Bitcoin

Fidelity CEO Abigail Johnson argues Bitcoin is shifting from speculative trade to household savings. This article evaluates the evidence, product and policy changes, practical allocation frameworks, custody options, and what advisers should do over the next 12–36 months.

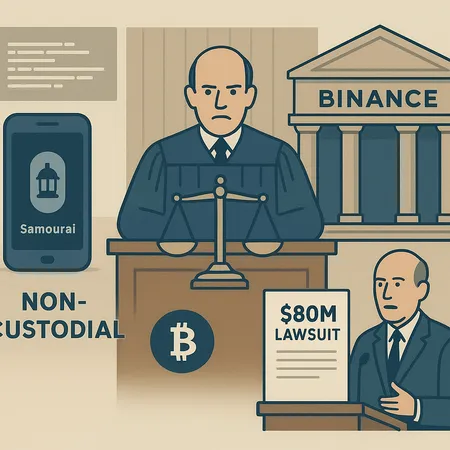

Recent legal moves — from calls to criminalize non‑custodial code to a reopened $80M Binance suit and regulators distinguishing BTC — are reshaping custody models and developer liability. This article maps the risk landscape and practical steps for compliance officers and legal teams.

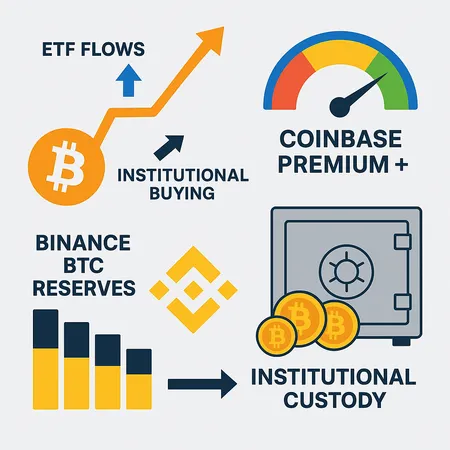

A synthesis of Coinbase premium, on‑exchange reserves, and corporate custody moves suggests the market may be shifting from short squeezes to structural accumulation — but confirmation needs multiple on‑chain and market indicators. This article outlines what to watch and practical thresholds for traders and analysts.

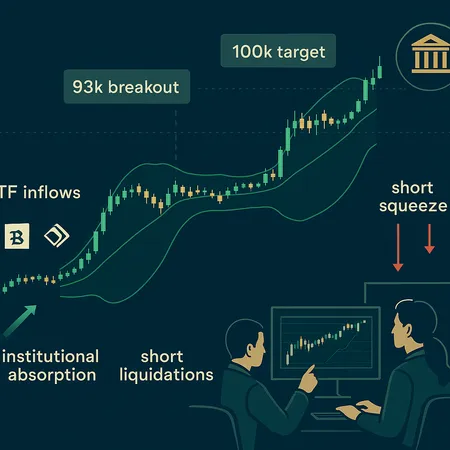

Bitcoin’s move above $93K has reignited breakout narratives, but whether this is the start of a sustained run to $100K+ depends on institutional absorption, short squeezes, and macro tailwinds. Traders should monitor ETF flows, derivatives positioning, Bollinger-band momentum, and key support/resistance levels to size risk.

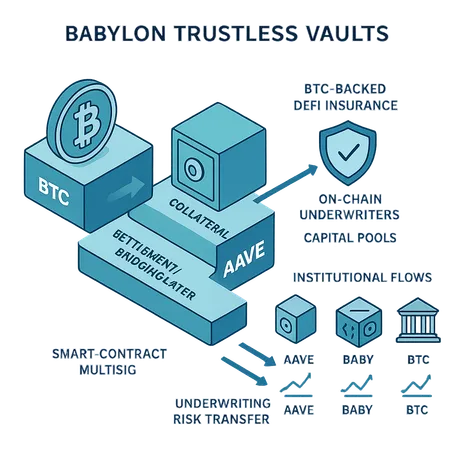

Babylon’s trustless vaults — enabling native BTC‑backed lending via Aave and planning BTC‑backed DeFi insurance — create a bridge between on‑chain liquidity and institutional capital, but they also introduce novel technical and economic trade‑offs. This piece unpacks the mechanics, insurance economics, implications for AAVE/BABY and practical steps for builders and allocators.

An integrated macro-to-onchain briefing on how recent Fed liquidity moves, ETF flows and structure, Strategy Inc.'s contingency rules, and Goldman Sachs’ Innovator buy will affect BTC liquidity, volatility and the price path into 2026.

An investigative reconstruction of Bitcoin’s early-December flash crash, showing how a Japanese government bond yield shock met thin liquidity and algorithmic flows to spark a 180k+ trader liquidation cascade. Actionable risk-management and trade scenarios for traders and portfolio managers follow.

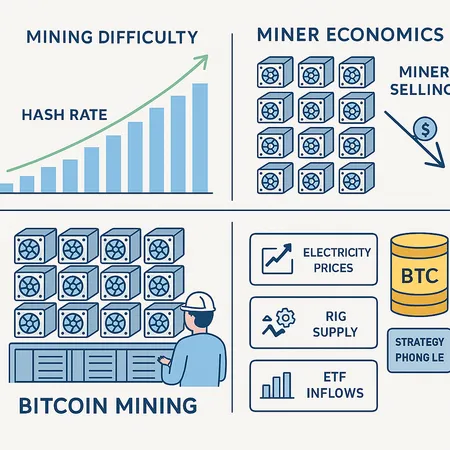

A predicted difficulty increase on December 11 will reshuffle miner economics, forcing older rigs out and changing short‑term selling dynamics. This explainer walks through the drivers, immediate margin impacts, institutional behavior, and the on‑chain and macro indicators to watch next.

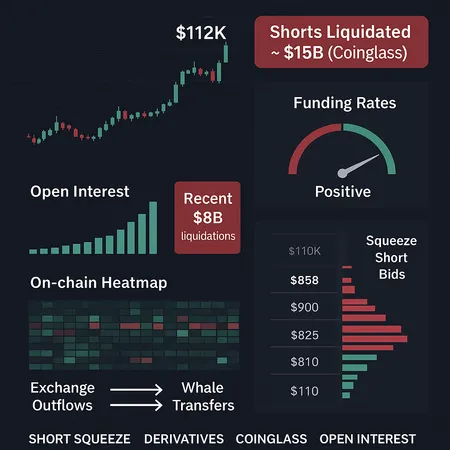

A tactical deep‑dive into how derivatives positioning can create a sudden BTC short squeeze and where liquidation risks are concentrated. Practical signals and scenario-based risk management for active traders and derivatives desks.

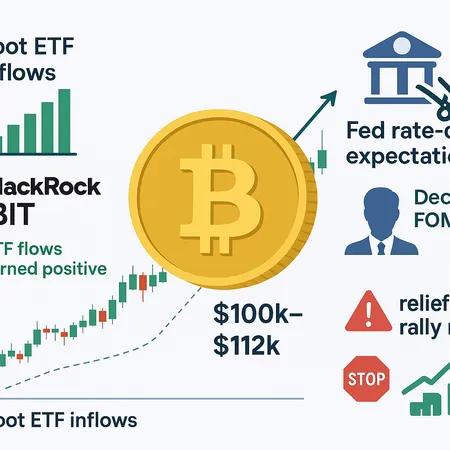

A mix of resumed spot ETF inflows and growing Fed rate‑cut expectations is powering Bitcoin’s recent bounce. This article explains the evidence, technical upside to $100k–$112k, and practical trade and portfolio steps for intermediate investors.