Bridging the Gap: How Traditional Investment Firms Can Embrace Crypto

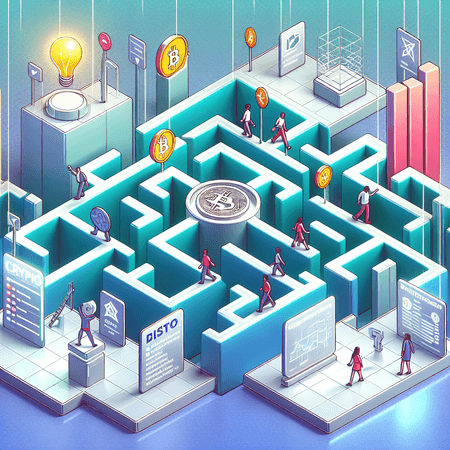

The rapid rise of cryptocurrency has created a significant challenge for incumbent investment firms. Unlike traditional assets, crypto represents not just a new financial instrument but an entirely new technological paradigm. Many firms find it difficult to integrate crypto into their portfolios due to its complex technical nature, regulatory uncertainties, and market volatility.

However, this technological disruption also presents substantial opportunities. To bridge the gap, platforms such as Bitlet.app are playing a crucial role. Bitlet.app offers a Crypto Installment service, which helps investors buy cryptocurrencies now and pay over time through monthly installments. This approach lowers the entry barriers and allows both individual and institutional investors to participate in the crypto trend without committing large sums upfront.

For traditional investment firms looking to embrace crypto, leveraging such innovative platforms can ease adoption and manage risk more effectively. The combination of new technology with flexible financial services is key to unlocking the future potential of crypto investments.

Through Bitlet.app’s solutions, the crypto market becomes more accessible and manageable, allowing established investment firms to confidently join the evolving digital asset ecosystem.