Crypto

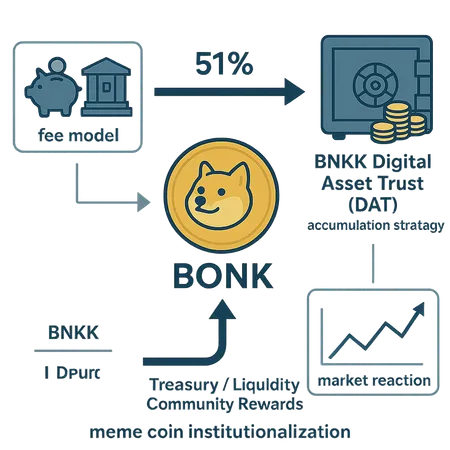

BONK’s recent fee model overhaul routes a majority of platform fees into BNKK’s Digital Asset Trust (DAT), shifting supply dynamics and signaling a move toward institutional-style treasuries. This article analyzes the mechanics, market implications, and lessons for token designers and DAO treasurers.

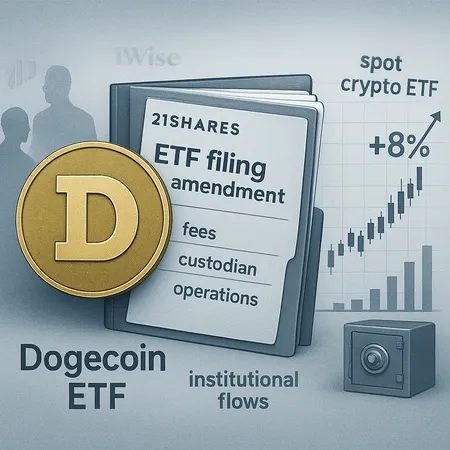

21Shares’ updated Dogecoin ETF filing — with fee disclosures and custodian details — reignited DOGE price action and debate over whether spot Dogecoin products can attract sustainable institutional capital.

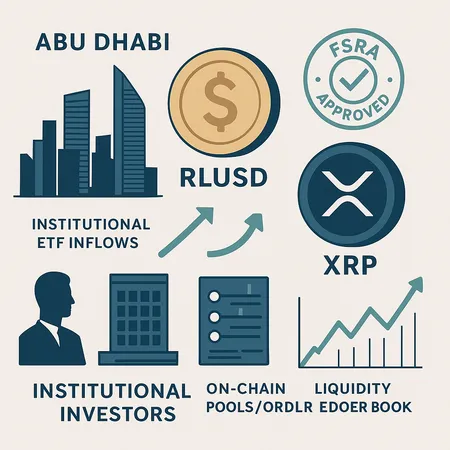

Ripple’s RLUSD won FSRA approval in ADGM just as spot XRP ETFs pulled significant institutional flows—this combination reshapes how regulated stablecoins and ETF demand interact with on-chain XRP liquidity. Asset managers and exchanges must rethink settlement rails, custody, and market-making across Gulf and global venues.

The Dogecoin ETF debut split the market — modest first-day volumes and price bumps contrasted with headlines calling it a flop. This explainer breaks down why a Wall Street product launch doesn't automatically translate to sustained institutional adoption, and gives a practical checklist for traders considering memecoin ETFs.

A second wave of spot Solana ETFs — led by Fidelity’s FSOL and 21Shares — has reintroduced institutional demand for SOL. This feature unpacks launch cadence, first-day trading dynamics, how flows helped SOL reclaim $140, what on-chain liquidity must improve for a durable rally, and the BTC-driven risks that could derail it.

XRP sits on a month-long downtrend testing a key $2 support while chatter about an ETF and large leveraged longs complicate the outlook. This piece parses technical structure, liquidation risk, headline significance and practical trade plans for intermediate traders.

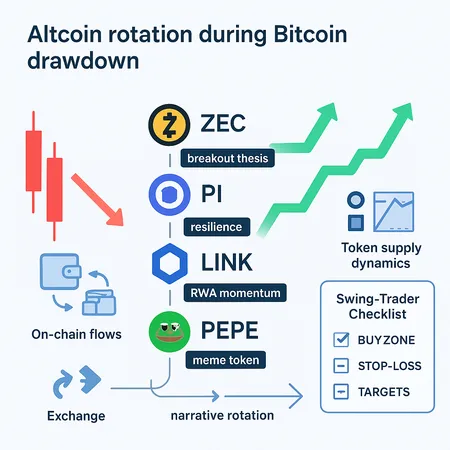

A marketwide drawdown doesn't mean every crypto goes down. Structural catalysts, supply dynamics and narrative rotations helped certain altcoins rally even while [Bitcoin] faded. This guide explains why and profiles five actionable names with swing-trader setups.

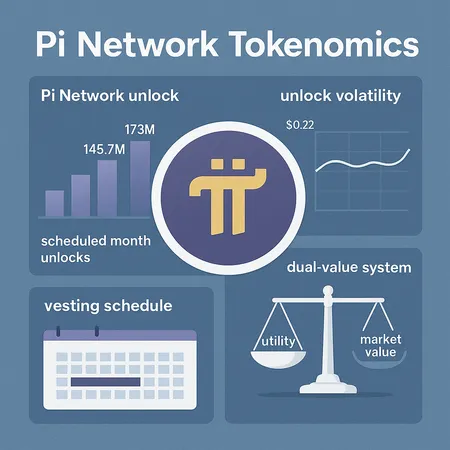

Pi Network faces heavy scheduled token unlocks through late 2027 that could create meaningful sell pressure despite pockets of demand. This article unpacks the tokenomics, the ‘dual-value system’ claim, current trading stability around $0.22, and a practical playbook for traders and holders to manage unlock-driven volatility.

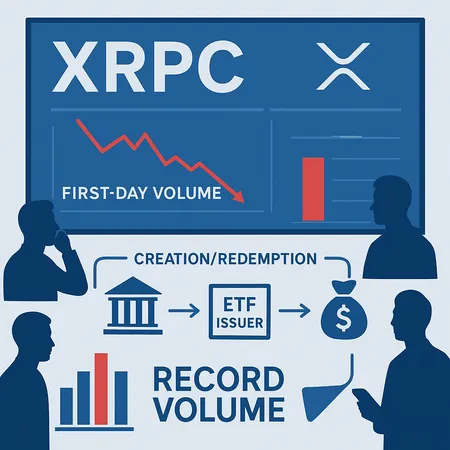

Canary Capital’s XRPC posted record first-day volumes even as XRP’s spot price weakened — a paradox exposing how ETF mechanics, market microstructure, and investor mix can decouple ETF demand from immediate spot appreciation.

Market sentiment has collapsed even as BTC trades above $100k, creating a paradox where price strength coexists with rising fragility. This analysis unpacks macro triggers, JPMorgan’s $94k support thesis, Fidelity’s on-chain selling signals, ETF flows and miner difficulty relief, and actionable trading ideas for a sideways-to-bearish regime.