Whales

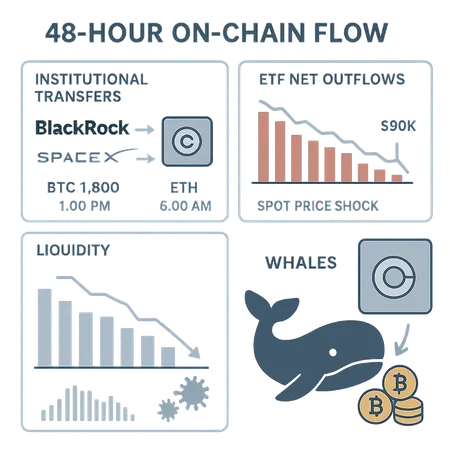

A forensic look at recent institutional transfers to Coinbase, large ETF outflows, whale accumulation patterns, and the liquidity dynamics that produced a sub-$90K price shock. Practical takeaways for spot and derivatives desks on managing risk and reading on‑chain signals.

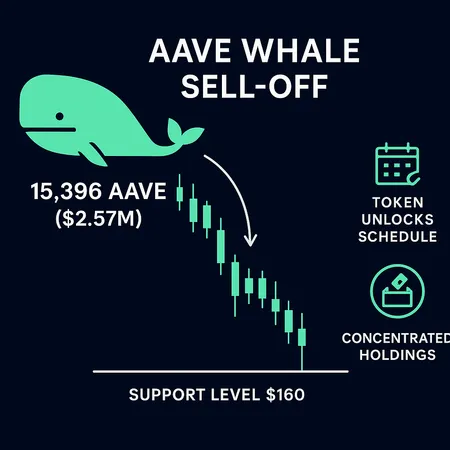

A 15,396 AAVE ($2.57M) whale sale has renewed downside risk for AAVE, putting the $160 support level in focus. Traders and governance participants should track exchange inflows, unlock schedules and on-chain concentration to gauge whether this was an isolated dump or the start of a broader capitulation.

BitMine’s disclosure of a 3.63M ETH treasury and recent multi‑million‑dollar whale long positions have focused attention on concentration risk in Ethereum. This piece unpacks the disclosure, examines evidence of big speculative bets, and lays out governance and risk steps for portfolio managers and on‑chain analysts.

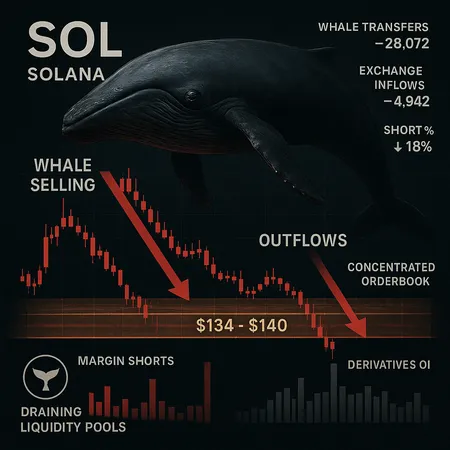

Recent on-chain signals and derivatives flows suggest Solana (SOL) is under growing stress as large holders shift to selling and shorting. This piece quantifies the evidence, maps metrics to the $134–$140 support band, and gives traders concrete signals to watch and hedge.

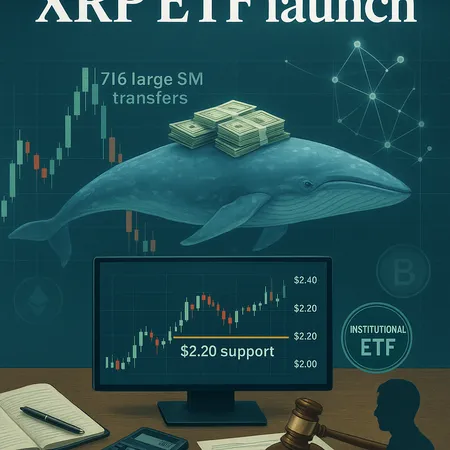

XRP's ETF listing reshapes narratives but raises practical questions for traders: it's testing critical $2.20 support amid extraordinary $716M on‑chain transfers and reduced legal noise — all of which should change how you size and time entries. This feature evaluates technical risk, whale flows, regulatory clarity, and why ETF inclusion doesn't make XRP equivalent to BTC/ETH.

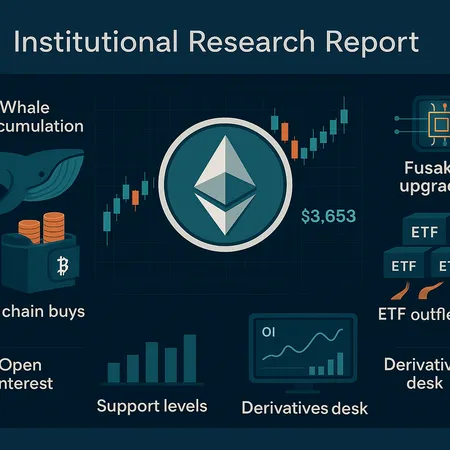

November’s price action in ETH exposed a liquidity paradox: institutional whales piled in while ETF products showed heavy outflows. This piece reconciles on-chain accumulation with ETF-driven selling, technical thresholds (notably $3,653), Fusaka’s role in positioning, and concrete trade scenarios for funds and derivatives desks.

A step‑by‑step investigation into recent claims that MicroStrategy sold large BTC holdings, the evidence refuting those stories, and a practical verification framework traders can use to avoid knee‑jerk moves. Learn how on‑chain checks, corporate disclosures, and market psychology interact when whale rumors surface.

Big Bitcoin sales by whales are affecting the market amidst ongoing uncertainty from the U.S. Federal Reserve. Understanding this impact can help crypto investors make informed decisions. Platforms like Bitlet.app provide innovative ways to buy Bitcoin with manageable payments even in volatile times.

After 14 years of dormancy, Bitcoin whales have moved $2 billion worth of BTC, signaling potential market shifts. This activity invites investors to reconsider strategies and explore tools like Bitlet.app, which offers crypto installment services for more flexible investment options.

After 14 years of inactivity, Bitcoin whales have moved $2 billion worth of BTC. This rare activity can significantly impact market dynamics. Learn how this movement affects crypto investors and how platforms like Bitlet.app make buying crypto more accessible.