Altcoins

Zcash surged ~1,000% in three months before a sharp ~15% pullback; this piece dissects drivers, on‑chain signals, regulatory risks and concrete trading tactics for speculative altcoin traders. Learn how to size, hedge, and read whether ZEC’s next leg is likely continuation or a deeper reversal.

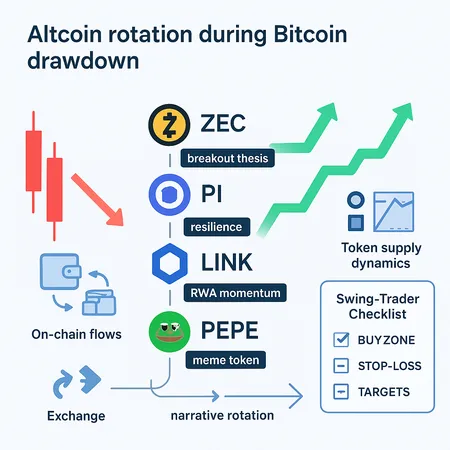

When BTC sells off, smart managers lean into altcoin rotation and selective diversification. This guide documents evidence of alt resilience, explains why certain categories hold up, and gives concrete rebalancing and scenario playbooks for Q4 volatility.

Bitcoin dominance has slipped below 60%, but analysts disagree on whether that alone signals an altseason. This piece reconciles the data, examines SOL, LINK and ZEC, outlines leading indicators and gives practical screening criteria for portfolio managers deciding whether to increase alt exposure.

Zcash (ZEC) recently topped Coinbase search charts, reigniting debate over whether privacy coins can stage a sustainable comeback. This article breaks down the drivers of the attention, the technical setup around $1,000, on-chain signals and the regulatory risks shaping the trade.

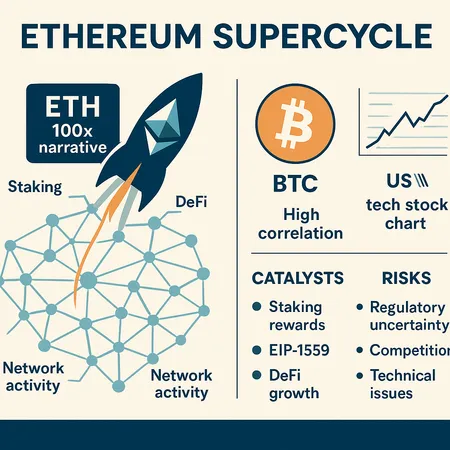

Tom Lee and others argue Ether (ETH) may be entering a Bitcoin-like supercycle; this article assesses that bullish case against evolving BTC correlation to US tech, macro flows, and network fundamentals. We provide a checklist of catalysts and risks for long-term investors deciding whether to rotate into ETH.

A marketwide drawdown doesn't mean every crypto goes down. Structural catalysts, supply dynamics and narrative rotations helped certain altcoins rally even while [Bitcoin] faded. This guide explains why and profiles five actionable names with swing-trader setups.

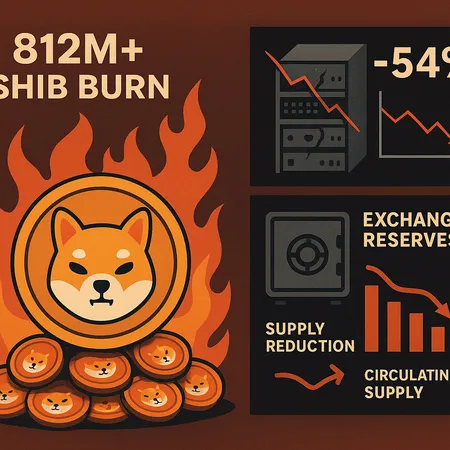

A recent 812,840,391 SHIB burn and a 2,405% surge in burn rate collided with a reported 54% drop in Shibarium activity. This piece breaks down the mechanics, on-chain signals and a practical risk/reward framework for traders and long-term holders.

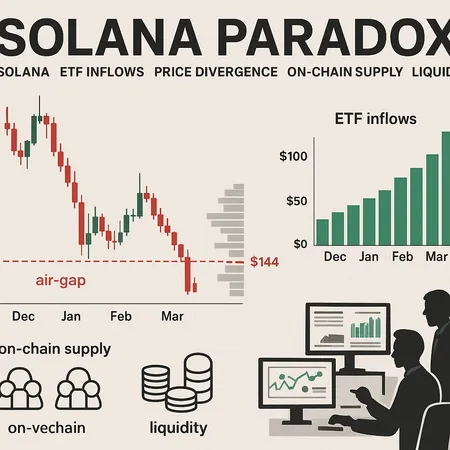

Solana-based ETFs have recorded consecutive inflows, yet SOL has slid to multi-month lows. This article unpacks ETF timing, on‑chain supply issues, the ‘air gap’ below $144, and whether institutional demand can overcome structural liquidity risks.

A measured look at Chainlink's short-to-medium term outlook after a prediction that LINK could rise to ~$19 from mid-$14s — covering technical pivots, on‑chain oracle demand, macro risks, and concrete trade scenarios.

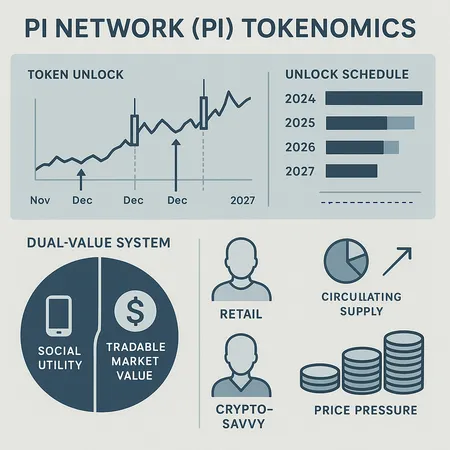

Pi Network faces a tokenomics stress test as heavy token unlocks begin — traders should weigh scheduled supply releases through 2027 and plan risk-managed responses. This article explains the unlock cadence, historical price behavior around releases, the dual-value narrative, and practical strategies for PI holders.