Stablecoins

PayPal’s PYUSD vaulted from roughly $1.2B to $3.8B market cap in months, reshaping stablecoin liquidity and competitive dynamics. This analysis unpacks the drivers, contrasts PYUSD with contracting niche coins like Ethena’s USDe, and outlines risks and market outcomes for product managers and analysts.

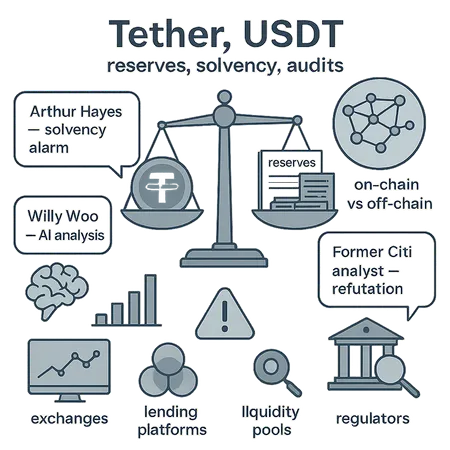

A recent social-media alarm over Tether’s reserves reignited long-running debates about on-chain visibility, attestation vs audit, and stablecoin liquidity risk. This explainer breaks down the facts, the analyst responses, and practical steps for investors and compliance teams.

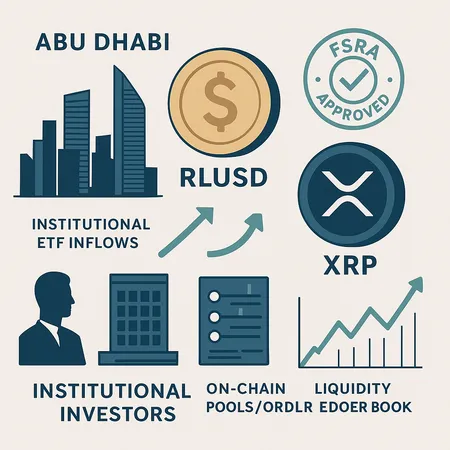

Ripple’s RLUSD won FSRA approval in ADGM just as spot XRP ETFs pulled significant institutional flows—this combination reshapes how regulated stablecoins and ETF demand interact with on-chain XRP liquidity. Asset managers and exchanges must rethink settlement rails, custody, and market-making across Gulf and global venues.

A deep-dive into why exchange-level euro stablecoin support matters, how Deutsche Börse’s EURAU integration shifts European on‑ramps, and a practical PYUSD vs RLUSD comparison for treasuries and payments teams.

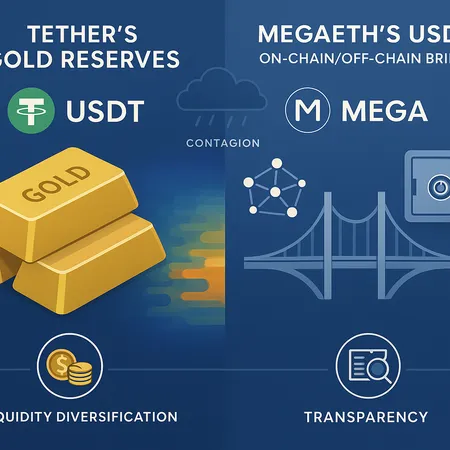

Tether's growing gold stockpile and MegaETH's USDm pre-deposit bridge reflect a shifting playbook for stablecoin reserves. This article analyzes why issuers diversify (gold vs cash), how on‑chain/off‑chain bridges work, and the systemic implications for liquidity, transparency, and contagion risk.

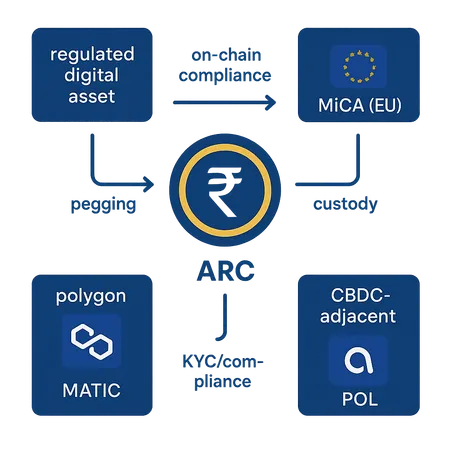

India’s announced rupee‑pegged Arc token built with Polygon and Anq marks a milestone in regulated digital assets — it forces a fresh look at custody, pegging models, and on‑chain compliance. This analysis unpacks architecture options, why Polygon was chosen, implications for MATIC and partner chains, and how Arc fits into a MiCA‑shaped global mosaic.

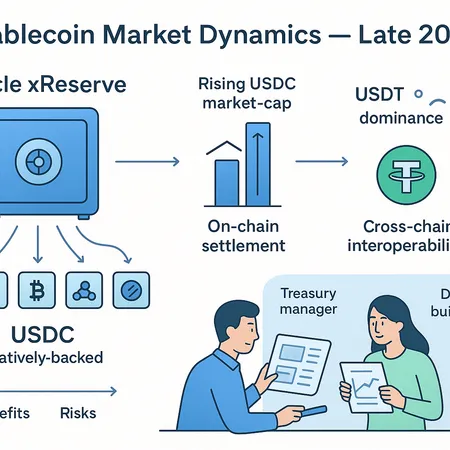

Late‑2025 stablecoin infrastructure is shifting: Circle’s xReserve pushes native USDC issuance across chains while USDT’s market share has climbed above 6%, reshaping liquidity and settlement choices for treasuries and DeFi builders.

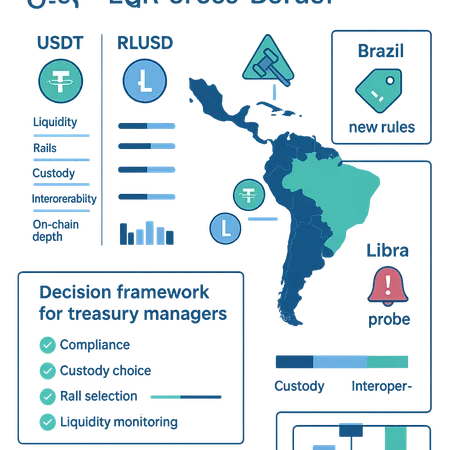

A practical explainer comparing USDT and RLUSD for Latin American cross-border rails, weighing liquidity, custody trade-offs, and Brazil's tightening rules to help treasurers choose compliant stablecoin strategies.

Recent cooperation by Tether to help freeze $12M in USDT tied to a Southeast Asia scam shows how stablecoin issuers are operational partners in law‑enforcement work. This piece explains on‑chain tracing, freeze mechanics, legal exposures, and what compliance officers should watch for.

Institutional interest in RWA tokens and upgraded stablecoin infrastructure is accelerating as investors seek yield and settlement certainty while spot crypto prices slump. Evidence from coin‑analytics and industry moves like Tether’s entry into trade finance suggests a structural shift toward tokenized real‑world flows and robust stablecoin rails.