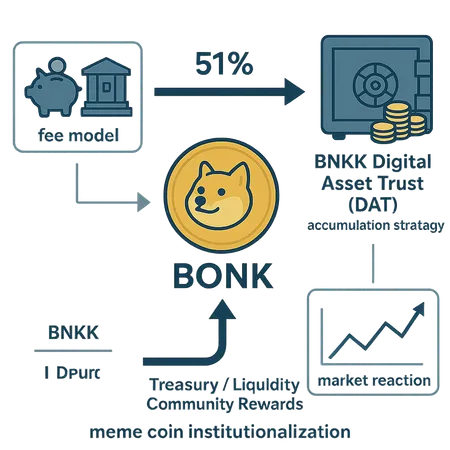

Tokenomics

BONK’s recent fee model overhaul routes a majority of platform fees into BNKK’s Digital Asset Trust (DAT), shifting supply dynamics and signaling a move toward institutional-style treasuries. This article analyzes the mechanics, market implications, and lessons for token designers and DAO treasurers.

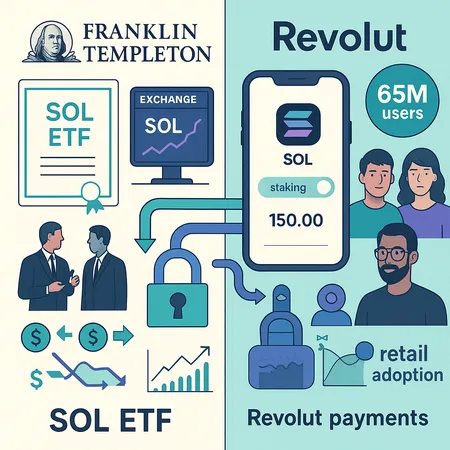

Franklin Templeton’s approval to list a Solana ETF on NYSE Arca and Revolut’s rollout of native SOL payments to 65 million users are twin catalysts that could reshape SOL’s on‑ramp liquidity, retail usage, and staking economics. This article dissects the mechanics, likely token‑economic impacts, and practical signals product managers and investors should watch.

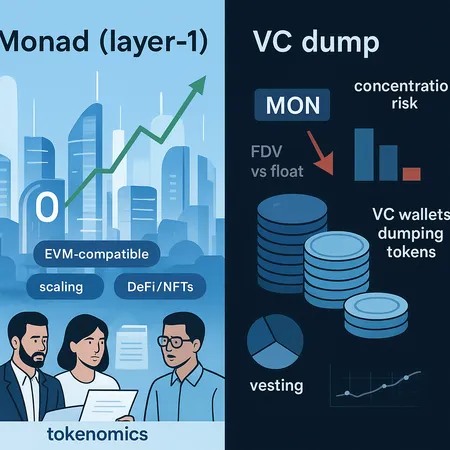

Monad promises an EVM‑compatible layer‑1 with a roadmap aimed at fast smart contracts and new use‑cases, but critics warn its tokenomics could enable heavy VC sell pressure. This explainer contrasts bullish forecasts with concentrated ownership risks and gives practical steps retail holders can use to manage exposure.

Monad’s mainnet pushed MON prices sharply higher as airdrop-driven transaction demand met speculative FOMO. Days later, fake ERC‑20 transfer attacks exposed a predictable threat for new Layer‑1 launches — and offered clear remediation steps.

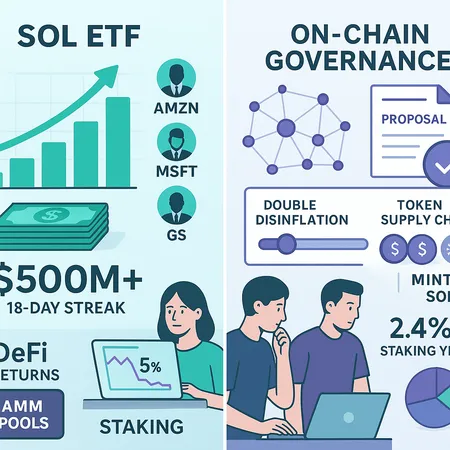

Solana is caught between heavy ETF-driven capital flows and a contentious inflation proposal that could reshape tokenomics and DeFi returns. This article explains the mechanics, immediate market implications, and an investor checklist for balancing price-driven momentum with governance risk.

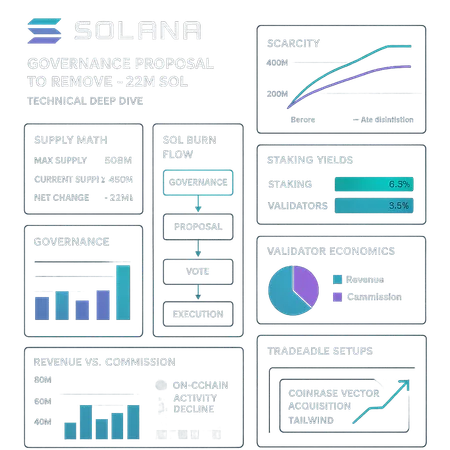

A technical analysis of the Solana governance proposal to remove ~22M SOL, modeling supply, staking and validator economics, and tradeable setups across short-to-mid horizons. We weigh disinflation mechanics against falling on‑chain activity and potential demand tailwinds like Coinbase Vector.

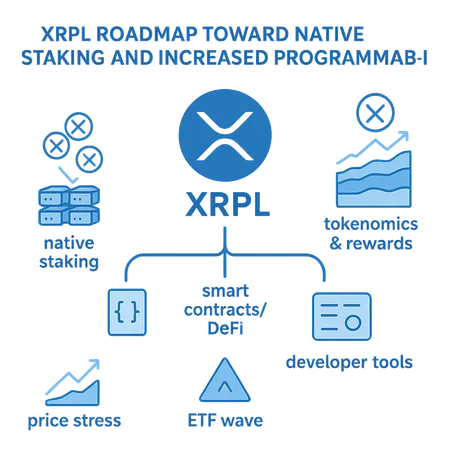

The XRP Ledger is moving toward native staking and richer programmability; this analysis evaluates the technical proposals, tokenomics shifts, ETF-era dynamics, and adoption challenges for developers and investors. We synthesize engineering commentary from RippleX and market context to judge whether staking could meaningfully change XRPL’s competitive position.

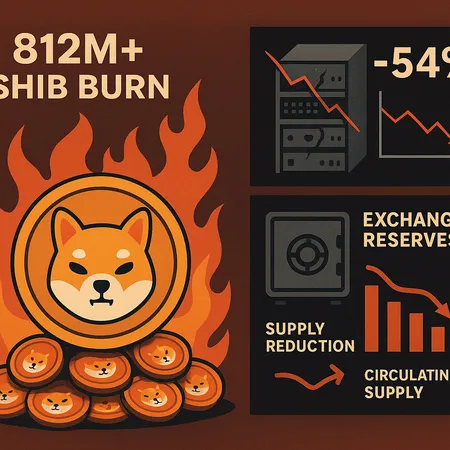

A recent 812,840,391 SHIB burn and a 2,405% surge in burn rate collided with a reported 54% drop in Shibarium activity. This piece breaks down the mechanics, on-chain signals and a practical risk/reward framework for traders and long-term holders.

A -64.89 billion SHIB 24‑hour net outflow made headlines — but headlines don’t equal trade signals. This explainer shows how to interpret large on‑chain flows, why they can paradoxically be bullish, and practical rules retail traders can use to separate noise from meaningful movement.

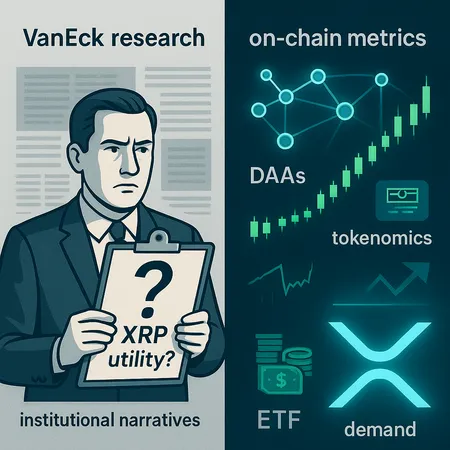

XRP’s ETF debut has reignited a debate: is this rally driven by genuine on‑chain growth or by market structure and ETF flows? This feature juxtaposes institutional skepticism with rising DAAs and ETF demand to build a practical framework for investors.