Ripple

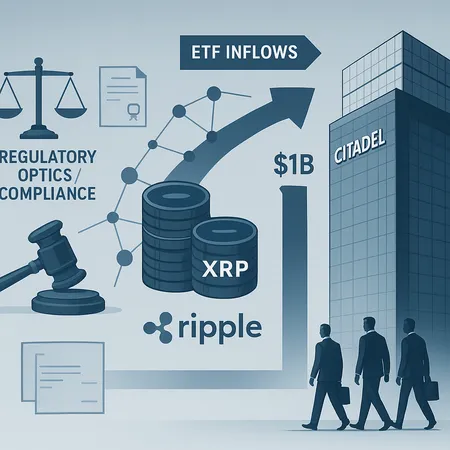

A wave of institutional capital — from Citadel’s investment to surging XRP spot ETF inflows — is reshaping XRP’s market structure and raising complex regulatory questions. This article breaks down the mechanics, liquidity effects, and compliance red flags institutional investors should weigh.

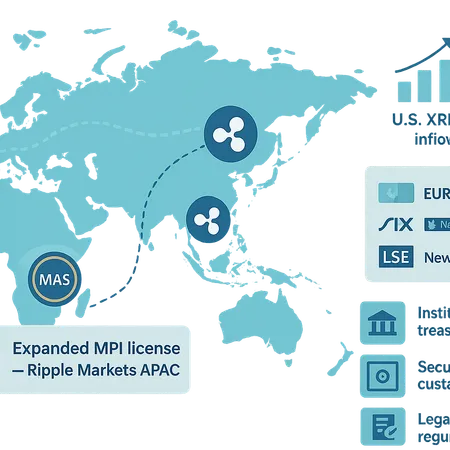

Ripple’s expanded MAS license and renewed ETP appetite for XRP are aligning regulatory and market signals across APAC, the U.S., and Europe. This brief assesses payments use-case implications, legal and custody considerations, and a practical 6–12 month thesis for institutional treasury teams and regulators.

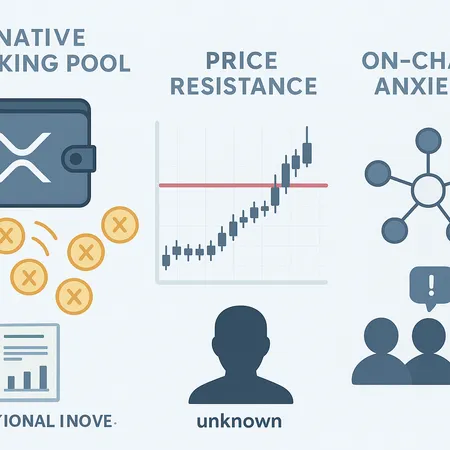

A balanced look at XRP’s recent large transfers, proposals for native staking, and persistent price resistance. This analysis weighs on-chain signals against whether staking or institutional demand can lift XRP near-term.

Evernorth's recent SPAC IPO sheds light on the significance of Ripple's $1 billion Nasdaq deal, marking a major step toward institutional adoption of XRP. This move reflects growing trust and interest from large investors in the crypto space. Platforms like Bitlet.app facilitate easier access to XRP by offering crypto installment services, enabling users to invest in digital assets with flexible payment options.

Ripple Labs has announced a $1 billion SPAC deal fueling XRP's recent rally. Discover how Bitlet.app's Crypto Installment service can help you invest in XRP now and pay monthly, making crypto investment more accessible.

Ripple's recent $1 billion acquisition of GTreasury marks a significant milestone in enhancing corporate treasury management and streamlining cross-border payments. This strategic move combines Ripple's blockchain-based payment solutions with GTreasury's advanced treasury management software, promising greater efficiency and cost savings for businesses worldwide.

Ripple has appointed Dennis Jarosch as the new leader, signaling a fresh wave of innovation for the XRP Ledger. This change aims to accelerate development and adoption of XRP-based technologies.

Gemini's recent Nasdaq IPO combined with a $150 million credit line from Ripple marks a significant milestone in the crypto industry's expansion. This financial boost will enable Gemini to scale operations and offer innovative services, signaling robust growth in the crypto market. Bitlet.app offers similar crypto investment opportunities with flexible payment options through its Crypto Installment service, allowing users to invest gradually and grow with the market.

Discover the new stablecoin RLUSD, a product of the Ripple and Gemini partnership, aiming to enhance crypto transactions with stability and efficiency. Learn how this collaboration impacts the crypto market and how Bitlet.app's flexible crypto purchasing options complement this innovation.

Gemini's recent $75 million credit facility from Ripple is a strategic move that may significantly boost its path to a U.S. IPO. Leveraging this capital can enhance Gemini's market position and operational capacity, making it a strong contender in the crypto exchange landscape. For those interested in crypto investments, platforms like Bitlet.app offer innovative solutions such as Crypto Installment services to buy cryptos conveniently.