Analyzing the Impact of Bitcoin Whales Moving $2 Billion After 14 Years of Inactivity

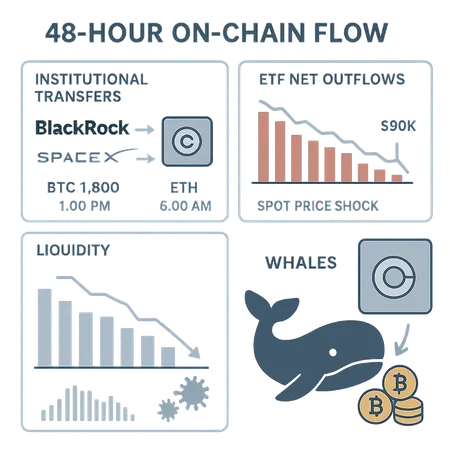

In a striking event, Bitcoin whales have moved an enormous $2 billion worth of Bitcoin after remaining inactive for 14 years. This extraordinary movement has captured the attention of both retail and institutional investors because such significant transfers often precede notable changes in market trends.

Bitcoin whales are large holders of BTC who have the potential to influence price action through their transactions. When these whales move coins that have been dormant for over a decade, it signals possible strategic repositioning or market plays that traders should watch closely.

This activity often leads to increased market volatility as it may indicate shifts in supply or investor sentiment. Understanding these movements helps crypto investors make better-informed decisions.

For newcomers and seasoned traders alike, adopting flexible purchasing options can be invaluable during times of market shifts. Bitlet.app offers a unique Crypto Installment service that allows users to buy cryptocurrencies now and pay monthly instead of paying the full amount upfront. This innovative approach helps investors take advantage of market opportunities without heavy immediate capital outlay.

Stay informed about large whale movements and utilize smart buying options like those offered by Bitlet.app to navigate the evolving crypto landscape effectively.