Payments

PayPal’s PYUSD vaulted from roughly $1.2B to $3.8B market cap in months, reshaping stablecoin liquidity and competitive dynamics. This analysis unpacks the drivers, contrasts PYUSD with contracting niche coins like Ethena’s USDe, and outlines risks and market outcomes for product managers and analysts.

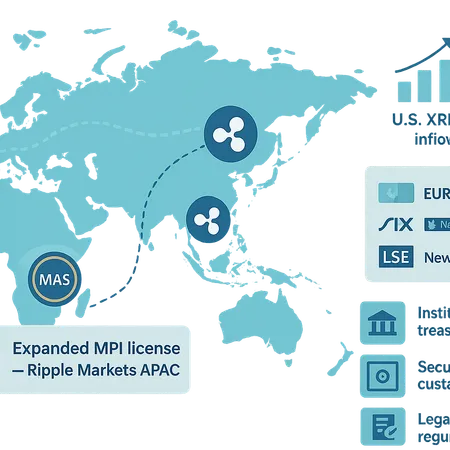

Ripple’s expanded MAS license and renewed ETP appetite for XRP are aligning regulatory and market signals across APAC, the U.S., and Europe. This brief assesses payments use-case implications, legal and custody considerations, and a practical 6–12 month thesis for institutional treasury teams and regulators.

A deep-dive into why exchange-level euro stablecoin support matters, how Deutsche Börse’s EURAU integration shifts European on‑ramps, and a practical PYUSD vs RLUSD comparison for treasuries and payments teams.

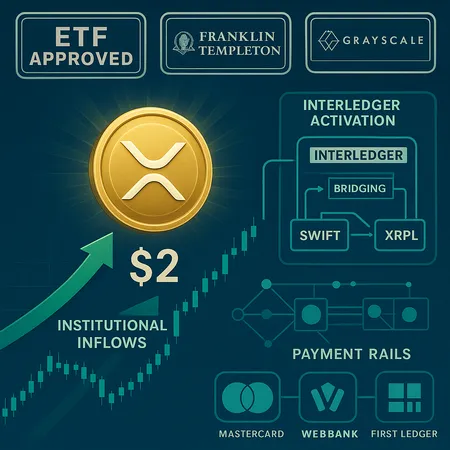

A convergence of NYSE-backed XRP-spot ETF approvals, massive spot inflows and plans to route Interledger through SWIFT has shifted XRP from courtroom speculation toward institutional payments utility. This explainer ties the approvals, liquidity, technical rails and business strategy into a single view for investors and payments executives.

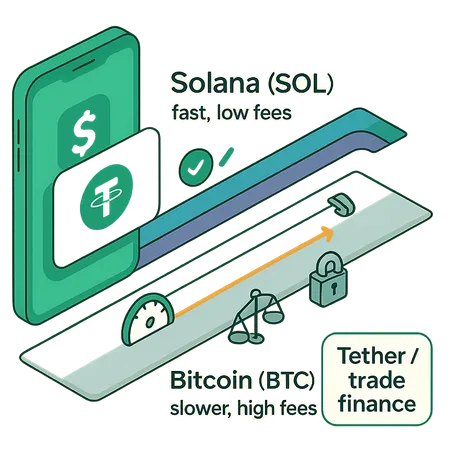

Mainstream payment apps are prioritizing Solana for stablecoin payments because of its throughput, latency, and low fees — tradeoffs that change wallet UX, reconciliation, and settlement guarantees. Tether’s expansion into trade finance further shifts how product teams should think about trust and counterparty risk for USDT rails.

Ripple’s announced $4B infrastructure commitment, coupled with the XRPC ETF launch and rising XRP market cap, could reshape institutional on‑ and off‑ramps. This feature assesses likely use cases, flow dynamics, and risks for treasurers and infrastructure investors.

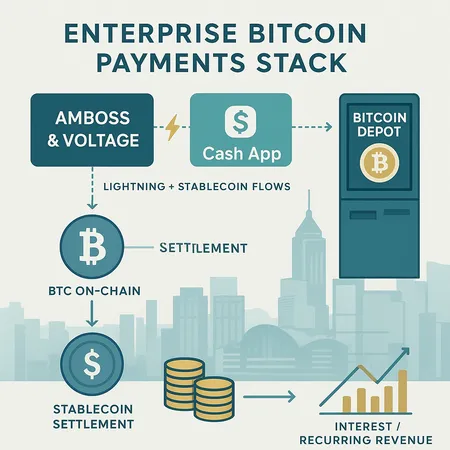

Bitcoin payments are shifting from a one‑off utility to a product that can generate recurring revenue and on‑chain yield. This article analyzes enterprise stacks (Amboss & Voltage), Cash App’s Lightning and USD rails, and Bitcoin Depot’s Asia push to show how the plumbing, UX, and settlement choices enable monetization.

Discover how Bitlet.app's crypto installment service is revolutionizing the way people buy cryptocurrencies by allowing monthly payments instead of upfront full payments, making crypto investments accessible to more users.

Dubai and the USA are making significant strides in adopting cryptocurrencies for everyday payments, marking a global milestone. This trend highlights the growing acceptance of digital currencies in mainstream financial systems. Platforms like Bitlet.app enhance this movement by offering innovative crypto installment services, allowing users to buy cryptocurrencies now and pay later in monthly installments.

Fiserv has launched a new stablecoin aimed at revolutionizing digital commerce by providing a seamless, secure, and efficient payment method. This initiative signals a significant step forward in the adoption of cryptocurrencies for everyday transactions.