XRP ETF Launch: Trading the $2.20 Test, Whale Flows, and What Legal Clarity Means

Summary

Why this matters now

The launch of an XRP ETF has re‑amped market attention, but the practical trading question is less about headline momentum and more about context: immediate price structure, on‑chain flows, and legal risk. For portfolio managers and active traders deciding whether to view the ETF as a buy‑on‑retest opportunity or as a longer‑term allocation, these three signals should drive position sizing and timing.

Institutional access often lowers a perceived risk premium, yet it doesn't erase discrete technical and on‑chain signals that determine short to medium‑term returns. For many market participants, including those who watch Bitcoin for macro cues, the right posture toward an XRP ETF is nuanced — blending tactical trade rules with strategic allocation discipline.

Technical picture: testing $2.20 support and what it implies

XRP is currently testing a critical support region around $2.20, a level flagged by technical commentators as the immediate downside risk to monitor. If this support holds on a credible retest with volume confirmation, it offers a defined risk entry for traders who prefer buy‑on‑retest setups: enter near support with a tight stop below and target near prior resistance bands. Conversely, a decisive break below $2.20 on expanding volume would flip the map toward distribution and force managers to reassess exposure size.

Technicians should combine the $2.20 pivot with time‑frame alignment: a clean retest and a higher‑timeframe trend staying intact justify adding size; a failure invites either hedging or stepping aside. Use position sizing that treats a retest trade as tactical (smaller, with strict stops) while any long‑term ETF allocation should be built gradually, not lumped at a single retest.

The 716 million anomaly: whales, on‑chain transfers, and interpretation

On‑chain analytics recently flagged an extraordinary cluster of transfers totaling roughly $716 million, an anomaly large enough to alter market expectations about supply movement and custody behaviors. Such mega‑value transactions can mean different things depending on destination and timing — custody inflows to a regulated custodian often imply institutional accumulation, while transfers toward exchanges can precede selling pressure. The raw number alone is a trigger for deeper flow analysis, not a trading signal by itself. See the on‑chain reporting for the transfer details here.

Practically: watch the receiving addresses. If those large transfers land in cold wallets or known institutional custody addresses, the market interprets it as accumulation and it reduces near‑term liquidation risk. If flows are to hot wallets or exchange deposit addresses, be ready for potential supply hitting the market. For active traders, the actionable step is to pair on‑chain alerts with order‑book and exchange flow data before assuming the whale is bullish or bearish.

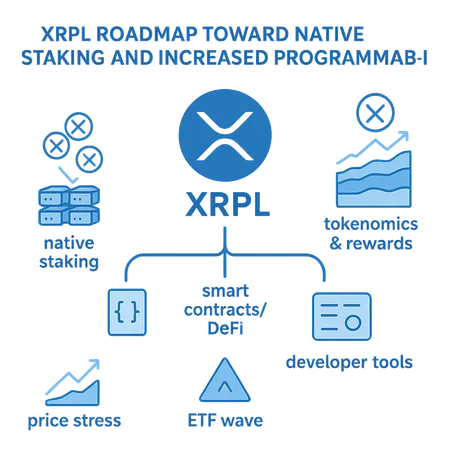

Legal clarity: Ripple CTO closes a Craig Wright subplot and why it matters

Regulatory and legal noise has historically been a major component of XRP’s risk premium. Recent public comments by Ripple’s CTO addressing and effectively ending a Craig Wright‑related episode remove a layer of distraction, improving legal clarity around the narrative. With that subplot diminished, institutions evaluating the ETF face fewer headline tail risks — a meaningful development for allocation committees that price regulatory uncertainty into required returns.

Legal clarity does not equal legal immunity, but it does matter: reduced peripheral litigation signals can lower event‑risk volatility and may increase the willingness of custody providers and compliance teams to onboard XRP for ETF exposures. This is one of the reasons some allocators are more willing to treat the ETF as a viable vehicle for long‑term exposure.

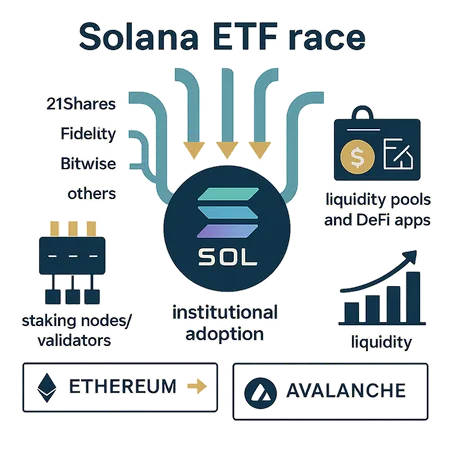

ETF inclusion ≠ equivalence to BTC/ETH: the fundamental distinctions

Institutional products bring legitimacy and flows, but they don't change the underlying fundamentals overnight. As industry voices have pointed out, XRP is not Bitcoin or Ethereum in terms of economic design, decentralization, or primary utility — and that distinction persists despite an ETF launch. The Canary Capital perspective captures this: XRP’s ETF status is an important market development, yet its role as a settlement/regulatory‑sensitive asset differentiates it from the more monetary or smart‑contract‑centric narratives of BTC and ETH.

For portfolio managers, that means ETF exposure to XRP should be sized with these differences in mind. BTC and ETH are often treated as macro or platform bets with deep liquidity and network effects; XRP’s value is more tied to payments rails, regulatory outcomes, and concentrated holder dynamics. Do not assume ETF inclusion automatically converts XRP into a macro hedge or a direct store‑of‑value proxy.

Trading frameworks: buy‑on‑retest vs longer‑term allocation

Here are practical frameworks you can apply depending on your mandate:

Tactical traders (buy‑on‑retest): prefer smaller, well‑defined entries at or just above $2.20 with tight stops beneath the support. Confirm with on‑chain context — large custodian inflows increase the odds of a successful retest, while exchange inflows raise caution. Use trailing stops or scale‑out rules near near‑term resistance.

Active swing managers: blend a tactical retest leg with staggered entries that add on confirmed range extension or sustained on‑chain accumulation. Maintain a risk budget per position size and avoid doubling down after a break of $2.20 without new, compelling flow evidence.

Long‑term allocators / institutions: treat the ETF as an access vehicle for phased entries over months, not a one‑time buy on a retest. Legal clarity improves the case for a strategic allocation, but fundamental differences from BTC/ETH argue for modest initial weights and periodic rebalancing rather than concentrated bets.

Whichever framework you adopt, make on‑chain monitoring part of your standard toolkit — whale flows and custody addresses tell you whether supply is being sequestered or prepared for listing and sale.

Practical risk management and execution checklist

- Set explicit stop‑loss levels tied to $2.20; treat a breach as a signal to reduce risk.

- Monitor order‑book depth and exchange inflows in real time when large transfers appear.

- Use scaled entries: smaller initial allocation on technical confirmation, larger adds only with corroborating on‑chain accumulation.

- Consider options or hedges for larger allocations to manage tail outcomes during ETF ramp periods.

- Keep legal and compliance updates on your radar — even marginal improvements in legal clarity can compress implied volatility and change optimal sizing.

Final read: how to think about the ETF in a portfolio

The XRP ETF launch is an important institutional milestone, but its practical implications depend on a mix of price structure, on‑chain behavior (notably the recent $716M anomaly), and regulatory signal‑to‑noise. For traders, $2.20 is the short‑term fulcrum: defend it and the narrative leans constructive; lose it and treat positions more defensively. For allocators, the ETF lowers some access friction but doesn't erase fundamental differences from BTC/ETH — so size allocations accordingly and use staggered build‑outs.

Stay disciplined, monitor on‑chain flows and custody movements closely, and use legal clarity as one input — not the sole reason — for increasing exposure. Tools like on‑chain analytics and a platform‑aware execution plan (including services such as Bitlet.app for operational needs) can help translate these signals into disciplined trades and allocations.

Sources and further reading

- Technical support note on the $2.20 area: XRP tests critical $2.20 support

- On‑chain whale anomaly reporting on the $716M transfers: Rare $716M on‑chain whale anomaly

- Canary Capital on why XRP differs from BTC/ETH despite an ETF: XRP is not Bitcoin or Ethereum

- Ripple CTO statement closing the Craig Wright episode: Ripple CTO ends debate over legal claims

For portfolio managers and active traders, the right answer is rarely binary: treat the ETF as a new market layer, not a replacement for price and on‑chain signals.