Stablecoin

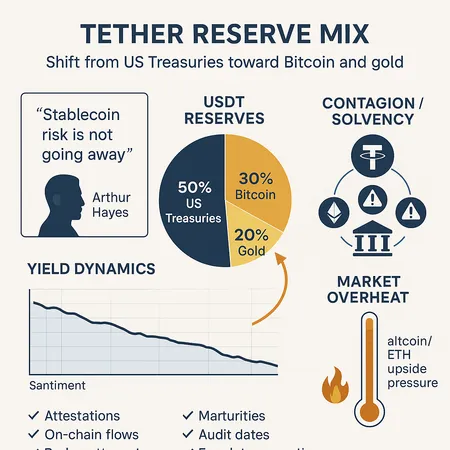

Tether’s attested move toward Bitcoin and gold raises nuanced solvency and contagion questions for institutional investors. This investigation parses Arthur Hayes’ critique, liquidity scenarios, yield signals for ETH and altcoins, and the monitoring metrics risk officers should adopt.

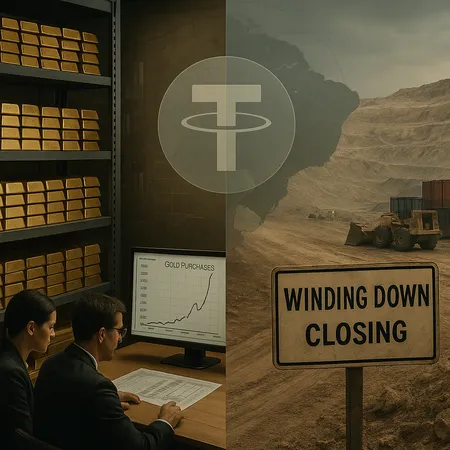

Tether’s simultaneous accumulation of gold and wind-down of mining operations in Uruguay presents a deliberate pivot in reserve strategy and operational focus. For treasury managers and macro traders, the moves raise questions about liquidity, transparency and how to size short-term exposure to USDT.

Tether’s decision to wind down Bitcoin mining in Uruguay reflects rising energy costs, shifting economics of large-scale mining, and growing reputational pressure after a public clash with S&P. This feature unpacks the operational drivers, the ratings fallout, and what compliance officers and policymakers should watch next.

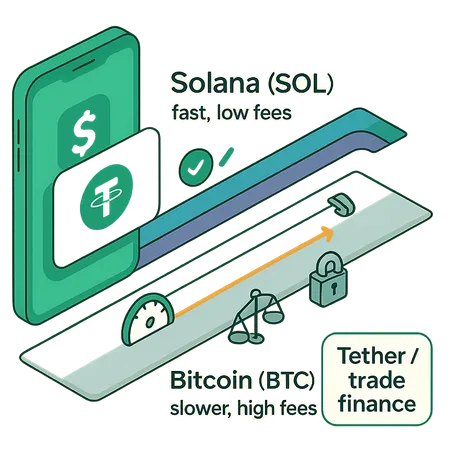

Mainstream payment apps are prioritizing Solana for stablecoin payments because of its throughput, latency, and low fees — tradeoffs that change wallet UX, reconciliation, and settlement guarantees. Tether’s expansion into trade finance further shifts how product teams should think about trust and counterparty risk for USDT rails.

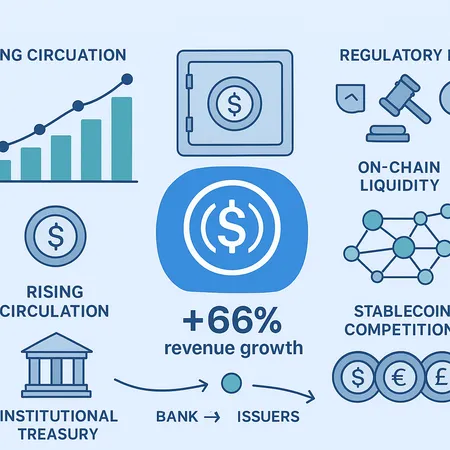

Circle’s latest quarter — 66% revenue growth alongside expanding USDC circulation — is more than a headline: it reshapes reserve economics, on-chain liquidity, and the competitive landscape for dollar‑pegged tokens heading into 2026. Institutional demand and regulatory scrutiny will determine whether that lead holds.

Japan's Financial Services Agency has taken a significant step by embracing stablecoin regulation, paving the way for increased security and trust in digital currencies. This move is poised to have a positive global impact, encouraging wider crypto adoption and innovation.

As USDC continues to outpace Tether in market presence, stablecoin investors should understand the implications of this shift in 2025. Learn about the benefits, risks, and how platforms like Bitlet.app offer unique opportunities for investing in stablecoins.

In 2025, the stablecoin landscape is shifting with USDC gaining market share while Tether faces challenges. Factors such as regulatory compliance and transparency are driving this change. Platforms like Bitlet.app offer innovative solutions to buy cryptos, including stablecoins, with flexible installment plans.

Ripio's wARS stablecoin is transforming cross-border payments in Latin America by offering fast, secure, and cost-effective transactions. This innovation is especially crucial in the region where traditional banking infrastructure can be limiting. Platforms like Bitlet.app complement these advancements by enabling users to buy cryptocurrencies easily with flexible payment options.

Discover why USDC is gaining popularity over USDT and what this shift means for stablecoin users. Learn how platforms like Bitlet.app are adapting to this trend, offering innovative crypto services including installment plans.