XRP

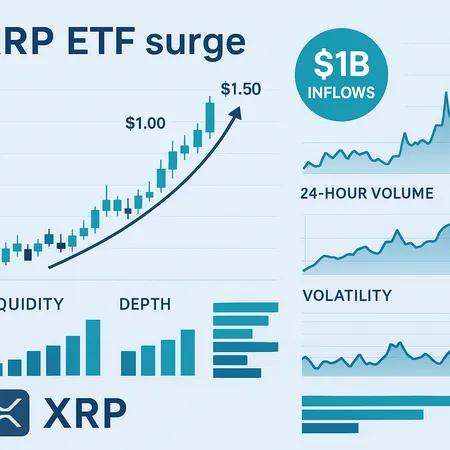

XRP ETFs have pulled in over $1 billion in under a month, reshaping how price discovery, liquidity and exchange dynamics function for the token. This article unpacks ETF mechanics, short‑term market signals, a bull‑case for multi‑dollar targets, key risks, and practical allocation guidance for speculators and institutions.

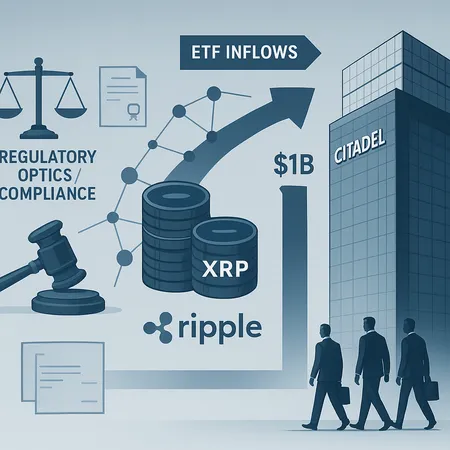

A wave of institutional capital — from Citadel’s investment to surging XRP spot ETF inflows — is reshaping XRP’s market structure and raising complex regulatory questions. This article breaks down the mechanics, liquidity effects, and compliance red flags institutional investors should weigh.

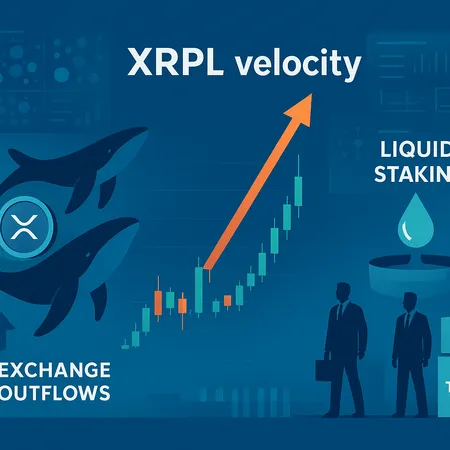

XRPL just logged a record on‑chain velocity spike — driven by whales, new liquid‑staking activity and ETF demand — a convergence that could force a decisive move once liquidity meets key resistance. This piece breaks down the on‑chain signals, technical levels, and practical scenarios for traders and allocators.

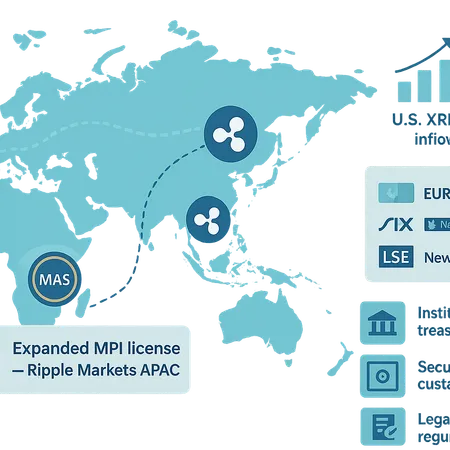

Ripple’s expanded MAS license and renewed ETP appetite for XRP are aligning regulatory and market signals across APAC, the U.S., and Europe. This brief assesses payments use-case implications, legal and custody considerations, and a practical 6–12 month thesis for institutional treasury teams and regulators.

XRP is sending mixed signals: large exchange outflows suggest tightening supply, while CoinShares' ETF withdrawal and weak ETF demand raise institutional doubts. Traders and portfolio managers must weigh on‑chain flows against ETF dynamics and model-based optimism.

The arrival of 21Shares’ TOXR and accelerating ETF demand have the potential to remove meaningful XRP from liquid markets. This feature unpacks the custody and OTC mechanics behind the supply-squeeze thesis, the evidence for a drain, and risk scenarios if ETF flows cool.

The launch of 21Shares' XRP spot ETF catalyzed a fresh price leg and raised structural questions as Binance reserves fell to ~2.7B. This article breaks down market reaction, supply dynamics, technical scenarios, institutional implications, and the risks allocators should weigh.

Ripple’s RLUSD won FSRA approval in ADGM just as spot XRP ETFs pulled significant institutional flows—this combination reshapes how regulated stablecoins and ETF demand interact with on-chain XRP liquidity. Asset managers and exchanges must rethink settlement rails, custody, and market-making across Gulf and global venues.

XRP’s recent rally looks driven by a confluence of hefty spot-ETF inflows and positive payment-rail tests. Here’s a focused breakdown of the day-one ETF demand, chart momentum (hourly golden cross), the SWIFT GPI + R3 Corda Settler pilot, realistic upside scenarios and practical position-sizing advice.

Grayscale’s newly approved spot Dogecoin (GDOG) and XRP (GXRP) ETFs change the toolkit for retail and institutional exposure, with implications for liquidity, arbitrage and short-term price dynamics. This analysis breaks down timing, ETF competition, expected volumes and tactical signals allocators and advanced traders should watch.