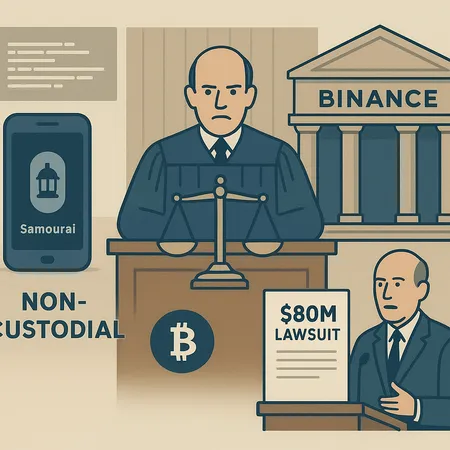

Regulation

Recent legal moves — from calls to criminalize non‑custodial code to a reopened $80M Binance suit and regulators distinguishing BTC — are reshaping custody models and developer liability. This article maps the risk landscape and practical steps for compliance officers and legal teams.

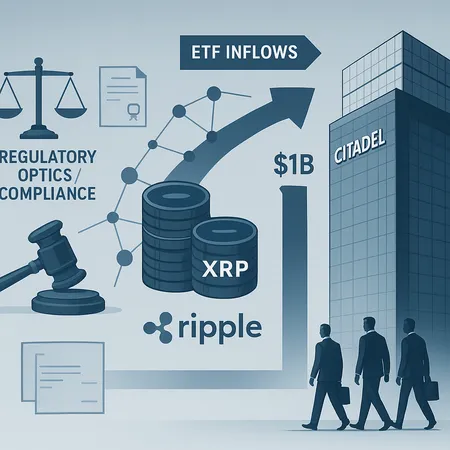

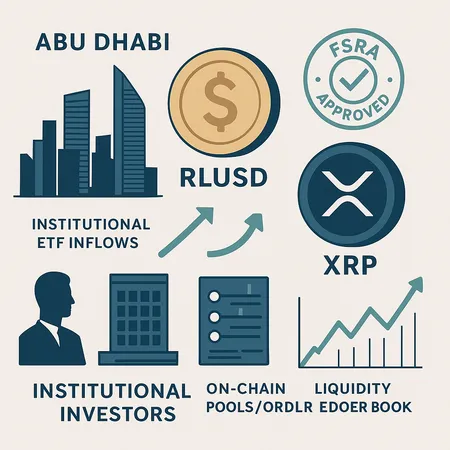

A wave of institutional capital — from Citadel’s investment to surging XRP spot ETF inflows — is reshaping XRP’s market structure and raising complex regulatory questions. This article breaks down the mechanics, liquidity effects, and compliance red flags institutional investors should weigh.

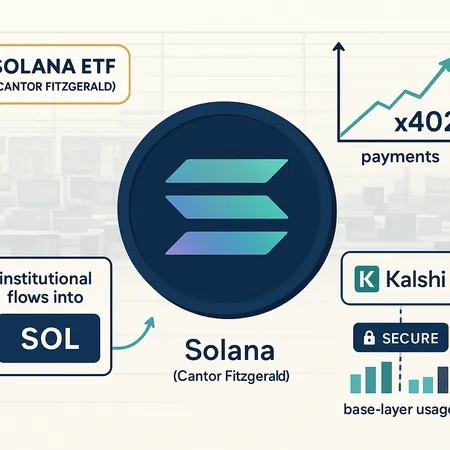

Recent institutional moves — Cantor Fitzgerald's Solana ETF stake, x402's payment-volume spike, and Kalshi’s tokenized contracts on Solana — suggest growing interest from regulated players. This piece evaluates whether these are durable signs of institutional adoption and higher base‑layer throughput usage for SOL.

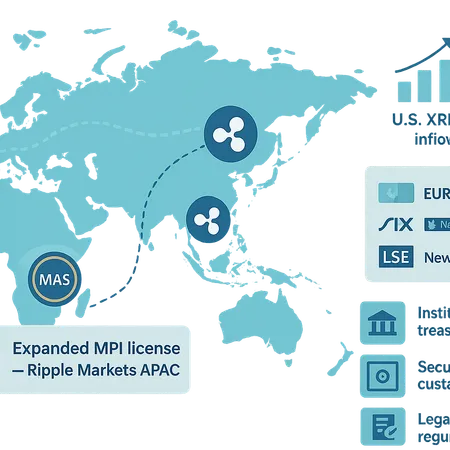

Ripple’s expanded MAS license and renewed ETP appetite for XRP are aligning regulatory and market signals across APAC, the U.S., and Europe. This brief assesses payments use-case implications, legal and custody considerations, and a practical 6–12 month thesis for institutional treasury teams and regulators.

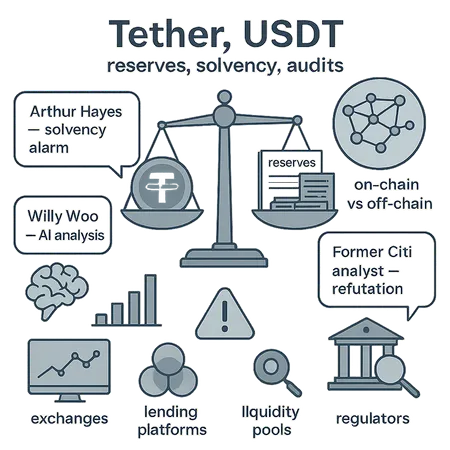

A recent social-media alarm over Tether’s reserves reignited long-running debates about on-chain visibility, attestation vs audit, and stablecoin liquidity risk. This explainer breaks down the facts, the analyst responses, and practical steps for investors and compliance teams.

Dogecoin’s recent bounce has been amplified by fresh DOGE ETF listings that attracted nearly $2M in early inflows. This explainer breaks down ETF-driven demand, the $0.15 technical support test, regulatory headwinds, and practical position-sizing ideas for retail traders.

Ripple’s RLUSD won FSRA approval in ADGM just as spot XRP ETFs pulled significant institutional flows—this combination reshapes how regulated stablecoins and ETF demand interact with on-chain XRP liquidity. Asset managers and exchanges must rethink settlement rails, custody, and market-making across Gulf and global venues.

Tether’s decision to wind down Bitcoin mining in Uruguay reflects rising energy costs, shifting economics of large-scale mining, and growing reputational pressure after a public clash with S&P. This feature unpacks the operational drivers, the ratings fallout, and what compliance officers and policymakers should watch next.

BitMine plans a US‑based Ethereum validator network for 2026 even as it reports roughly $4 billion in unrealized treasury losses. This piece examines the technical, financial, and regulatory trade‑offs of that strategy: staking economics, centralization risks, MEV exposure, and what ARK Invest’s interest signals about institutional appetite.

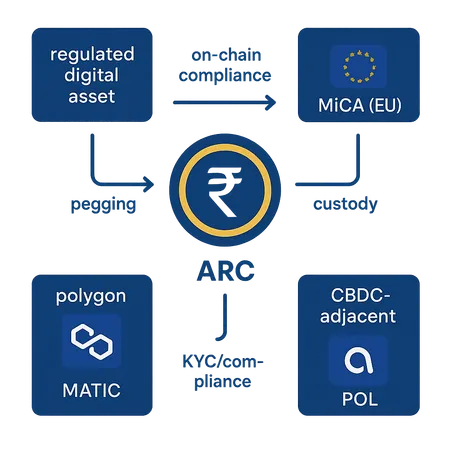

India’s announced rupee‑pegged Arc token built with Polygon and Anq marks a milestone in regulated digital assets — it forces a fresh look at custody, pegging models, and on‑chain compliance. This analysis unpacks architecture options, why Polygon was chosen, implications for MATIC and partner chains, and how Arc fits into a MiCA‑shaped global mosaic.