Ethereum

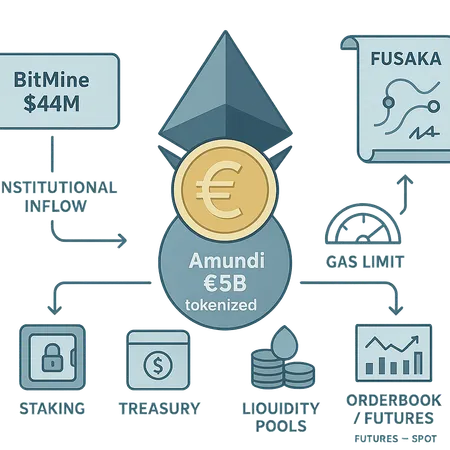

Fusaka (Fulu‑Osaka) and EIP 7825 introduce Peer Data Availability Sampling and gas‑limit mechanics that proponents say unlock large scaling gains. This explainer walks Ethereum devs, rollup teams and NFT/DeFi builders through the technical changes, expected market impact, and an operational checklist for post‑fork readiness.

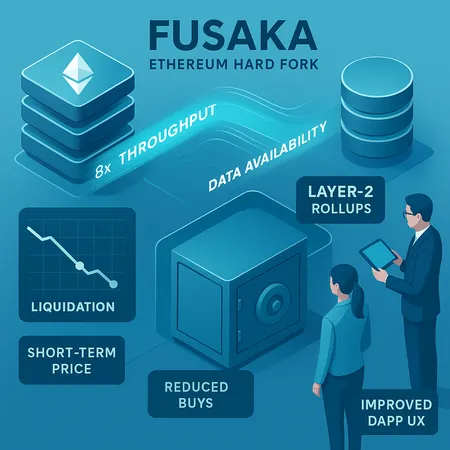

Fusaka's PeerDAS hard fork multiplies Ethereum's blob capacity by roughly eight times, changing the data availability landscape and opening new L2 and large-data dApp possibilities. This article breaks down the technical changes, short‑term performance impacts, security tradeoffs, and concrete preparation steps for validators, node operators, and protocol teams.

Fusaka delivers material data availability and throughput gains for Ethereum, but protocol upgrades alone rarely stop short‑term selling. Traders and protocol analysts need to separate technical improvements from real token demand.

A deep-dive into the Fusaka upgrade and emerging zero-knowledge privacy tooling, how they reshape Layer‑2 economics and builder incentives, and why recent ETH spot ETF outflows and falling open interest complicate the near‑term narrative.

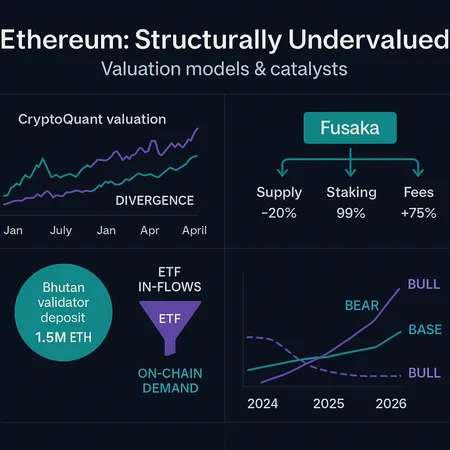

Multiple valuation models and on‑chain indicators suggest Ethereum is trading below intrinsic value. Upcoming protocol changes like Fusaka plus growing institutional staking and ETF flows could compress supply and trigger a re-rating.

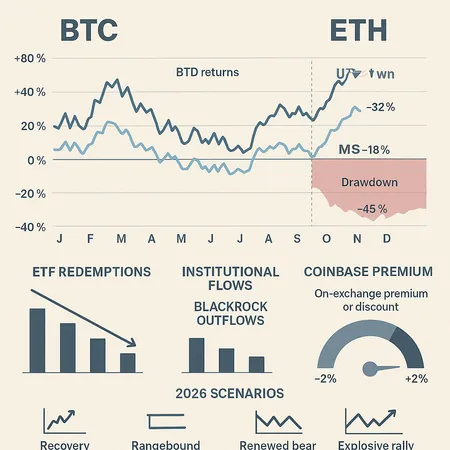

After October’s flash crash, 2025 left investors asking whether the year qualifies as a bear market. This feature synthesizes drawdowns, ETF redemptions, exchange-premium signals and technical calls to offer a balanced view and allocation guidance for 2026.

Ethereum is shifting from retail-driven experimentation to institutional-grade rails ahead of the Fusaka upgrade. This article unpacks recent tokenization moves, smart‑money flows, and protocol changes — and gives practical steps for asset managers and DeFi teams.

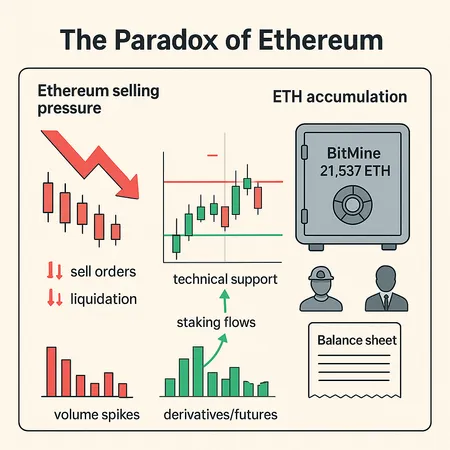

BitMine’s disclosure of a 3.63M ETH treasury and recent multi‑million‑dollar whale long positions have focused attention on concentration risk in Ethereum. This piece unpacks the disclosure, examines evidence of big speculative bets, and lays out governance and risk steps for portfolio managers and on‑chain analysts.

Ethereum is facing heavy selling pressure and volatile volume even as large holders like BitMine quietly add tens of thousands of ETH. This article reconciles those forces, outlines technical levels to watch, and maps practical 3–6 month scenarios and risk management for ETH investors.

BitMine plans a US‑based Ethereum validator network for 2026 even as it reports roughly $4 billion in unrealized treasury losses. This piece examines the technical, financial, and regulatory trade‑offs of that strategy: staking economics, centralization risks, MEV exposure, and what ARK Invest’s interest signals about institutional appetite.