Blockchain

Shibarium plans a 2026 privacy upgrade with Zama promising fully homomorphic encryption (FHE) for private transactions and confidential smart contracts. This article examines the technical promise, deployment tradeoffs after the 2025 exploit, developer hurdles, AML tensions, and how this compares to DA-focused upgrades like Fusaka.

CoinShares’ withdrawal of a U.S. staked‑SOL ETF filing and the first Solana ETF outflow after a 21‑day inflow streak complicate the near‑term breakout thesis for SOL. This brief breaks down why the filing was pulled, how ETF flows have propped price, the technical levels that matter for a run to $170, and what institutional appetite currently signals.

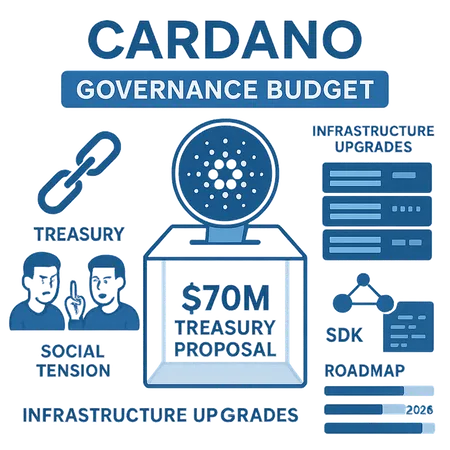

A deep dive into the $70M ADA treasury proposal — the Cardano Critical Integrations Budget — and why community trust, measurable KPIs, and tranche-based accountability will decide whether this reboot delivers real infrastructure upgrades or more stagnation.

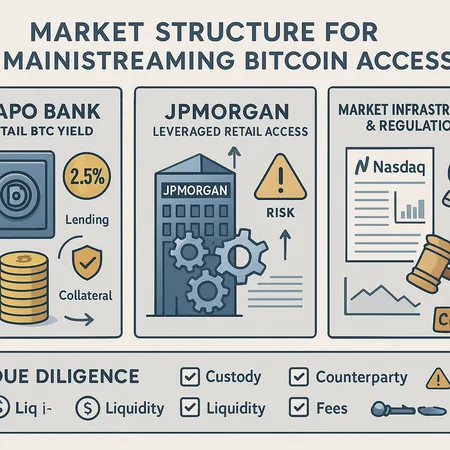

Banks and exchanges are packaging Bitcoin exposure with yield and leverage, changing retail access and raising new custody and counterparty trade-offs. Advisors must weigh issuer credit, liquidity, and product mechanics before recommending these formalized BTC products.

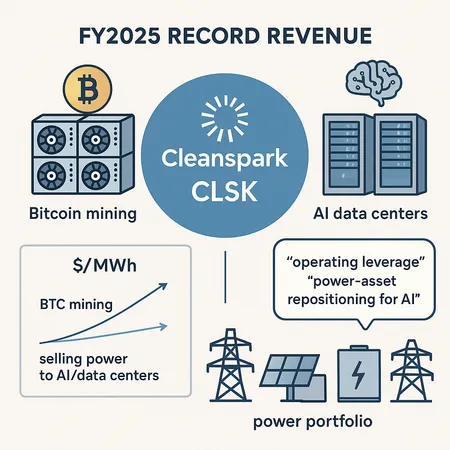

Cleanspark's FY2025 pivot shows miners can monetize power assets beyond hashing. The shift toward AI/data‑center workloads reshapes revenue mix, balance‑sheet dynamics, and BTC supply incentives for miners.

Solana is seeing sizable, persistent ETF inflows even as on-chain fees and derivatives demand lag. This post contrasts ETF momentum with network fundamentals and gives a practical framework for DeFi allocators and ETF watchers deciding whether to chase SOL now or wait for on-chain recovery.

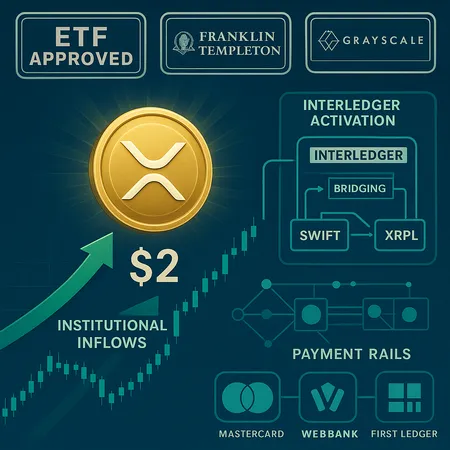

XRP’s recent rally looks driven by a confluence of hefty spot-ETF inflows and positive payment-rail tests. Here’s a focused breakdown of the day-one ETF demand, chart momentum (hourly golden cross), the SWIFT GPI + R3 Corda Settler pilot, realistic upside scenarios and practical position-sizing advice.

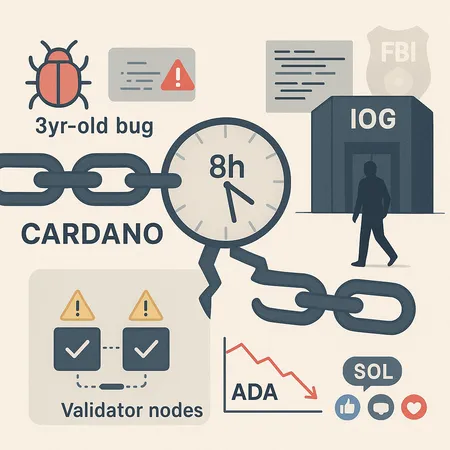

A forensic look at Cardano’s eight‑hour chain split: what went wrong, how the network recovered, and concrete steps validators, auditors, and institutions should take to reduce future PoS risk.

Cardano experienced a rare mainnet partition caused by a network bug; rapid node upgrades and coordinated communications restored service. This post walks developers, validators, exchanges and project teams through the technical post‑mortem, operational risks (including impacts on token mints like Midnight’s NIGHT), and a practical checklist to harden future launches.

A convergence of NYSE-backed XRP-spot ETF approvals, massive spot inflows and plans to route Interledger through SWIFT has shifted XRP from courtroom speculation toward institutional payments utility. This explainer ties the approvals, liquidity, technical rails and business strategy into a single view for investors and payments executives.