Tether

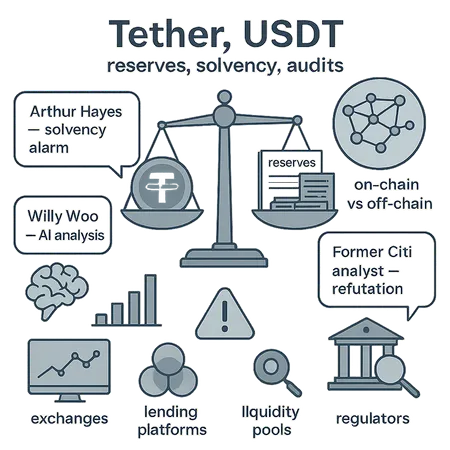

A recent social-media alarm over Tether’s reserves reignited long-running debates about on-chain visibility, attestation vs audit, and stablecoin liquidity risk. This explainer breaks down the facts, the analyst responses, and practical steps for investors and compliance teams.

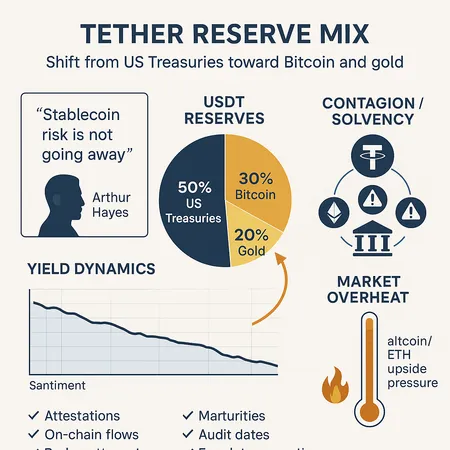

Tether’s attested move toward Bitcoin and gold raises nuanced solvency and contagion questions for institutional investors. This investigation parses Arthur Hayes’ critique, liquidity scenarios, yield signals for ETH and altcoins, and the monitoring metrics risk officers should adopt.

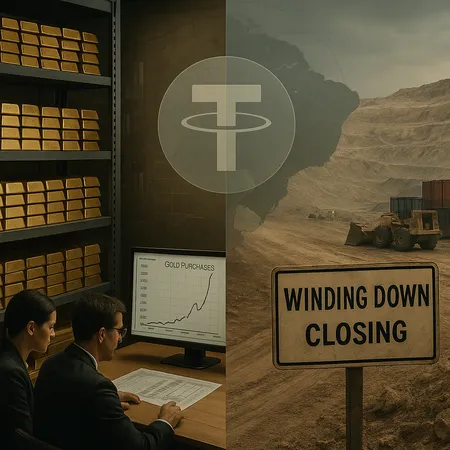

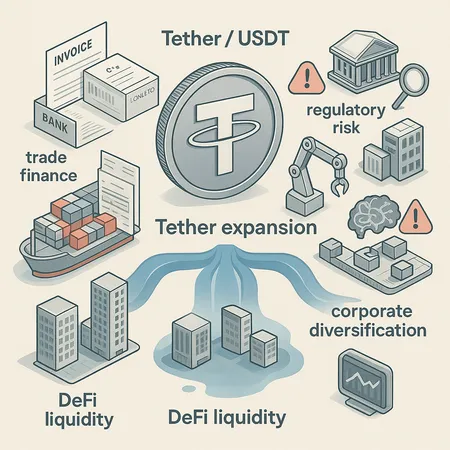

Tether’s simultaneous accumulation of gold and wind-down of mining operations in Uruguay presents a deliberate pivot in reserve strategy and operational focus. For treasury managers and macro traders, the moves raise questions about liquidity, transparency and how to size short-term exposure to USDT.

Tether’s decision to wind down Bitcoin mining in Uruguay reflects rising energy costs, shifting economics of large-scale mining, and growing reputational pressure after a public clash with S&P. This feature unpacks the operational drivers, the ratings fallout, and what compliance officers and policymakers should watch next.

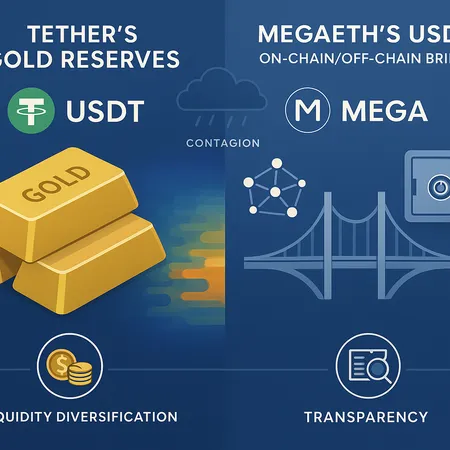

Tether's growing gold stockpile and MegaETH's USDm pre-deposit bridge reflect a shifting playbook for stablecoin reserves. This article analyzes why issuers diversify (gold vs cash), how on‑chain/off‑chain bridges work, and the systemic implications for liquidity, transparency, and contagion risk.

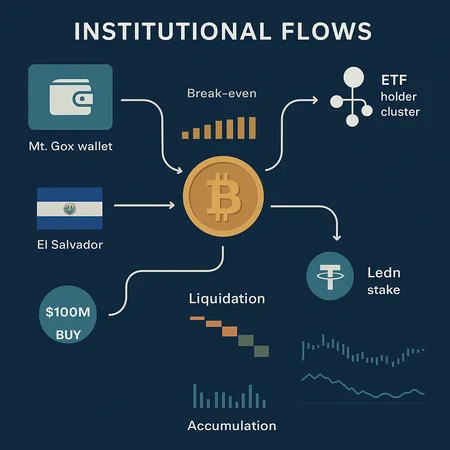

An investigative roundup of institutional behavior during the latest Bitcoin sell‑off, tracing major on‑chain movements, ETF holder dynamics, sovereign buys, and corporate plays to assess near‑term stability and conviction. Read the synthesis and tactical takeaways for analysts and institutional allocators.

Tether’s reported move into trade finance and large-scale robotics/AI investments marks a strategic pivot from pure stablecoin issuance toward corporate diversification. This explainer assesses how those moves could affect USDT reserve liquidity, counterparty concentration, DeFi exposure, and potential regulatory responses.

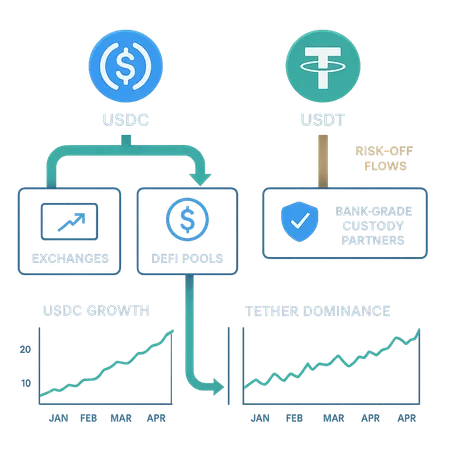

In November 2025 stablecoins — led by rising USDC circulation and a Tether dominance spike — are acting as the market’s liquidity backbone. New custody and settlement integrations are reshaping institutional on-chain flows and DeFi liquidity provisioning.

As USDC continues to outpace Tether in market presence, stablecoin investors should understand the implications of this shift in 2025. Learn about the benefits, risks, and how platforms like Bitlet.app offer unique opportunities for investing in stablecoins.

In 2025, USDC is gaining popularity as a stablecoin, while Tether faces increasing scrutiny. Understanding these dynamics is key for crypto investors. Platforms like Bitlet.app offer innovative services such as Crypto Installment, making it easier to invest in cryptocurrencies amid these market changes.