Crypto Market

PayPal’s PYUSD vaulted from roughly $1.2B to $3.8B market cap in months, reshaping stablecoin liquidity and competitive dynamics. This analysis unpacks the drivers, contrasts PYUSD with contracting niche coins like Ethena’s USDe, and outlines risks and market outcomes for product managers and analysts.

CoinShares’ withdrawal of a U.S. staked‑SOL ETF filing and the first Solana ETF outflow after a 21‑day inflow streak complicate the near‑term breakout thesis for SOL. This brief breaks down why the filing was pulled, how ETF flows have propped price, the technical levels that matter for a run to $170, and what institutional appetite currently signals.

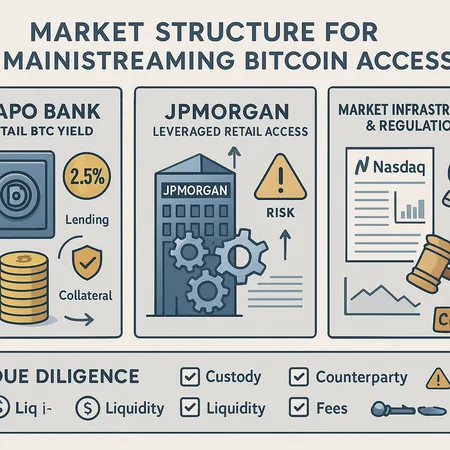

Banks and exchanges are packaging Bitcoin exposure with yield and leverage, changing retail access and raising new custody and counterparty trade-offs. Advisors must weigh issuer credit, liquidity, and product mechanics before recommending these formalized BTC products.

XRP’s recent rally looks driven by a confluence of hefty spot-ETF inflows and positive payment-rail tests. Here’s a focused breakdown of the day-one ETF demand, chart momentum (hourly golden cross), the SWIFT GPI + R3 Corda Settler pilot, realistic upside scenarios and practical position-sizing advice.

A step‑by‑step investigation into recent claims that MicroStrategy sold large BTC holdings, the evidence refuting those stories, and a practical verification framework traders can use to avoid knee‑jerk moves. Learn how on‑chain checks, corporate disclosures, and market psychology interact when whale rumors surface.

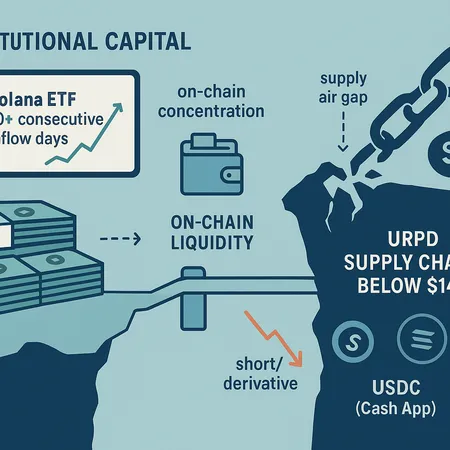

Solana is seeing persistent spot‑ETF inflows while SOL’s market price remains weak—an uneasy divergence driven by liquidity mismatches, derivatives, and an on‑chain supply ‘air gap’ below key levels. This deep dive unpacks the evidence, the mechanics, and practical risk management for traders and allocators.

Canary Capital’s XRPC posted a record first‑day trading volume while XRP’s spot price tumbled. This article explains why heavy ETF activity didn’t translate into immediate price support and what that means for future single‑asset crypto ETFs.

Cipher Mining is diversifying into artificial intelligence (AI) as the crypto market faces difficulties, highlighting a strategic move to leverage emerging technologies. This expansion showcases how crypto firms adapt to market volatility by exploring AI innovations. Platforms like Bitlet.app support crypto enthusiasts through flexible payment options like Crypto Installment service.

US-China trade tensions coupled with Federal Reserve rate cuts have played a significant role in the recent surge of the cryptocurrency market. These macroeconomic factors have driven investors toward crypto assets as alternative investments. Platforms like Bitlet.app offer innovative services such as Crypto Installment plans, making it easier to invest in cryptocurrencies even during volatile times.

The cryptocurrency market faced a significant downturn in October 2025, with Bitcoin and Ethereum prices dropping amid turmoil in the banking sector. Learn how to navigate these price changes and consider options like Bitlet.app's Crypto Installment service to buy cryptos without paying the full amount upfront.