DeFi

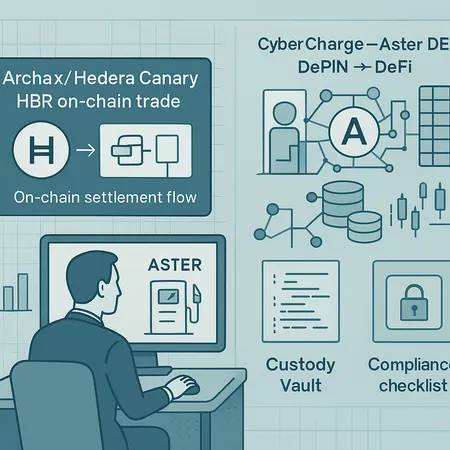

The Archax on‑chain trade of the tokenised Canary HBR ETF on Hedera and the CyberCharge–Aster DEX alliance show how tokenized ETFs and DePIN rewards are moving from concept to production. Institutional builders must weigh mechanics, custody, regulation, and liquidity as real‑world assets become natively tradable on blockchains.

Grayscale’s S‑1 filing for a spot Sui trust and the SEC’s sign‑off on a 2x leveraged SUI ETF mark a step toward institutional productization. This article explains the timeline, product mechanics, likely liquidity and volatility effects, and what developers and token holders should expect.

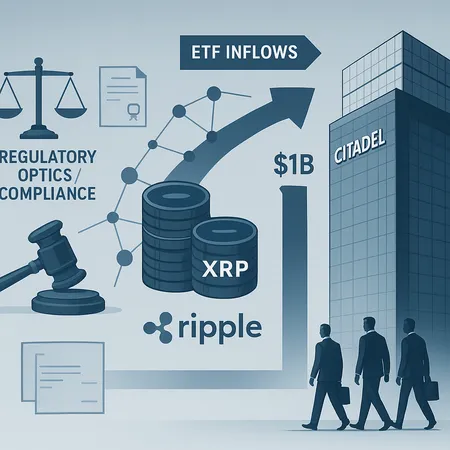

A wave of institutional capital — from Citadel’s investment to surging XRP spot ETF inflows — is reshaping XRP’s market structure and raising complex regulatory questions. This article breaks down the mechanics, liquidity effects, and compliance red flags institutional investors should weigh.

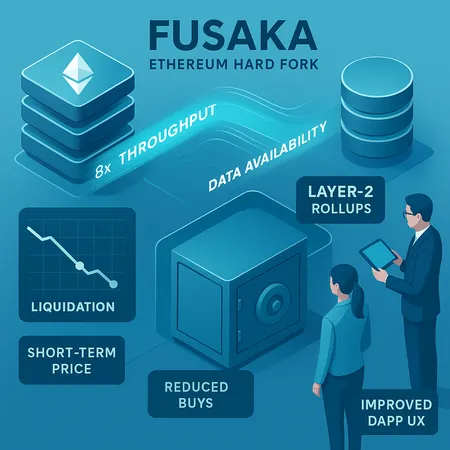

Fusaka delivers material data availability and throughput gains for Ethereum, but protocol upgrades alone rarely stop short‑term selling. Traders and protocol analysts need to separate technical improvements from real token demand.

21Shares’ updated Dogecoin ETF filing — with fee disclosures and custodian details — reignited DOGE price action and debate over whether spot Dogecoin products can attract sustainable institutional capital.

Shibarium plans a 2026 privacy upgrade with Zama promising fully homomorphic encryption (FHE) for private transactions and confidential smart contracts. This article examines the technical promise, deployment tradeoffs after the 2025 exploit, developer hurdles, AML tensions, and how this compares to DA-focused upgrades like Fusaka.

PayPal’s PYUSD vaulted from roughly $1.2B to $3.8B market cap in months, reshaping stablecoin liquidity and competitive dynamics. This analysis unpacks the drivers, contrasts PYUSD with contracting niche coins like Ethena’s USDe, and outlines risks and market outcomes for product managers and analysts.

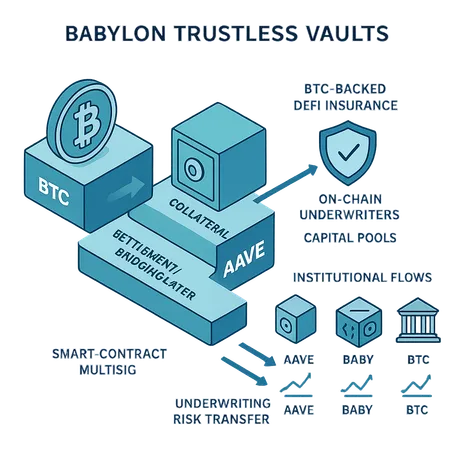

Babylon’s trustless vaults — enabling native BTC‑backed lending via Aave and planning BTC‑backed DeFi insurance — create a bridge between on‑chain liquidity and institutional capital, but they also introduce novel technical and economic trade‑offs. This piece unpacks the mechanics, insurance economics, implications for AAVE/BABY and practical steps for builders and allocators.

Tokenized gold’s $3 billion milestone signals a maturing market for digital commodities. This primer breaks down product types (PAXG, XAUT), institutional drivers, custody and legal risks, and practical due diligence for integrating tokenized metals into portfolios.

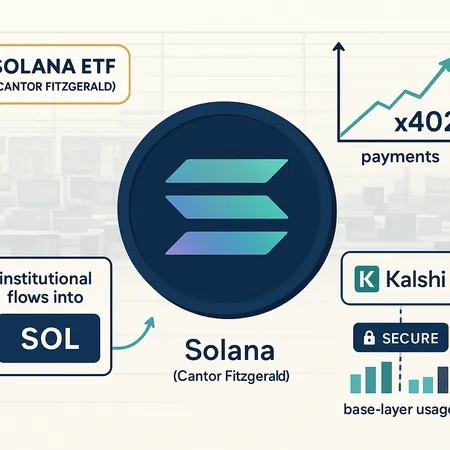

Recent institutional moves — Cantor Fitzgerald's Solana ETF stake, x402's payment-volume spike, and Kalshi’s tokenized contracts on Solana — suggest growing interest from regulated players. This piece evaluates whether these are durable signs of institutional adoption and higher base‑layer throughput usage for SOL.