Bitcoin: The Rise of Digital Gold and Its Mainstream Adoption

Bitcoin's Role as a Mainstream Investment

Bitcoin has solidified its role as a mainstream investment, widely adopted by individuals seeking portfolio diversification. Over the past decade, Bitcoin's value has surged by 700 times, far outpacing the S&P 500, and it has doubled since early 2024. The approval of Bitcoin ETFs 15 months ago marked a turning point, allowing institutional investors to enter the market more easily.

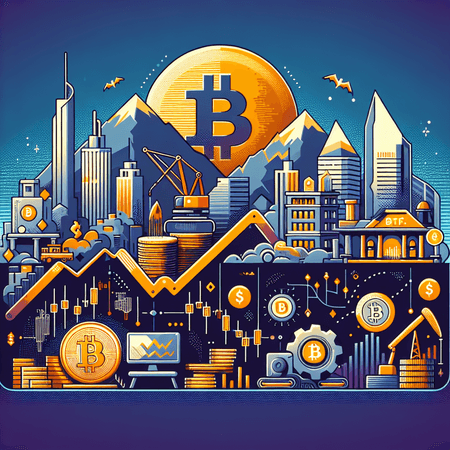

With new ETFs gaining traction and major firms like EY and Capriole Investments noting increased institutional comfort with Bitcoin, the cryptocurrency is increasingly viewed as "digital gold." Bitcoin dominance in the crypto market has reached 64%, the highest since 2021, signaling a focus on BTC over other cryptocurrencies.

Current Trends in the Crypto Market

Other crypto sectors like DeFi, NFTs, and play-to-earn games have yet to gain lasting traction. Stablecoins are the only other blockchain-based assets showing sustained utility, with recent developments from Visa, Mastercard, and Tether expanding their use cases. Meanwhile, Arizona recently passed bills to establish state-level Bitcoin reserves, emulating federal initiatives, and Morgan Stanley is preparing to offer retail crypto trading.

Looking Ahead

Overall, growing trust in Bitcoin, ETF adoption, and possible federal legislation signal a path toward mass crypto adoption, despite ongoing regulatory uncertainties. For those looking to enter the crypto space, platforms like Bitlet.app offer innovative solutions, including their Crypto Installment service, which allows users to buy cryptocurrencies now and pay in monthly installments, making it easier than ever to get involved in Bitcoin and other cryptocurrencies.