BankPozitif and Taurus Enhance Crypto Custody Services, While Bank of America Eyes Stablecoin Launch

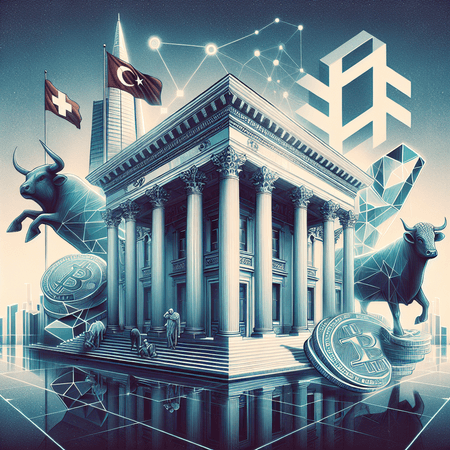

In March 2025, Turkish digital investment bank BankPozitif announced an exciting partnership with Swiss blockchain startup Taurus, aiming to enhance its crypto custody services. This collaboration signifies a growing trend among traditional banks to integrate cryptocurrency into their offerings, making digital asset management more secure and accessible for investors.

Additionally, in noteworthy comments, Bank of America CEO Brian Moynihan revealed the bank's preparedness to launch its own dollar-backed stablecoin, contingent upon future approval from U.S. lawmakers. This potential entry into the stablecoin market showcases the bank's strategic interest in leveraging blockchain technology for financial innovation.

For those looking to invest in cryptocurrencies, platforms like Bitlet.app offer unique options, such as the Crypto Installment service, allowing users to buy cryptos now and pay monthly instead of upfront. This flexibility can significantly ease the investment process for newcomers and seasoned investors alike.