How Ripple’s $4B Infrastructure Push and the XRPC ETF Could Institutionalize XRP Liquidity

Summary

Executive overview

Ripple’s headline — a $4 billion commitment to expand its infrastructure — arrived at a pivotal moment: the XRPC ETF launch and a material uplift in XRP’s market cap. For corporate treasurers and crypto infrastructure investors the question is practical: does this constellation of product, capital and distribution meaningfully institutionalize Ripple as a payments and liquidity provider, or is this mostly market optics?

Short answer: the moves can be mutually reinforcing. But the mechanics matter. A committed capital base can accelerate liquidity provisioning, build rails and compliance tooling, and underwrite market‑making and custodial partnerships — all of which are necessary to make XRP useful for large, routine payments. That said, concentrated token holdings, regulatory cycles, and operational complexity create non‑trivial execution and governance risks.

What the $4B commitment likely targets

Ripple hasn’t published a line‑item ledger for the full $4B in every market; however, the most sensible allocation for institutionalization focuses on three buckets: liquidity, rails, and compliance/operations.

Liquidity and market‑making

A large portion of the capital will plausibly subsidize liquidity: dedicated market‑making desks, inventory financing, and programmatic bids across venues. For institutions, deeper native XRP liquidity means tighter spreads and the ability to source large blocks without significant market impact. That supports institutional liquidity by lowering transaction costs for cross‑border settlement, FX conversion and intraday treasury movements.

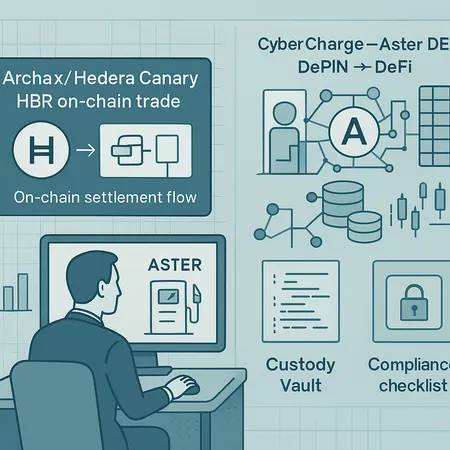

Payments rails and settlement infrastructure

Capital here funds rails upgrades: APIs, cross‑border settlement gateways, regional liquidity pools, and integrations with banking partners and custodians. Combining these rails with on‑chain settlement reduces settlement time and counterparty credit exposure for treasurers who want to move value across jurisdictions faster than correspondent banking allows.

Compliance, custody, and operational tooling

A disciplined institutional push requires compliance tooling (KYC/AML automation, transaction monitoring), audited custody solutions, and legal wrappers for settlement finality. Expect investments in regulated custodians, insurance programs, and enterprise APIs enabling reconciliation, reporting and risk controls that treasury teams demand.

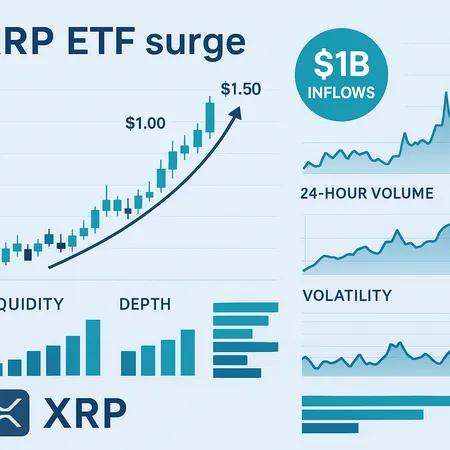

Why an active XRPC ETF changes the math

An actively managed or physically backed XRPC ETF changes several levers simultaneously.

- Predictable demand: ETF inflows create scheduled, visible demand for XRP that can be translated into hedging and inventory strategies for market‑makers. That predictability reduces one source of liquidity risk.

- Distribution and access: ETFs provide a regulated, brokerage‑friendly vehicle for institutions that cannot hold tokens directly. They widen the pool of buyers — pension funds, endowments, and corporate treasuries that prefer regulated wrappers.

- Price discovery and market‑cap inflows: ETF flows can amplify market‑cap inflows, making XRP a deeper and more tradable asset, which helps when treasurers need to convert sizable fiat to crypto or vice versa.

For payment rails, the ETF’s main value is indirect: it professionalizes the holding and trading base, which encourages custodians to offer better settlement rails between on‑chain XRP and ETF custody accounts.

How coordinated product, capital and distribution institutionalize the stack

Institutionalization requires more than one component — it needs coordination. There are three reinforcing layers:

- Product (rails + tooling): APIs, settlement guarantees, liquidity pools, and compliance features that meet treasury SLA expectations.

- Capital (market‑making + inventory): Funding that absorbs volatility, provides depth, and supports intraday settlement.

- Distribution (ETF + broker channels): Regulated vehicles that broaden demand and simplify custody/accounting.

When these three move together, several outcomes emerge:

- Lower total cost of settlement: tighter spreads, faster on‑chain settlement, and fewer reconciliation headaches.

- More routable liquidity: treasurers can programmatically source liquidity across pooled regional rails rather than relying on single counterparty lines.

- Reduced operational friction: standardized custody and reporting reduce the internal compliance lift for corporates.

This is the architecture Ripple appears to be targeting: embedding XRP as the “on‑demand liquidity” layer while partners provide custody and distribution.

What this looks like for corporate treasuries

For a treasury group, the appeal is pragmatic: faster, cheaper FX conversion and cross‑border value transfer without pre‑funding large nostro/vostro balances. Practically, treasurers would evaluate:

- Counterparty risk: Who holds the counterparties’ inventory? Are market‑makers vertically integrated with the custodian?

- Settlement guarantees: What SLAs exist for settlement finality, and how is chain reorg risk mitigated?

- Accounting and regulatory treatment: Can the treasury treat XRP exposure within its risk limits and accounting frameworks?

A staged adoption path is prudent: begin with small, measurable corridors, test reconciliation and custody, then scale if execution and regulatory clarity hold.

Risks and failure modes

Institutionalization is not guaranteed. Key risks include:

Regulatory cycles and legal uncertainty

Regulatory headlines can vaporize flows. An adverse decision or restrictive rulemaking can reduce institutional appetite overnight, constrain custodial choices, and limit distribution channels for an XRPC ETF. Organizations must model regulatory stress scenarios and maintain contingency plans.

Token concentration and market impact

If significant XRP supply is illiquid or controlled by a single entity, large flows (ETF rebalances, corporate conversions) can create outsized price moves. Treasurers need to model slippage and ensure execution strategies that slice orders and use diversified liquidity venues.

Custody, operational and counterparty risk

Custodial failure, weak insurance, or conflicts of interest among market‑makers, custodians and distribution partners can expose institutions to loss or reputational harm. Thorough due diligence on custody terms and insurance is essential.

Liquidity mismatches and FX corridors

Even with a large capital commitment, liquidity is thin in some corridors. Liquidity provision must be regional and currency‑pair aware; otherwise large fiat‑XRP conversions will still face slippage and latency.

Practical due diligence checklist for treasurers and investors

- Liquidity profiling: Request depth curves across the exchanges and OTC venues for target corridors at anticipated trade sizes.

- Custody and insurance review: Verify qualified custody, segregation, and insured limits for token holdings — not just accounting assurances.

- Legal and tax treatment: Confirm how treasuries must report holdings and whether internal policies permit exposure to native tokens or only to regulated ETF shares.

- Counterparty mapping: Understand who is market‑making, who holds inventory, and whether risks are ring‑fenced.

- Integration testing: Pilot payments in low‑value corridors to validate reconciliation, settlement timing and FX outcomes.

Scenario analysis: upside and downside

Upside scenario: coordinated capital, tight market‑making and wide ETF distribution create deep, low‑cost liquidity. Treasuries reduce nostro lines, shorten settlement windows, and optimize FX spend.

Downside scenario: regulatory action, coupled with concentration or operational failure, freezes flows. ETF redemptions amplify volatility, custodians limit withdrawals, and institutional adoption stalls.

Strategic recommendations

- Start small, measure, scale: Pilot predictable corridors and integrate T+0/T+1 settlement expectations into treasury workflows.

- Use mixed exposure: Maintain part of exposure via regulated ETF positions for balance‑sheet simplicity while testing native rails for operational efficiency.

- Demand transparency: Require partners to disclose inventory, settlement guarantees and reorg protection mechanisms.

- Monitor token concentration: Track on‑chain concentration metrics and exchange order‑book depth for early warning signs of fragility.

Institutional infrastructure investors should pressure test business continuity, insurance arrangements and regulatory playbooks before underwriting large positions.

Final takeaways

Ripple’s $4B infrastructure commitment, when combined with an active XRPC ETF and rising market‑cap inflows, can shift the economics and mechanics of institutional payments and liquidity. The combination can lower execution costs, expand distribution, and encourage custodial improvements — but only if capital is channeled into real liquidity, regional rails and robust compliance tooling.

For corporate treasurers and crypto infrastructure investors, success will come from conservative pilots, rigorous due diligence, and stress testing against regulatory and concentration risks. Keep an eye on how custody markets, market‑maker relationships and ETF flows evolve; those are the levers that will determine whether Ripple’s expansion becomes a new norm for cross‑border treasury operations or another interesting but niche experiment.

For practical integrations and tools that support treasury testing and OTC execution, consider platform compatibility and custody partners that already integrate with enterprise finance stacks such as SAP and treasury workstations — and note how providers like Bitlet.app fit into broader execution and fiat on‑ramps.

Payments | XRP | Institutional