunks. Net inflows mean APs will source large blocks of XRP, pressuring spot liquidity at discrete moments rather than steadily drip-buying.

- Arbitrage and spread compression: APs and market makers arbitrage small price differentials between ETF shares and spot XRP, usually tightening bid-ask spreads and improving on-exchange depth.

- Concentrated custody: Custodians hold large centralized reserves of XRP under institutional-grade custody arrangements, which reduces counterparty complexity for ETF investors but concentrates asset custody risk.

Payment-led utility (Interledger/Visa compatibility)

- Organic transactional demand: Improvements to Ripple’s Interledger and reports of Visa compatibility expand real-world use cases — cross-border settlement, real-time rails between fiat and crypto — which can generate continuous, utility-driven demand for XRP as a settlement or bridge asset.

- Network effects and utility stickiness: Payment adoption can increase on-chain volume and decentralized liquidity demands, but the resulting flows are often distributed across corridors and counterparties rather than concentrated into institutional buckets.

Both demand vectors are complementary: ETFs provide portfolio demand and market structure improvements, while rails adoption provides economic demand and long-term use cases. Coinpaper’s coverage on Interledger gaining traction and potential Visa compatibility highlights that fundamental utility can underpin lasting demand even when ETF flows are episodic.

Short-term price and liquidity implications

Immediate liquidity effects

In the short term, ETF creation flows can cause noticeable spot squeezes if authorized participants need to source large quantities of XRP quickly. That dynamic depends on three levers:

- Available floating supply: how much XRP is readily transferable on exchanges and OTC markets.

- Market-maker inventories: how much primary liquidity makers hold versus hedged positions.

- Custody and settlement speed: faster custody onboarding reduces the time APs need to source spot, easing transient supply pressure.

If Franklin Templeton’s ETF attracts meaningful early inflows, expect narrower spreads and deeper displayed liquidity during normal market hours because arbitrageurs will inventory XRP to capture creation/redemption spread. However, during initial ramp-up and rebalancing windows, volatility can spike as APs and OTC desks scramble to match demand.

Price trajectory vs. fundamentals

ETFs can push price higher temporarily by concentrating buy pressure, but sustained price appreciation needs either repeated inflows or growing real-world utility. Interledger adoption and Visa rails compatibility supply a path for persistent demand: payments require continuous settlement liquidity, not one-off buy-ins. In other words, ETFs can amplify price moves and improve market structure; lasting valuation change needs protocol-level usage.

Custody, settlement, and operational risks

Introducing ETFs shifts custody from many retail wallets to a few institutional custodians. That has pros and cons:

- Pro: Professional custody reduces retail operational risk, introduces insurance frameworks, and aligns compliance with regulated entities — attractive for pension funds and family offices.

- Con: Custody concentration increases single-point-of-failure risk and could raise systemic concerns if a custodian faces operational issues. APs and issuers must insist on multi-sig, cold-storage provisions, and audited insurance.

Clearing and settlement flow also matters. XRP’s fast settlement is an advantage from a hot‑liquidity stance, but ETF issuers and custodians will impose KYC/AML and on/off ramps that could slow effective settlement compared to native on-chain transfers. For market-makers, balancing between exchange-held inventory and custodian-held ETF-eligible supply becomes a new optimization problem.

What this means for key stakeholders

For retail holders

- Tighter spreads and deeper books: The ETF arbitrage ecosystem generally improves price discovery and narrows retail execution costs.

- Volatility windows: Expect episodes of pronounced volatility during ETF launches, re-openings, or large redemptions. Retailers should be prepared for transient price dislocations.

- Access to institutional rails: Some retail investors will prefer ETF exposure for custody simplicity and tax/reporting benefits, while others retaining self-custody will benefit from improved liquidity.

For market makers and liquidity providers

- New revenue and risk profiles: APs earn fees and capture spreads but need to manage inventory and funding risk. Market makers will profit from tighter spreads but must grow capital allocated to XRP inventory.

- Increased OTC demand: A parallel OTC market will persist for large fills and may grow as ETF issuers source initial creation baskets.

For ETF issuers and asset managers

- Product design choices matter: Physical-replication vs. synthetic, custody provider selection, and creation/redemption mechanics (in-kind vs. cash) will determine market impact and regulatory friction.

- Liquidity sourcing strategy: Issuers must line up APs, prime brokers, and OTC desks to ensure smooth onboarding. The Canary Capital debut provided early data; Franklin Templeton’s scale will test market capacity.

Practical checklist for asset managers and long-term investors

- Stress-test liquidity needs: Model creation/redemption scenarios to estimate slippage and sourcing cost for different fund sizes.

- Vet custody and insurance: Demand robust, audited custody (multi-sig, geographically dispersed cold storage) and explicit insurance for hot-wallet exposures.

- Monitor on-chain utility metrics: Track Interledger adoption, payment corridor volumes, and Visa integration signals — these indicate whether demand is purely financial or backed by usage.

- Coordinate with market makers: Pre-agree with APs and OTC desks on block sizes, routing, and settlement windows to reduce execution risk.

Bitlet.app users and other investors should view ETF products as a structural improvement for market access, not a substitute for evaluating on-chain fundamentals and network adoption.

Conclusion — convergence, not replacement

The arrival of Franklin Templeton’s ETF will likely compress spreads, institutionalize custody, and create sizable, predictable buy pressure at times — all of which change XRP’s market structure. Yet it does not replace the importance of Ripple’s Interledger and possible Visa rails compatibility, which deliver a different, usage-based form of demand. Together, ETF flows and improved rails can be mutually reinforcing: ETFs improve tradability and liquidity, lowering friction for institutions that might underwrite or use payment corridors; enhanced rails provide the economic foundation that helps sustain asset value once speculation cools.

For asset managers and long-term investors, the key is to separate market structure effects (ETF mechanics, custody, arbitrage) from fundamental effects (payment adoption, settlement volume). Both matter — and both should be modeled in any rigorous investment thesis on XRP.

For further reading on the ETF launch and market reaction, see Franklin Templeton’s planned roll-out coverage on TokenPost and expert commentary compiled by CoinGape. To understand the payments-side developments that underpin long-term utility, review the recent reporting on Ripple’s Interledger and potential Visa compatibility in Coinpaper.

Selected sources

- Franklin Templeton XRP ETF announcement: TokenPost

- Market and expert reaction to the ETF launch: CoinGape

- Interledger traction and Visa compatibility reporting: Coinpaper

For broader market context, remember that for many traders, Bitcoin remains the primary market bellwether even as niche products like XRP ETFs reshape specific microstructure dynamics.