ETFs

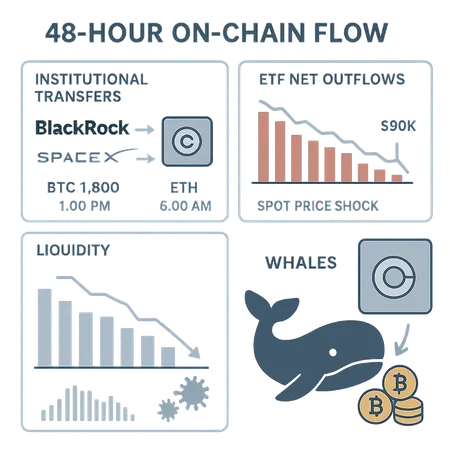

A forensic look at recent institutional transfers to Coinbase, large ETF outflows, whale accumulation patterns, and the liquidity dynamics that produced a sub-$90K price shock. Practical takeaways for spot and derivatives desks on managing risk and reading on‑chain signals.

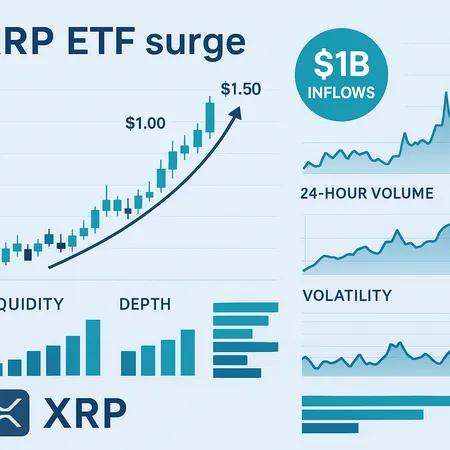

XRP ETFs have pulled in over $1 billion in under a month, reshaping how price discovery, liquidity and exchange dynamics function for the token. This article unpacks ETF mechanics, short‑term market signals, a bull‑case for multi‑dollar targets, key risks, and practical allocation guidance for speculators and institutions.

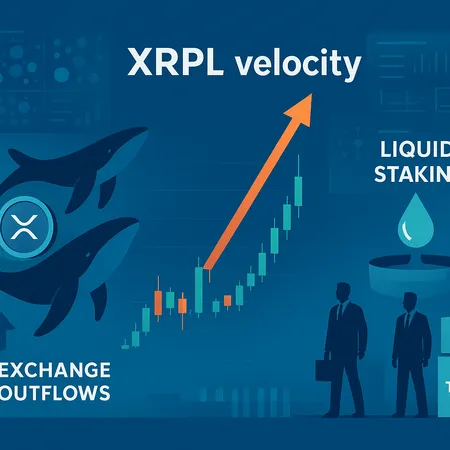

XRPL just logged a record on‑chain velocity spike — driven by whales, new liquid‑staking activity and ETF demand — a convergence that could force a decisive move once liquidity meets key resistance. This piece breaks down the on‑chain signals, technical levels, and practical scenarios for traders and allocators.

An integrated macro-to-onchain briefing on how recent Fed liquidity moves, ETF flows and structure, Strategy Inc.'s contingency rules, and Goldman Sachs’ Innovator buy will affect BTC liquidity, volatility and the price path into 2026.

A deep-dive into the Fusaka upgrade and emerging zero-knowledge privacy tooling, how they reshape Layer‑2 economics and builder incentives, and why recent ETH spot ETF outflows and falling open interest complicate the near‑term narrative.

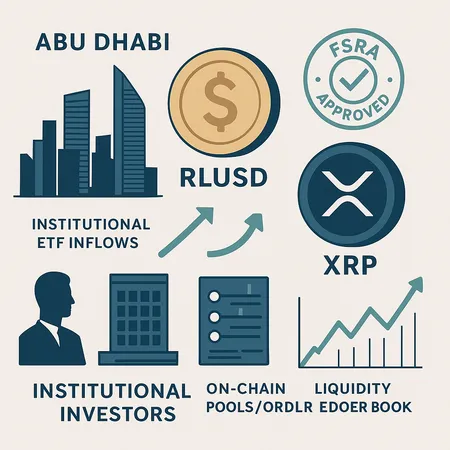

Ripple’s RLUSD won FSRA approval in ADGM just as spot XRP ETFs pulled significant institutional flows—this combination reshapes how regulated stablecoins and ETF demand interact with on-chain XRP liquidity. Asset managers and exchanges must rethink settlement rails, custody, and market-making across Gulf and global venues.

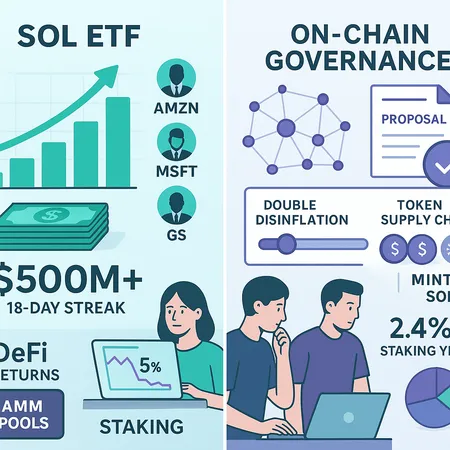

Solana is seeing sizable, persistent ETF inflows even as on-chain fees and derivatives demand lag. This post contrasts ETF momentum with network fundamentals and gives a practical framework for DeFi allocators and ETF watchers deciding whether to chase SOL now or wait for on-chain recovery.

XRP’s recent rally looks driven by a confluence of hefty spot-ETF inflows and positive payment-rail tests. Here’s a focused breakdown of the day-one ETF demand, chart momentum (hourly golden cross), the SWIFT GPI + R3 Corda Settler pilot, realistic upside scenarios and practical position-sizing advice.

A tactical deep-dive into DOGE’s falling wedge, measured breakout targets toward $0.25, and the ETF-driven volatility mechanics that can create short-term spikes followed by mean reversion. Practical trade plans, sizing, and stop guidance for swing traders.

Solana is caught between heavy ETF-driven capital flows and a contentious inflation proposal that could reshape tokenomics and DeFi returns. This article explains the mechanics, immediate market implications, and an investor checklist for balancing price-driven momentum with governance risk.