Technical Analysis

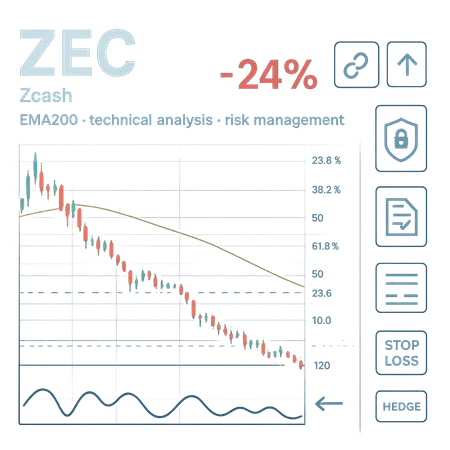

Zcash (ZEC) plunged roughly 24% after losing the EMA200 and several key supports; this article analyzes technicals, on‑chain and macro drivers cited by analysts and lays out a tactical risk‑management playbook for traders and funds.

Dogecoin’s recent bounce has been amplified by fresh DOGE ETF listings that attracted nearly $2M in early inflows. This explainer breaks down ETF-driven demand, the $0.15 technical support test, regulatory headwinds, and practical position-sizing ideas for retail traders.

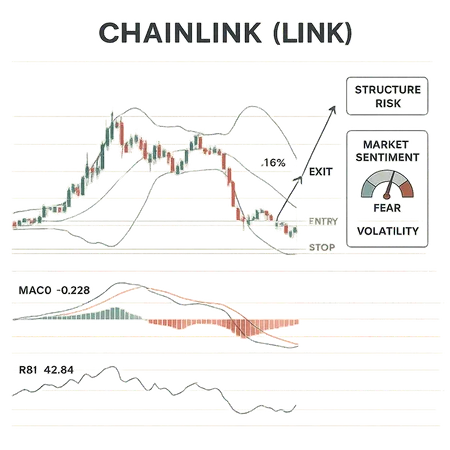

LINK has slipped for several sessions even as ETF hopes rise — a mix of technical sell signals and a curious decline in exchange reserves demands careful reading. This post blends on‑chain context and TA to outline scenarios and trade management ideas for holders.

A tactical deep-dive into DOGE’s falling wedge, measured breakout targets toward $0.25, and the ETF-driven volatility mechanics that can create short-term spikes followed by mean reversion. Practical trade plans, sizing, and stop guidance for swing traders.

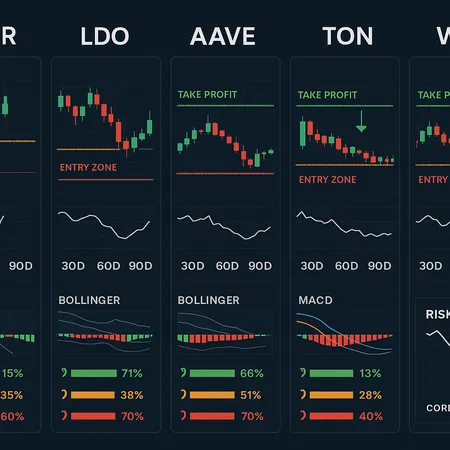

A comparative technical roundup of HBAR, LDO, AAVE, TON and WLD that synthesizes recent forecasts, indicator signals (RSI, Bollinger, MACD), probability-weighted timelines, and actionable trade setups with stop-loss sketches. Ideal for retail altcoin investors and swing traders seeking prioritized ideas and clear timeframes.

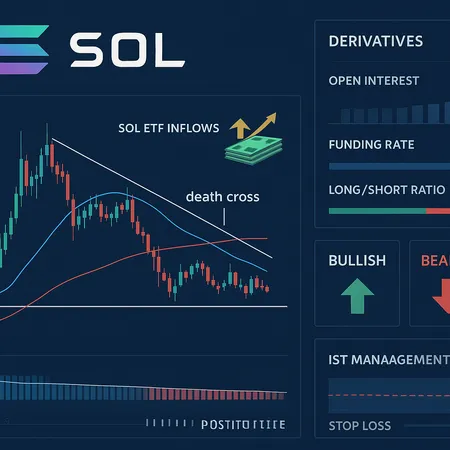

Solana shows a classic technical warning — a reported death cross — even as SOL ETF inflows and derivatives activity suggest institutional buyers are still present. This piece explains the signal, why flows can decouple price from fundamentals, how to read derivatives positioning, and concrete, risk-managed trade ideas for traders and portfolio managers.

A trader-focused technical breakdown of LINK after the recent pullback: setup, the case for a short-term 16% rebound to $16.50, the structural risks, and a concrete trade plan with stops and targets. Includes how extreme fear readings can amplify quick rebounds or violent breakdowns.

Explore the latest technical indicators pointing to Bitcoin's potential price targets by late 2025, and learn how platforms like Bitlet.app can help you invest smartly with flexible payment options.