Solana

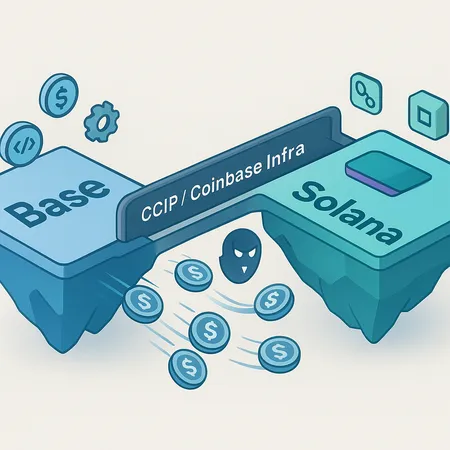

Base’s new bridge to Solana has divided builders: some call it a liquidity‑siphoning ‘vampire attack,’ others see pragmatic multichain engineering. This article breaks down the technical design, the claims and counterclaims, and the real implications for Solana liquidity and developer strategy.

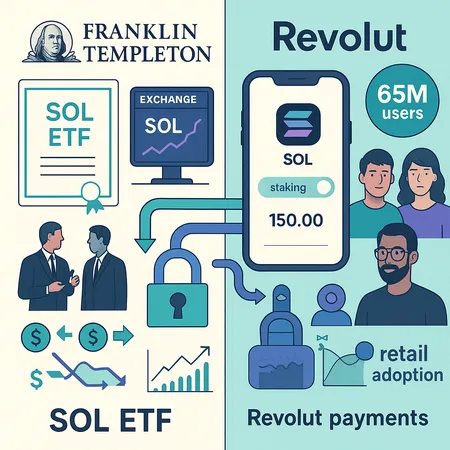

Franklin Templeton’s approval to list a Solana ETF on NYSE Arca and Revolut’s rollout of native SOL payments to 65 million users are twin catalysts that could reshape SOL’s on‑ramp liquidity, retail usage, and staking economics. This article dissects the mechanics, likely token‑economic impacts, and practical signals product managers and investors should watch.

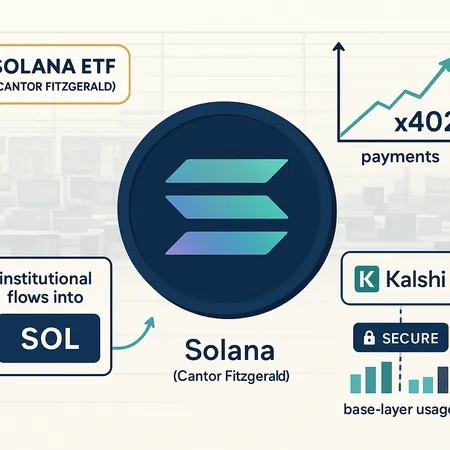

Recent institutional moves — Cantor Fitzgerald's Solana ETF stake, x402's payment-volume spike, and Kalshi’s tokenized contracts on Solana — suggest growing interest from regulated players. This piece evaluates whether these are durable signs of institutional adoption and higher base‑layer throughput usage for SOL.

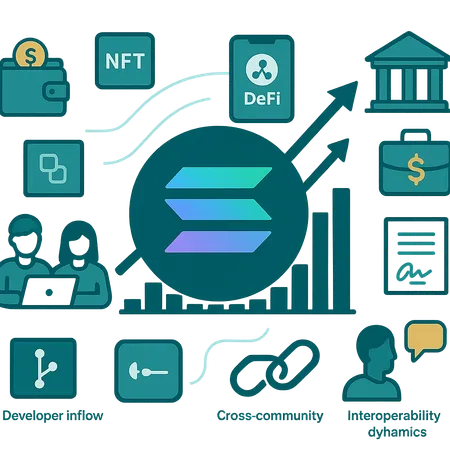

Solana is posting a string of product launches and institutional wins that suggest accelerating adoption; cross‑community endorsements—like a Ripple exec urging the XRP community not to ignore Solana—are reshaping its narrative. This piece unpacks the concrete milestones, how interoperability and sentiment affect market positioning, and the metrics developers and DAOs should track to judge durability.

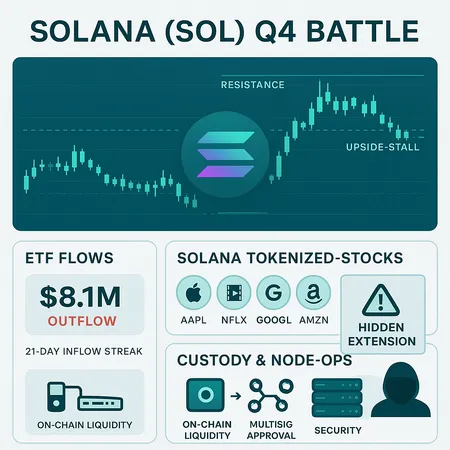

CoinShares’ withdrawal of a U.S. staked‑SOL ETF filing and the first Solana ETF outflow after a 21‑day inflow streak complicate the near‑term breakout thesis for SOL. This brief breaks down why the filing was pulled, how ETF flows have propped price, the technical levels that matter for a run to $170, and what institutional appetite currently signals.

Q4 is shaping up as a decisive stretch for Solana: price action is testing critical resistance even as ETFs register their first outflows and tokenized-stock adoption surfaces novel attack vectors. Funds and node operators must weigh liquidity dynamics against custody and UX risks before redeploying capital.

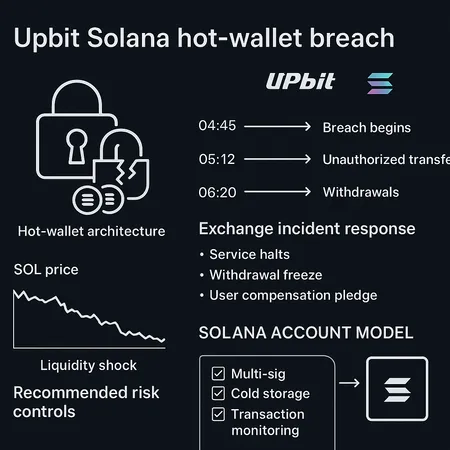

A Franklin Templeton Solana ETF could materially change liquidity and derivatives pricing for SOL, but recent exchange exploits have created near-term selling pressure. This piece lays out the technicals, on‑chain signals, and concrete trade setups for swing traders and institutions managing the ETF catalyst and exchange risk.

A technical post‑mortem of the Upbit Solana hot‑wallet breach that drained roughly $36–38.8M: what happened, why Solana’s architecture mattered, how exchanges responded, and the controls traders and custodians should insist on.

Franklin Templeton's Form 8‑A to list a Solana ETF as SOEZ on NYSE Arca signals a new institutional on‑ramp for SOL. This analysis breaks down the filing, fee/waiver dynamics, likely inflow scenarios, and how ETF availability might interact with Solana's network fundamentals and liquidity.

Solana is seeing sizable, persistent ETF inflows even as on-chain fees and derivatives demand lag. This post contrasts ETF momentum with network fundamentals and gives a practical framework for DeFi allocators and ETF watchers deciding whether to chase SOL now or wait for on-chain recovery.