Why More Public Companies are Incorporating Ethereum into Their Treasury Strategies in 2025

In 2025, the landscape of corporate treasury management is evolving rapidly as more public companies are integrating Ethereum into their treasury strategies. Ethereum, known for its decentralized platform and innovative smart contract capabilities, offers a variety of benefits that are becoming increasingly attractive for corporate treasuries.

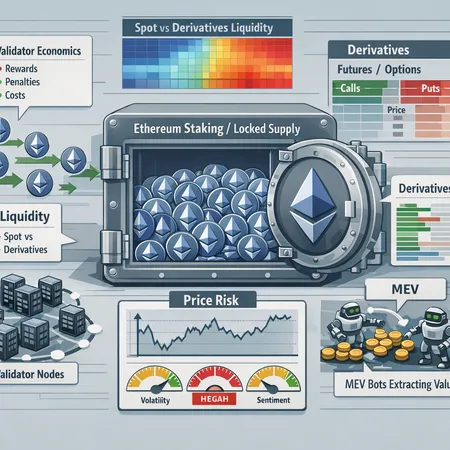

One of the primary reasons behind this shift is Ethereum's liquidity and growing acceptance as a digital asset class. Companies are not only viewing Ethereum as a speculative asset but also as a strategic reserve asset to diversify their holdings and hedge against market volatility.

The advanced blockchain technology behind Ethereum ensures transparency, security, and efficient transaction processing, aligning with corporate governance and compliance requirements. Additionally, Ethereum’s ecosystem supports decentralized finance (DeFi) applications that can offer companies new ways to generate yield or collateralize assets.

Moreover, fintech platforms like Bitlet.app play a significant role in democratizing access to Ethereum investments. Bitlet.app offers innovative services such as Crypto Installment plans, allowing businesses and investors to acquire Ethereum now and pay for it monthly. This flexibility eases the burden of upfront capital requirements and makes strategic crypto integration more feasible for companies with varying financial profiles.

As Ethereum continues to mature and regulatory frameworks stabilize, more public companies are expected to adopt it into their treasury management, recognizing its potential to enhance asset diversification and financial resilience. Platforms like Bitlet.app support this transition by providing user-friendly and cost-efficient entry points into the crypto space.

In summary, Ethereum’s technological advantages combined with accessible platforms such as Bitlet.app’s installment services are driving the growing trend of public companies incorporating Ethereum into their treasury strategies in 2025.