Derivatives

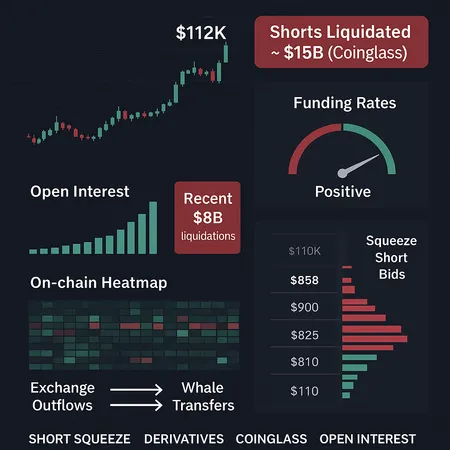

A tactical deep‑dive into how derivatives positioning can create a sudden BTC short squeeze and where liquidation risks are concentrated. Practical signals and scenario-based risk management for active traders and derivatives desks.

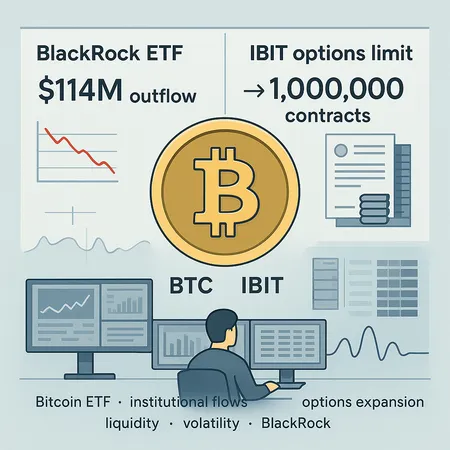

Recent institutional shifts — including a $114M net outflow from BlackRock’s Bitcoin ETF and IBIT’s bid to raise options limits — are reshaping liquidity, volatility, and hedging mechanics across BTC markets. This piece breaks down the mechanics, timeline, and practical implications for allocators and derivatives traders.

A focused risk primer for traders and allocators: why the imminent BTC/ETH options expiry, a $7.5B spike in whale deposits to Binance, and deteriorating sentiment raise downside scenarios — and how to hedge them.

A data-first look at massive recent Bitcoin on-chain flows — 580k BTC withdrawn from exchanges, SpaceX’s $105M wallet moves, Coinbase custody migrations and a $100B market inflow — and how to convert those signals into practical trading rules.

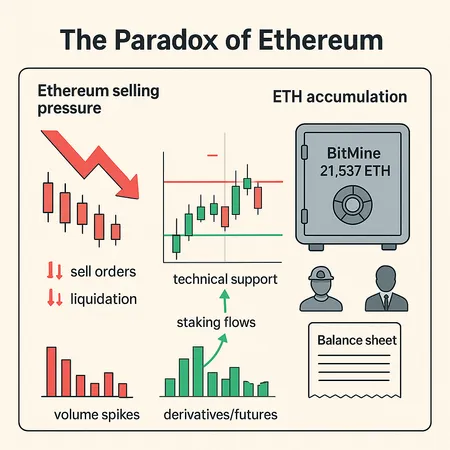

Ethereum is facing heavy selling pressure and volatile volume even as large holders like BitMine quietly add tens of thousands of ETH. This article reconciles those forces, outlines technical levels to watch, and maps practical 3–6 month scenarios and risk management for ETH investors.

Singapore Exchange’s new exchange‑cleared BTC and ETH perpetual futures promise institutional-grade access in Asia, combining perpetual-style exposure with central clearing and MAS-aligned oversight. This piece dissects how SGX perpetuals differ from US spot ETFs and existing derivatives, the likely flow implications for Asian allocators, margin/clearing benefits, interactions with global liquidity, and near-term arbitrage plays.

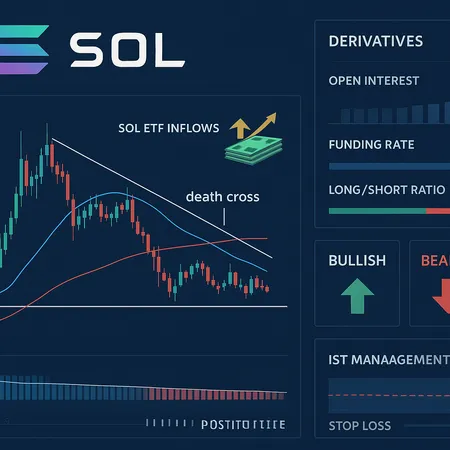

Solana shows a classic technical warning — a reported death cross — even as SOL ETF inflows and derivatives activity suggest institutional buyers are still present. This piece explains the signal, why flows can decouple price from fundamentals, how to read derivatives positioning, and concrete, risk-managed trade ideas for traders and portfolio managers.

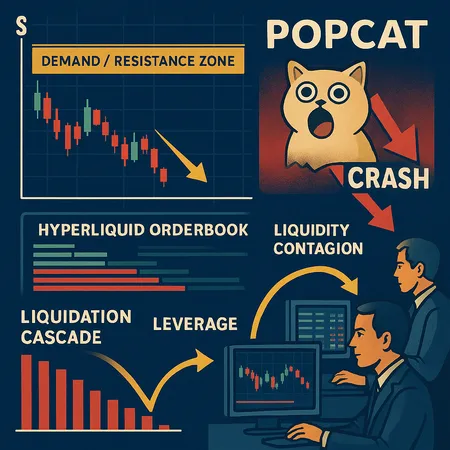

Solana sits at a pivotal technical level while the POPCAT memecoin crash and suspicious Hyperliquid order flows have amplified systemic risk. Active traders and risk managers need a clear map of demand/resistance, contagion mechanics, and tactical hedges.

FalconX's recent acquisition of 21Shares marks a significant shift in the crypto derivatives and structured products landscape, enabling innovative financial solutions and broader market access. Discover how this deal shapes the future of crypto trading and investment.

Coinbase's acquisition of Deribit marks a significant step in the evolution of crypto derivatives trading. This strategic move is expected to enhance Coinbase's offerings and attract more institutional investors into the crypto space.