Analyzing Bitcoin Whales' $2 Billion BTC Movement After 14 Years of Dormancy: Market Implications and Investor Strategies

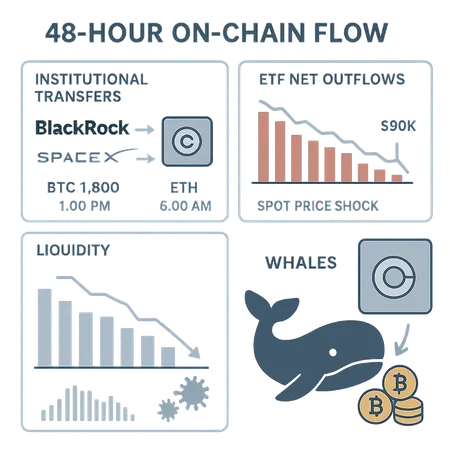

Bitcoin whales — large holders who can influence market dynamics — have recently moved an astonishing $2 billion worth of BTC after more than 14 years of dormancy. Such significant transactions by these early adopters often precede notable market shifts, raising questions about what lies ahead for Bitcoin and the broader crypto ecosystem.

Market Implications of Whale Movements

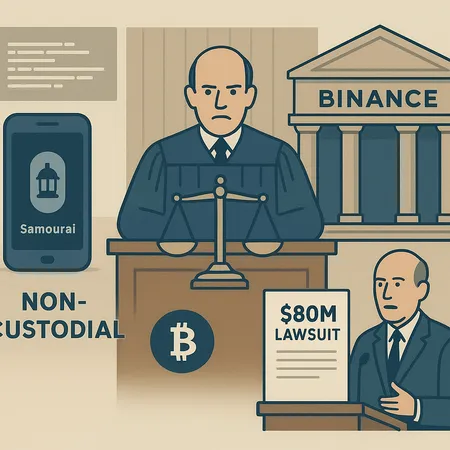

Whales typically move large amounts of Bitcoin for reasons ranging from portfolio rebalancing, profit-taking, or strategic positioning ahead of upcoming market events. The sudden activity after a lengthy dormancy period can signal increased market volatility or a shift in investor sentiment. Analysts often watch these movements closely, interpreting them as potential leading indicators for price trends.

How Should Investors React?

For individual investors, these whale movements underscore the importance of staying informed and adaptable. Rather than panic selling or impulsive buying, leveraging innovative platforms like Bitlet.app can offer strategic advantages. Bitlet.app provides a unique Crypto Installment service, enabling investors to buy cryptocurrencies now while paying monthly installments instead of paying the entire amount upfront. This service allows investors to manage risk and portfolio exposure effectively during uncertain market conditions.

Conclusion

The $2 billion BTC movement by dormant whales is a powerful reminder of the ongoing influence large holders have over the market. By utilizing flexible buying options like those from Bitlet.app, investors can stay nimble and well-positioned to capitalize on emerging opportunities amid the evolving landscape of Bitcoin.

For more updates on crypto market trends and smart investment tools, stay connected with Bitlet.app, where innovation meets opportunity.