ETF

Grayscale’s S‑1 filing for a spot Sui trust and the SEC’s sign‑off on a 2x leveraged SUI ETF mark a step toward institutional productization. This article explains the timeline, product mechanics, likely liquidity and volatility effects, and what developers and token holders should expect.

Fidelity CEO Abigail Johnson argues Bitcoin is shifting from speculative trade to household savings. This article evaluates the evidence, product and policy changes, practical allocation frameworks, custody options, and what advisers should do over the next 12–36 months.

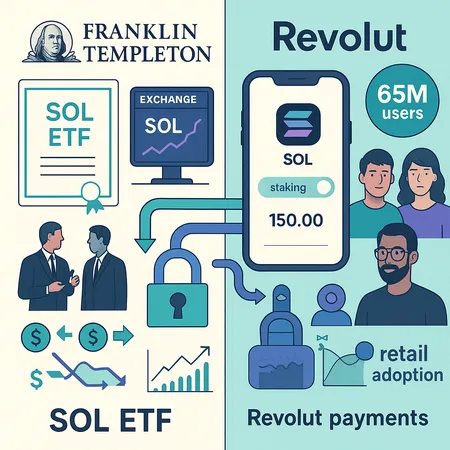

Franklin Templeton’s approval to list a Solana ETF on NYSE Arca and Revolut’s rollout of native SOL payments to 65 million users are twin catalysts that could reshape SOL’s on‑ramp liquidity, retail usage, and staking economics. This article dissects the mechanics, likely token‑economic impacts, and practical signals product managers and investors should watch.

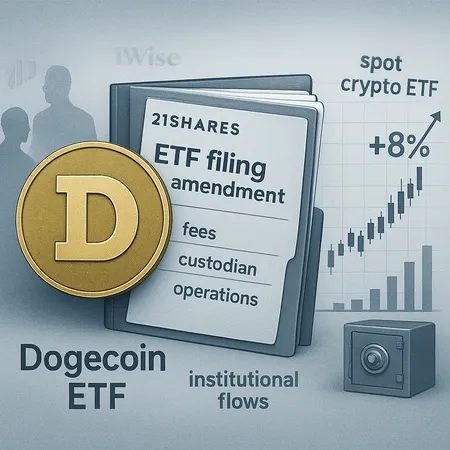

21Shares’ updated Dogecoin ETF filing — with fee disclosures and custodian details — reignited DOGE price action and debate over whether spot Dogecoin products can attract sustainable institutional capital.

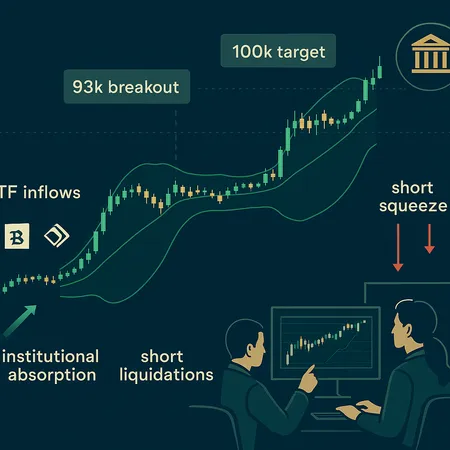

Bitcoin’s move above $93K has reignited breakout narratives, but whether this is the start of a sustained run to $100K+ depends on institutional absorption, short squeezes, and macro tailwinds. Traders should monitor ETF flows, derivatives positioning, Bollinger-band momentum, and key support/resistance levels to size risk.

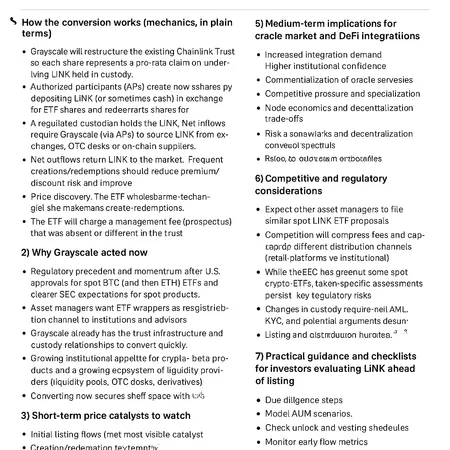

Grayscale’s move to convert its Chainlink Trust into the first U.S. spot LINK ETF is a structural event that could reshape liquidity, institutional access, and oracle economics. This feature explains the mechanics, near-term price drivers, and how allocators should evaluate LINK ahead of the listing.

XRP is sending mixed signals: large exchange outflows suggest tightening supply, while CoinShares' ETF withdrawal and weak ETF demand raise institutional doubts. Traders and portfolio managers must weigh on‑chain flows against ETF dynamics and model-based optimism.

Dogecoin’s recent bounce has been amplified by fresh DOGE ETF listings that attracted nearly $2M in early inflows. This explainer breaks down ETF-driven demand, the $0.15 technical support test, regulatory headwinds, and practical position-sizing ideas for retail traders.

CoinShares’ withdrawal of a U.S. staked‑SOL ETF filing and the first Solana ETF outflow after a 21‑day inflow streak complicate the near‑term breakout thesis for SOL. This brief breaks down why the filing was pulled, how ETF flows have propped price, the technical levels that matter for a run to $170, and what institutional appetite currently signals.

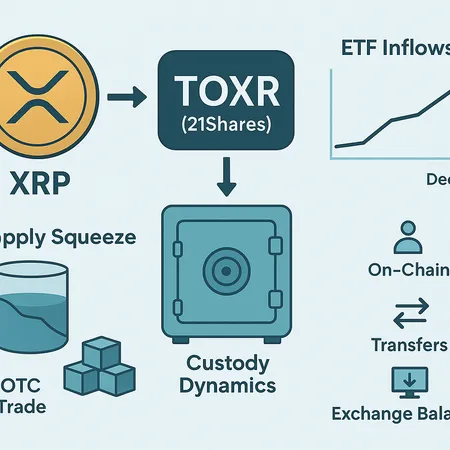

The arrival of 21Shares’ TOXR and accelerating ETF demand have the potential to remove meaningful XRP from liquid markets. This feature unpacks the custody and OTC mechanics behind the supply-squeeze thesis, the evidence for a drain, and risk scenarios if ETF flows cool.