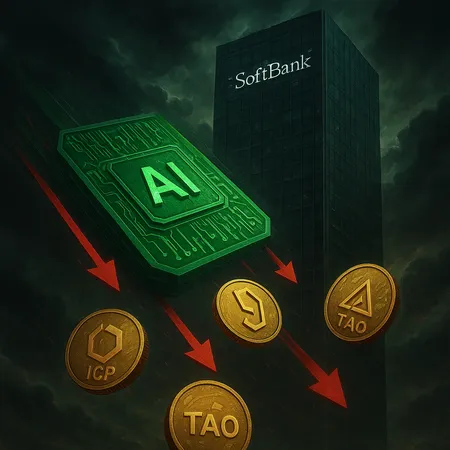

AI Tokens Slide After SoftBank Dumps $5.83B NVIDIA Stake to Back OpenAI

Summary

SoftBank's strategic pivot: NVIDIA to OpenAI

SoftBank disclosed the sale of a $5.83 billion NVIDIA stake to expand its ownership in OpenAI. The headline grabbed headlines not just for the size of the trade but for what it signals: a tilt away from public hardware plays toward concentrated ownership in a private AI platform. Markets interpreted the move as a vote of confidence in closed-source, centralized AI platforms — a development that pressures projects and tokens that derive value from open, decentralized AI infrastructure.

SoftBank’s reallocation creates two simultaneous effects: it deprives Nvidia-linked bulls of a high-profile holder and it funnels narrative momentum into private AI ventures. For crypto investors, that means reassessing whether value will accrue to tokenized AI infrastructure, data marketplaces, or to proprietary, off-chain models controlled by a few large entities.

Why AI tokens and related altcoins reacted

The immediate reaction in the crypto market was negative for many AI or ML-adjacent tokens. Traders dumped positions in coins perceived to benefit from GPU demand or open AI tooling while rotating capital toward safer large-cap assets. Specific tickers under strain included ICP, INJ, TAO, and THETA, which either host AI services, oracle/compute layers, or video and content infrastructure that markets associate with AI monetization.

There are a few mechanisms behind the sell-off: correlation risk (NVIDIA stock decline can pressure tokens tied to hardware demand), narrative risk (investor preference for private AI ownership), and liquidity flows (large fiat reallocations into private deals can tighten crypto liquidity). However, not all projects are equally exposed — those with strong on-chain adoption, clear revenue models, or defensible tokenomics may withstand the shock.

Short-term implications and opportunities for traders

Expect elevated volatility. Short-term traders may find momentum-driven trades on oversold AI tokens, while longer-term investors should separate speculative narrative plays from projects with demonstrable utility. Look for on-chain signals like active addresses, developer commits, and staking participation to gauge resilience.

Risk management matters: tighten stop losses, reduce position sizes, and avoid leverage on thinly traded tokens. For users of platforms like Bitlet.app, this period may bring more P2P activity and demand for installment or earn products as investors rebalance exposure.

Outlook: Stabilization or prolonged rotation?

If private AI platforms deliver outsized commercial returns and partnerships, capital might permanently favor non-tokenized players — a negative structural outcome for many AI tokens. Conversely, if decentralized alternatives continue to build unique data, privacy, or composability advantages, selective tokens could recover and outperform.

For now, treat the sell-off as a risk re-pricing rather than an industry death knell. Monitor broader macro signals, NVIDIA’s own price action, and project-specific fundamentals. Stay informed on cross-sector trends in blockchain and DeFi as they will influence liquidity and demand dynamics.

Bold market moves by major investors reshape narratives quickly — but they also create opportunities for disciplined, research-driven crypto investors.