Dogecoin

21Shares’ updated Dogecoin ETF filing — with fee disclosures and custodian details — reignited DOGE price action and debate over whether spot Dogecoin products can attract sustainable institutional capital.

Dogecoin’s recent bounce has been amplified by fresh DOGE ETF listings that attracted nearly $2M in early inflows. This explainer breaks down ETF-driven demand, the $0.15 technical support test, regulatory headwinds, and practical position-sizing ideas for retail traders.

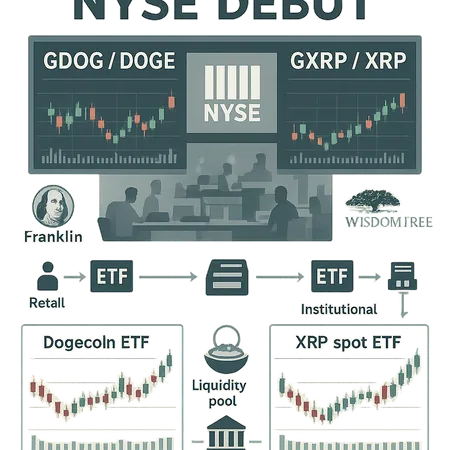

A critical investigation comparing Bitwise’s BWOW and Grayscale’s GDOG launches, reconciling contradictory volume reports, and explaining why investor appetite is fragmenting across Dogecoin ETFs. Practical guidance for ETF‑savvy investors evaluating early altcoin ETFs and what secondary‑market liquidity might look like next.

The Dogecoin ETF debut split the market — modest first-day volumes and price bumps contrasted with headlines calling it a flop. This explainer breaks down why a Wall Street product launch doesn't automatically translate to sustained institutional adoption, and gives a practical checklist for traders considering memecoin ETFs.

A tactical deep-dive into DOGE’s falling wedge, measured breakout targets toward $0.25, and the ETF-driven volatility mechanics that can create short-term spikes followed by mean reversion. Practical trade plans, sizing, and stop guidance for swing traders.

Grayscale’s newly approved spot Dogecoin (GDOG) and XRP (GXRP) ETFs change the toolkit for retail and institutional exposure, with implications for liquidity, arbitrage and short-term price dynamics. This analysis breaks down timing, ETF competition, expected volumes and tactical signals allocators and advanced traders should watch.

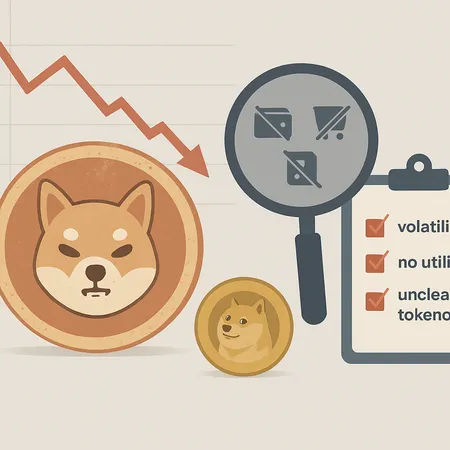

SHIB remains far below its multi-year highs and lacks clear, widely adopted utility. This article critiques the late-2025 investment case for Shiba Inu and offers a practical risk checklist for memecoin investors.

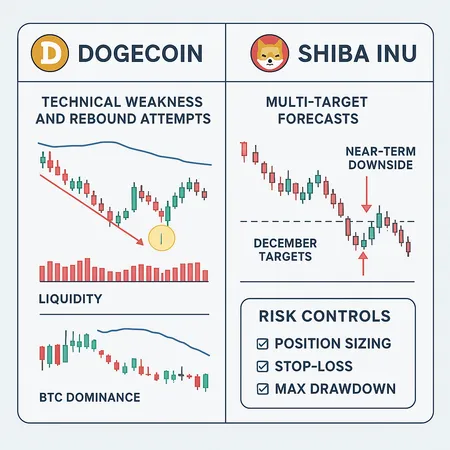

A tactical deep-dive into how Dogecoin’s technical frailty and Shiba Inu’s bifurcated forecasts play out during liquidity drains. Includes concrete entry/exit rules, position sizing formulas, and volatility controls for retail meme-coin traders.

The cryptocurrency market is showing signs of recovery, with Cardano and Dogecoin leading the growth. Discover how Bitlet.app's innovative Crypto Installment service can help you invest in these rising assets now and pay over time.

Easing trade tensions between the US and EU have positively influenced the crypto market, especially boosting Dogecoin and Cardano. This development creates fresh opportunities for investors using platforms like Bitlet.app, which offers flexible payment options for crypto purchases.