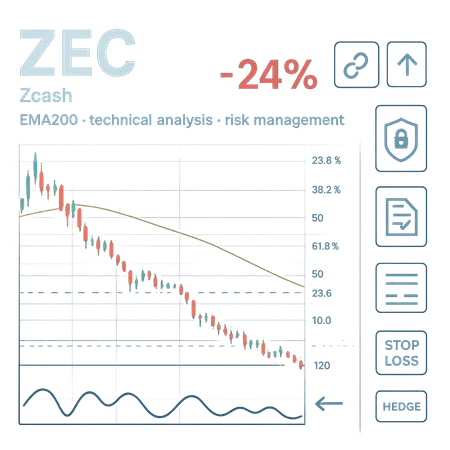

Risk Management

Zcash (ZEC) plunged roughly 24% after losing the EMA200 and several key supports; this article analyzes technicals, on‑chain and macro drivers cited by analysts and lays out a tactical risk‑management playbook for traders and funds.

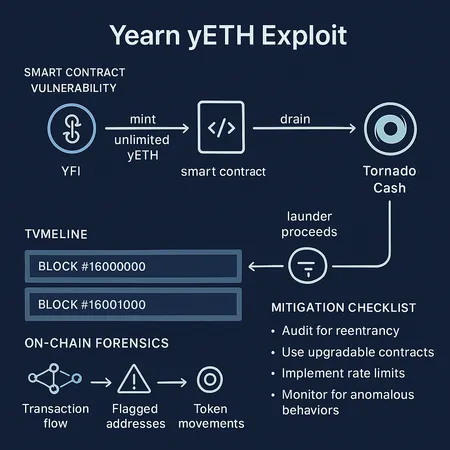

A technical post‑mortem reconstructing how attackers minted unlimited yETH, drained a bespoke stETH/rETH pool, and laundered proceeds via Tornado Cash. Includes on‑chain forensic signals, timeline, vulnerability class, and mitigation checklist for DeFi engineers and risk officers.

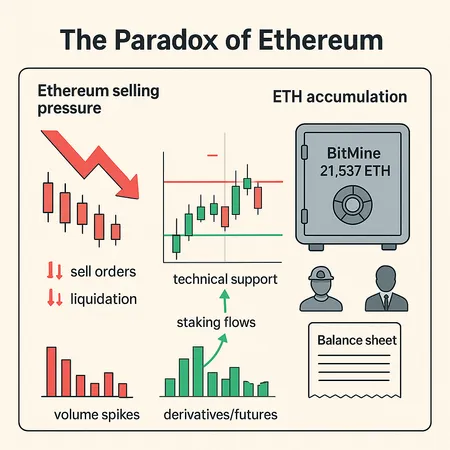

BitMine’s disclosure of a 3.63M ETH treasury and recent multi‑million‑dollar whale long positions have focused attention on concentration risk in Ethereum. This piece unpacks the disclosure, examines evidence of big speculative bets, and lays out governance and risk steps for portfolio managers and on‑chain analysts.

Ethereum is facing heavy selling pressure and volatile volume even as large holders like BitMine quietly add tens of thousands of ETH. This article reconciles those forces, outlines technical levels to watch, and maps practical 3–6 month scenarios and risk management for ETH investors.

PEPE's head‑and‑shoulders breakdown and Fibonacci target near 0.00000185 is a timely reminder that memecoins need strict, scenario‑based risk controls amid post‑crash liquidity stress. This article translates the technical call into actionable rules for position sizing, stops, hedging and off‑ramp checklists.

When BTC sells off, smart managers lean into altcoin rotation and selective diversification. This guide documents evidence of alt resilience, explains why certain categories hold up, and gives concrete rebalancing and scenario playbooks for Q4 volatility.

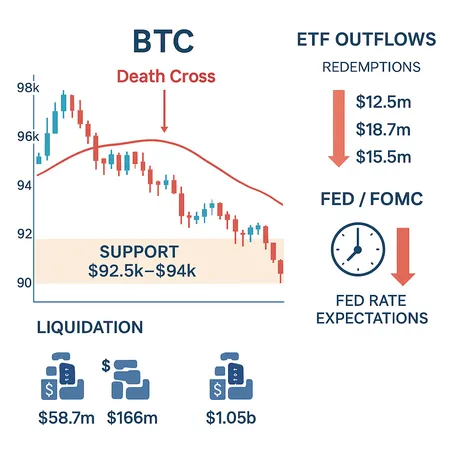

Bitcoin’s recent drop toward $93k–$95k reflects structural pressures — sustained US spot ETF outflows, concentrated forced liquidations, and changing Fed-rate expectations — not just noise. This piece unpacks the drivers, technical danger zones, and concrete risk-management steps for traders and allocators.

A practical, trader-focused framework to reconcile bullish commentary (Saylor, Santiment) with on-chain and technical warning signs (six‑month lows, death cross, rising exchange supply). Includes a checklist, exact BTC/ETH levels to watch, and a 4-step scaling‑in plan for managers with a long bias.

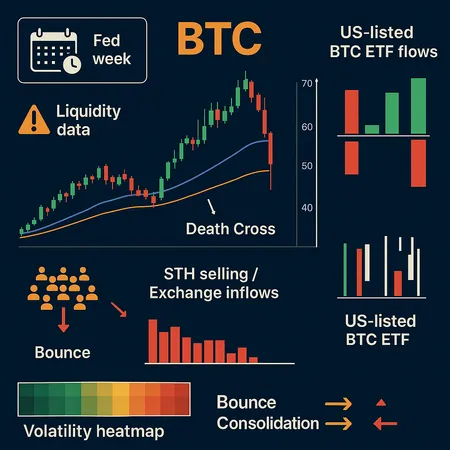

A breakdown of the drivers behind Bitcoin’s sharp November pullback — on-chain STH selling, a looming death cross, volatile ETF flows and a critical macro week — plus actionable signals and three risk-management strategies for traders and PMs.

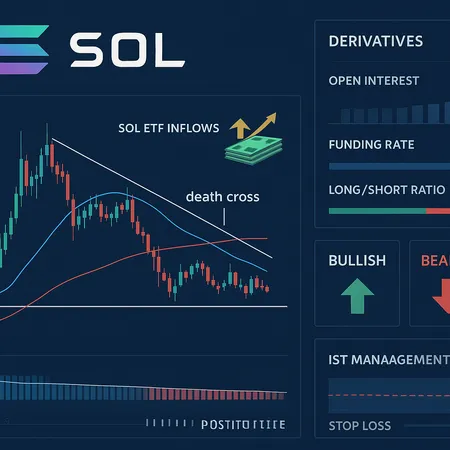

Solana shows a classic technical warning — a reported death cross — even as SOL ETF inflows and derivatives activity suggest institutional buyers are still present. This piece explains the signal, why flows can decouple price from fundamentals, how to read derivatives positioning, and concrete, risk-managed trade ideas for traders and portfolio managers.