Liquidity

Grayscale’s S‑1 filing for a spot Sui trust and the SEC’s sign‑off on a 2x leveraged SUI ETF mark a step toward institutional productization. This article explains the timeline, product mechanics, likely liquidity and volatility effects, and what developers and token holders should expect.

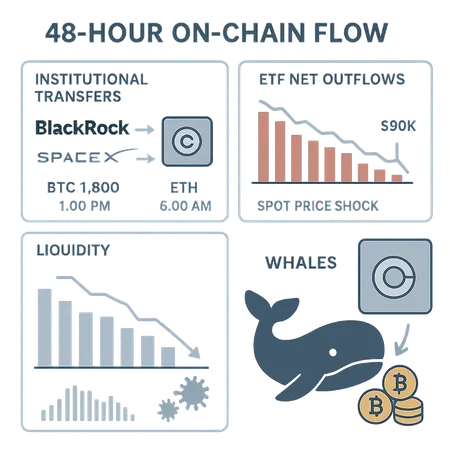

A forensic look at recent institutional transfers to Coinbase, large ETF outflows, whale accumulation patterns, and the liquidity dynamics that produced a sub-$90K price shock. Practical takeaways for spot and derivatives desks on managing risk and reading on‑chain signals.

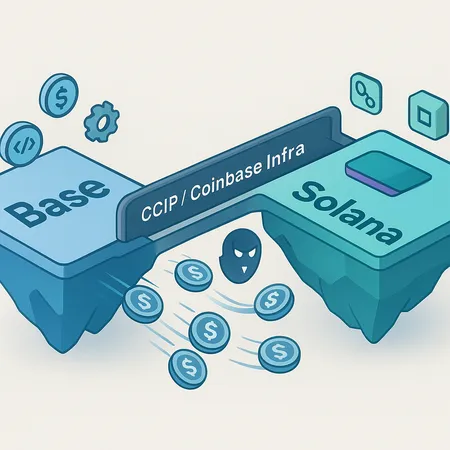

Base’s new bridge to Solana has divided builders: some call it a liquidity‑siphoning ‘vampire attack,’ others see pragmatic multichain engineering. This article breaks down the technical design, the claims and counterclaims, and the real implications for Solana liquidity and developer strategy.

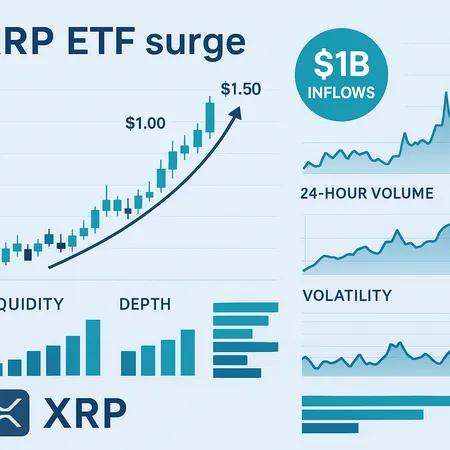

XRP ETFs have pulled in over $1 billion in under a month, reshaping how price discovery, liquidity and exchange dynamics function for the token. This article unpacks ETF mechanics, short‑term market signals, a bull‑case for multi‑dollar targets, key risks, and practical allocation guidance for speculators and institutions.

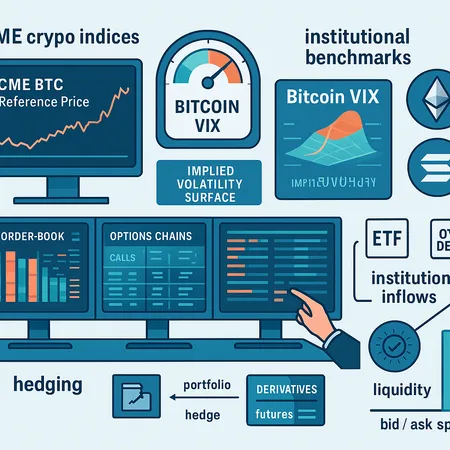

CME’s new pricing indices and a VIX‑style Bitcoin volatility measure are creating standardized reference points that change hedging, derivatives pricing and liquidity provision for BTC, ETH, SOL and XRP. Institutional benchmarks reduce fragmentation, force re‑calibration of models, and reshape how ETF, OTC and market‑making desks operate.

An investigative reconstruction of Bitcoin’s early-December flash crash, showing how a Japanese government bond yield shock met thin liquidity and algorithmic flows to spark a 180k+ trader liquidation cascade. Actionable risk-management and trade scenarios for traders and portfolio managers follow.

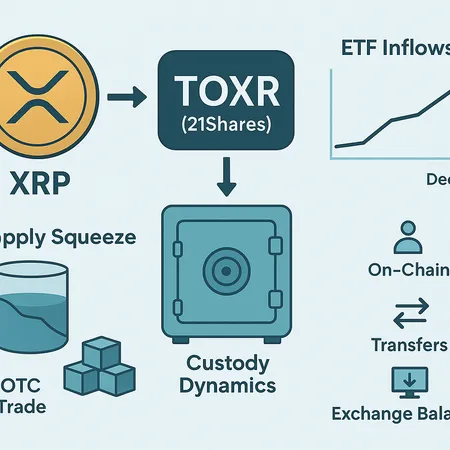

The arrival of 21Shares’ TOXR and accelerating ETF demand have the potential to remove meaningful XRP from liquid markets. This feature unpacks the custody and OTC mechanics behind the supply-squeeze thesis, the evidence for a drain, and risk scenarios if ETF flows cool.

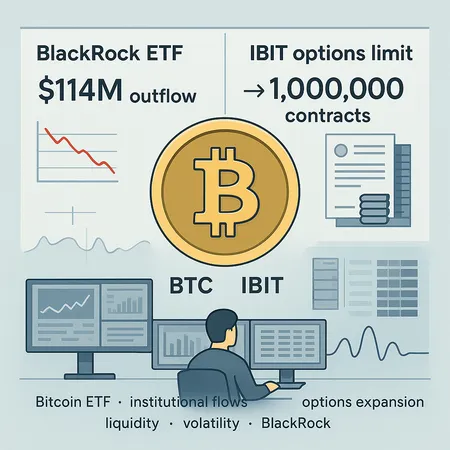

Recent institutional shifts — including a $114M net outflow from BlackRock’s Bitcoin ETF and IBIT’s bid to raise options limits — are reshaping liquidity, volatility, and hedging mechanics across BTC markets. This piece breaks down the mechanics, timeline, and practical implications for allocators and derivatives traders.

The launch of 21Shares' XRP spot ETF catalyzed a fresh price leg and raised structural questions as Binance reserves fell to ~2.7B. This article breaks down market reaction, supply dynamics, technical scenarios, institutional implications, and the risks allocators should weigh.

ARK Invest argues that roughly $300 billion in liquidity could return once the U.S. reopens — a thesis with big implications for Bitcoin’s bounce and where fresh capital will land. This piece breaks down ARK’s timing claim, on-chain and exchange signals to watch, and tactical portfolio rules for allocators.