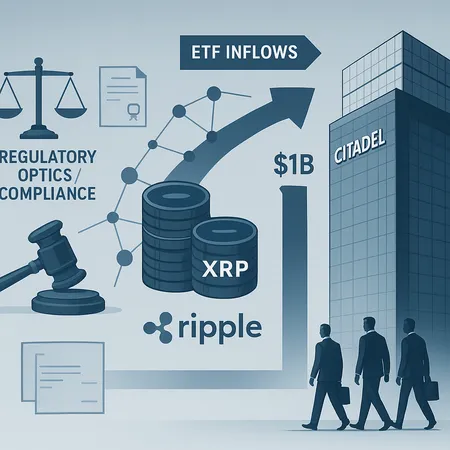

How Gemini's $75 Million Credit Facility from Ripple Could Accelerate Its U.S. IPO Journey

Gemini, one of the well-known cryptocurrency exchanges, recently secured a substantial $75 million credit facility from Ripple. This financial boost is more than just capital; it represents a strategic partnership that could accelerate Gemini's journey towards a U.S. Initial Public Offering (IPO).

With increased funds, Gemini can expand its infrastructure, invest in compliance, and enhance product offerings—key factors that investors look for when a company plans to go public. This move signals strong confidence in the future of crypto markets and institutional support.

For crypto enthusiasts and investors, this development underlines the growing mainstream integration of digital assets. If you're considering investing in cryptocurrencies, platforms like Bitlet.app provide an innovative approach. Bitlet.app offers a Crypto Installment service, allowing users to buy cryptocurrencies immediately and pay monthly installments instead of paying the full amount upfront. This makes crypto investment more accessible and manageable.

In conclusion, Gemini’s partnership with Ripple and the resulting credit facility is a pivotal step towards its IPO ambitions. Meanwhile, tools like Bitlet.app empower investors to participate in this evolving market comfortably and efficiently.