ETF Flows

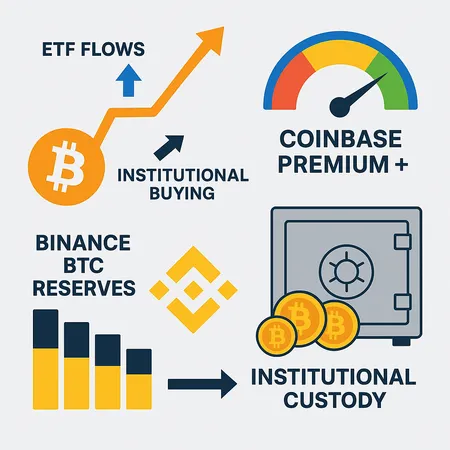

A synthesis of Coinbase premium, on‑exchange reserves, and corporate custody moves suggests the market may be shifting from short squeezes to structural accumulation — but confirmation needs multiple on‑chain and market indicators. This article outlines what to watch and practical thresholds for traders and analysts.

An investigative reconstruction of Bitcoin’s early-December flash crash, showing how a Japanese government bond yield shock met thin liquidity and algorithmic flows to spark a 180k+ trader liquidation cascade. Actionable risk-management and trade scenarios for traders and portfolio managers follow.

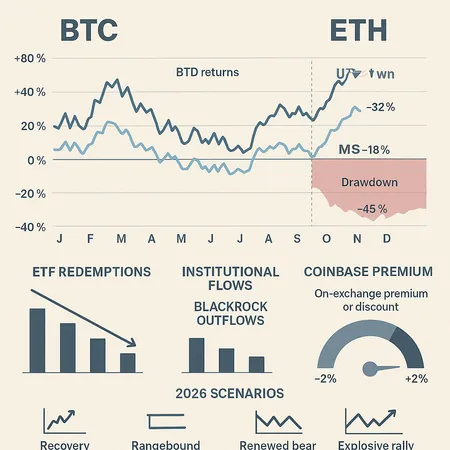

After October’s flash crash, 2025 left investors asking whether the year qualifies as a bear market. This feature synthesizes drawdowns, ETF redemptions, exchange-premium signals and technical calls to offer a balanced view and allocation guidance for 2026.

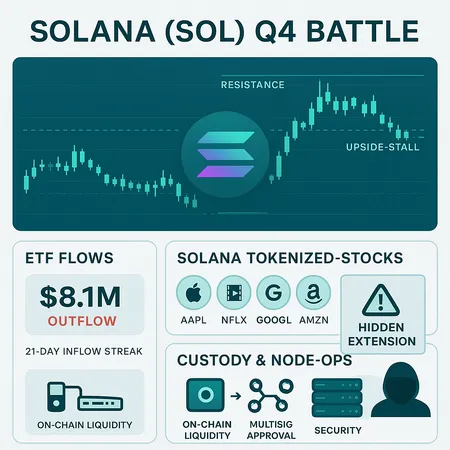

Q4 is shaping up as a decisive stretch for Solana: price action is testing critical resistance even as ETFs register their first outflows and tokenized-stock adoption surfaces novel attack vectors. Funds and node operators must weigh liquidity dynamics against custody and UX risks before redeploying capital.

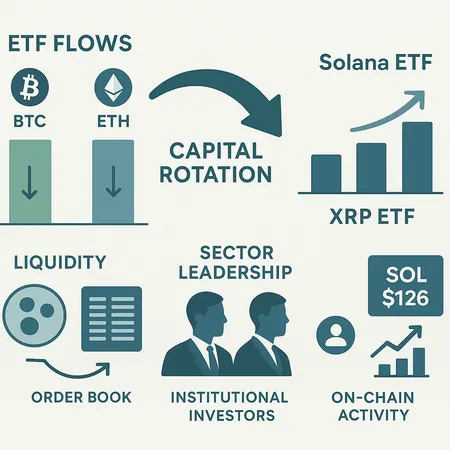

A steady stream of inflows into Solana and XRP ETFs, while Bitcoin and Ethereum ETFs see outflows, signals a tactical capital rotation. This piece breaks down the flow patterns, what institutional demand means for on-chain activity and liquidity, and practical allocation rules for portfolio managers.

A focused market note on the recent Bitcoin stress episode: large ETF outflows (including the $860M event), price slipping under $100k, and mixed institutional messaging. Actionable near‑term scenarios, support zones, and tactical risk-management ideas for intermediate traders and CIOs.