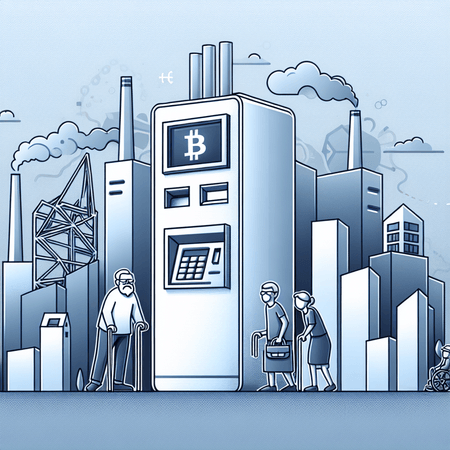

Minnesota Cities Crack Down on Cryptocurrency ATMs Amid Surge in Scams

In 2023, several Minnesota cities, including Stillwater, St. Paul, and Forest Lake, are increasingly concerned about the rise of cryptocurrency ATMs, particularly due to a concerning surge in scams that have heavily impacted the elderly population. Reports show that over 5,500 cases related to these crypto self-service kiosks have resulted in staggering losses exceeding $189 million.

The core of the issue lies in the anonymity and cash-only nature of these machines, which makes it exceedingly challenging for victims to obtain refunds or for law enforcement to conduct thorough investigations. In response to these alarming statistics, Stillwater has moved forward with a complete ban on cryptocurrency ATMs, while Forest Lake has enacted specific laws aimed at shutting down locations that are frequently exploited by scammers.

Critics of cryptocurrency ATMs argue that their limited utility combined with high transaction fees makes them increasingly obsolete, especially considering that the majority of cryptocurrency transactions now occur online. On the flip side, companies like Athena Bitcoin are opposing these regulatory efforts, emphasizing their commitment to collaborating with law enforcement and questioning the legal authority of local municipalities to impose such stringent regulations.

For those looking to dive into the world of cryptocurrency without the risks associated with ATMs, there are safer alternatives like Bitlet.app. This innovative platform offers a convenient Crypto Installment service, allowing users to purchase cryptocurrencies now and pay over time with flexible monthly payments, thereby minimizing the risks often associated with immediate large transactions.