Related posts

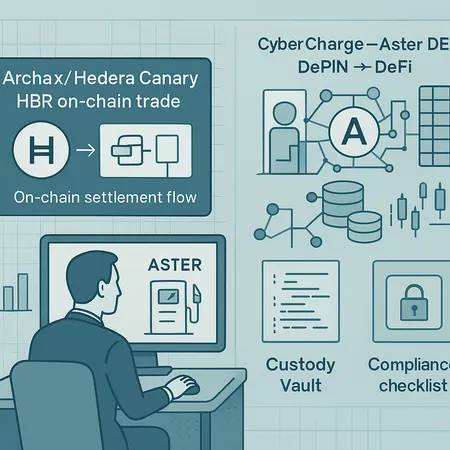

The Archax on‑chain trade of the tokenised Canary HBR ETF on Hedera and the CyberCharge–Aster DEX alliance show how tokenized ETFs and DePIN rewards are moving from concept to production. Institutional builders must weigh mechanics, custody, regulation, and liquidity as real‑world assets become natively tradable on blockchains.

Pi Network’s recent upgrade promises a 50% faster KYC experience ahead of a large token unlock — a change with meaningful operational, security, and market implications for pioneers and exchanges. This article breaks down the technical upgrades, tradeoffs, and concrete next steps for community managers and exchange ops teams.

Grayscale’s S‑1 filing for a spot Sui trust and the SEC’s sign‑off on a 2x leveraged SUI ETF mark a step toward institutional productization. This article explains the timeline, product mechanics, likely liquidity and volatility effects, and what developers and token holders should expect.