Investing

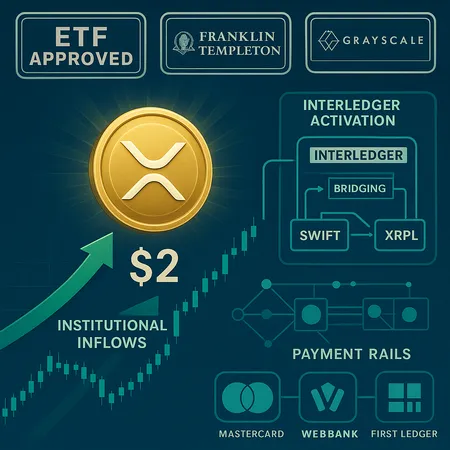

A convergence of NYSE-backed XRP-spot ETF approvals, massive spot inflows and plans to route Interledger through SWIFT has shifted XRP from courtroom speculation toward institutional payments utility. This explainer ties the approvals, liquidity, technical rails and business strategy into a single view for investors and payments executives.

A second wave of spot Solana ETFs — led by Fidelity’s FSOL and 21Shares — has reintroduced institutional demand for SOL. This feature unpacks launch cadence, first-day trading dynamics, how flows helped SOL reclaim $140, what on-chain liquidity must improve for a durable rally, and the BTC-driven risks that could derail it.

Recent balance-sheet buys and developer momentum have reignited the thesis that Ethereum could enter a multi-year growth cycle similar to Bitcoin’s. This article examines BitMine Immersion’s $173M purchase, Tom Lee’s bullish framing, DevConnect’s ‘trustless manifesto,’ and how staking + restaking infrastructure might sustain institutional inflows.

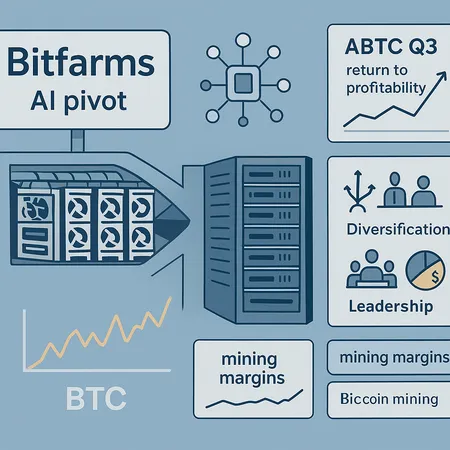

Faced with wild BTC swings, miners are reshaping strategy—pivoting workloads, pruning costs, and reallocating capital to protect margins. Case studies from Bitfarms, ABTC and governance moves at BitMine show the playbook evolving.

Bitlet.app is revolutionizing cryptocurrency investing in 2025 by offering flexible crypto installment plans, allowing investors to buy digital assets now and pay monthly, making crypto more accessible than ever.

Bitlet.app is changing the game in crypto investing with its innovative installment plans, allowing investors to buy cryptocurrencies now and pay monthly. This approach makes investing more accessible and manageable in 2025.

The October 2025 crypto market crash, fueled by escalating U.S.-China trade tensions, has created volatility and uncertainty for investors. Learn effective strategies to manage your crypto portfolio, including how Bitlet.app's Crypto Installment service can help you buy cryptos with manageable monthly payments during turbulent times.

In 2025, regulatory actions continue to shape the volatility and growth of Bitcoin and Ethereum. Understanding these effects helps investors navigate the crypto market more effectively. Platforms like Bitlet.app enhance this experience by offering flexible Crypto Installment services to buy now and pay monthly.

In the fast-paced world of cryptocurrency, staying updated with relevant news is crucial. Learn effective strategies to filter out noise and focus on impactful information to make smarter investment decisions. Plus, discover how Bitlet.app can enhance your crypto investment journey with flexible payment options.

The surge in U.S. spot Solana ETFs presents new investment opportunities. Learn what’s driving this growth and discover strategies to leverage this boom, including innovative options like Bitlet.app's Crypto Installment service.