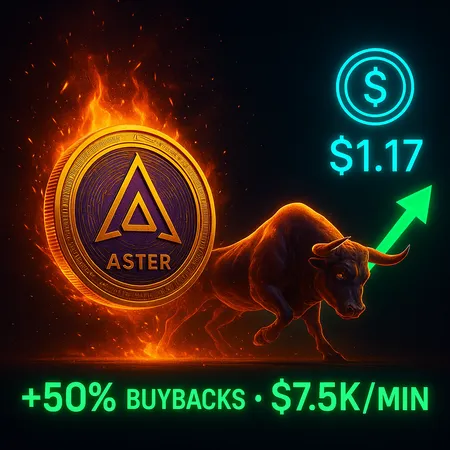

Aster buybacks surge 50% to $7.5K/min — Can bulls hold the $1 zone?

Summary

Momentum returns as buybacks and burns accelerate

Aster’s on-chain activity spiked this week after protocol buybacks increased about 50%, lifting the buyback pace to roughly $7,500 per minute. At the same time the token’s burn rate doubled, producing a visible deflationary effect on circulating supply. Traders and validators reacted quickly: active addresses ticked up and exchange order books showed heavier bids clustered near the psychological $1 support.

This renewed activity has reignited debate among traders — can this momentum clear the near-term ceiling at $1.17, or will the move fade and leave bulls scrambling to defend the $1 zone? The answer depends on execution: sustained buybacks, continued burns, and higher on-chain demand.

On-chain indicators and what they imply

On-chain signals point to a coordinated push rather than a one-off spike. The combination of larger buybacks and an accelerating burn rate reduces available supply if sustained. That dynamic is especially potent for tokens with modest market caps, where even relatively small buyback flows can move price materially.

At the same time, watch for liquidity concentration. If buybacks are funneled through thin pools or if a few wallets control large sell pressure, volatility can spike. For traders, that means monitoring wallet distribution, DEX liquidity depth, and whether fresh demand comes from retail or larger allocators. Protocol teams often use buybacks as a signaling and tokenomics tool; pairing that with DeFi utility or listings tends to amplify positive price action — which is why integrations into DeFi rails or new DEX pairs could be meaningful catalysts.

Technical outlook — support, resistance, and scenarios

Short-term structure centers on two levels: $1 support and $1.17 resistance. The market has respected $1 as a defensive zone several times this cycle, creating a clear stop-loss level for many longs. A decisive break above $1.17 on elevated volume would likely invite momentum traders and could open a run toward mid-level resistances around $1.30–$1.50.

Conversely, if volume dries up and buybacks taper, bears may test $1 and push for a retest of lower liquidity bands. Risk management matters: use position sizing and watch order book depth — memecoin-style surges can reverse quickly, and Aster’s moves so far show both rapid rallies and sharp reactions, a behavior often seen in memecoins and small-cap tokens.

Catalysts, risks, and what to watch next

Key bullish catalysts: sustained or larger buybacks, continued doubling of burn rate, higher on-chain activity, new exchange listings, or partnerships that increase token utility. Risks include concentrated sell-side supply, a cooling of buyback funding, broader crypto market weakness, or liquidity migration.

For traders and holders, monitor these on-chain metrics closely: buyback cadence, burn transactions, active addresses, and DEX liquidity. Tools on platforms like Bitlet.app can help users track token flows and market activity while deciding on entry or exit strategies.

Bottom line — cautiously optimistic

Aster’s 50% jump in buybacks to about $7.5K per minute and the doubled burn rate are meaningful positives that tighten supply and support price. However, the move is conditional: bulls need continued volume and follow-through to clear $1.17 and turn the $1 zone into a reliable springboard. If buybacks continue and DeFi integrations arrive, Aster has a clear path higher — but traders should size positions and plan for swift volatility in this market environment.