CryptoInvesting

Rumble has agreed to merge with Northern Data after divesting its Bitcoin mining arm, Peak Mining. At the same time, Tether announced a $150 million commitment to AI projects — moves that could reshape crypto infrastructure, stablecoin strategy, and compute-heavy services. Here’s what to watch and how investors might respond.

Bitcoin and Ether prices have fallen sharply due to investor concerns over AI-linked stock valuations and a cautious market mood. With Bitcoin potentially testing critical support levels near $100,000, long-term holders' selling increases downside risk. Bitlet.app's Crypto Installment service can help investors buy crypto gradually during volatile times.

Bitcoin and major cryptocurrencies saw modest gains while MoneyGram introduced a new stablecoin app in Colombia. ARK Invest increased its Bullish shares significantly, and Tether reported over $10 billion profits with a new buyback program.

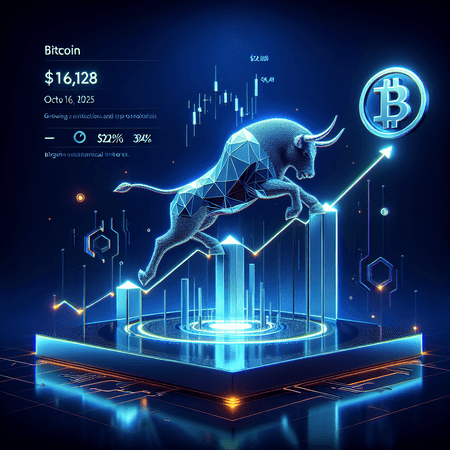

Bitcoin surged to a new all-time high of $126,198 on October 6, 2025, continuing a bullish run with a 34% gain so far this year. Strong market indicators and growing institutional interest are driving this momentum.

The ongoing 21-day Trump-Republican government shutdown has caused major volatility in the cryptocurrency markets, with Bitcoin dropping 14.6% and some altcoins plunging even more. Regulatory bodies like the SEC and CFTC have halted operations, raising concerns about market oversight and insider trading, especially after a trader profited $150 million during the crash. Platforms like Bitlet.app offer safe ways to navigate such turbulent times with their crypto installment services.

In the fast-paced world of cryptocurrency, distinguishing relevant from irrelevant content is key to making informed decisions. Learn practical tips to filter out noise and focus on valuable crypto information.

Bitcoin recovered to $114,000 after a dip, driven by bullish sentiment for October, or 'Uptober.' Despite some investor caution due to potential US government shutdown risks, the market shows signs of stabilization as futures open interest rises and technical indicators suggest possible upward momentum.

Bitcoin reached an all-time high of $125,800 on October 6, 2023, breaking out of a two-month descending channel. Analysts expect prices could surge to $160,000 within 12 weeks, supported by strong investor interest and significant ETF inflows. Discover how Bitlet.app can help you join this momentum with flexible crypto installment plans.

Robinhood CEO Vladimir Tenev predicts that tokenization will revolutionize the entire financial system, potentially setting the framework for major markets by 2030. Speaking at an event in Singapore, he emphasized the transformative power of tokenized assets.

Ethereum currently trades at $4,333.66 with a market cap exceeding $523 billion. Since its 2015 launch, it has revolutionized smart contracts and decentralized apps. Explore its latest market stats and historical milestones, and discover how you can start investing with flexible Crypto Installments on Bitlet.app.